What is an Index Fund vs Mutual Fund? What’s the Difference Between Index and Mutual Funds?

Two of the most common types of funds that are typically invested in by wise investors are index funds and mutual funds. Now, whether or not you know what a mutual fund or an index fund are, after this article you will have a good understanding of what both of them do and how to get the best yield out of both of them. The most common question associated with these two accounts is what is an index fund vs a mutual fund? What’s the difference, what are the similarities, which one can I get better returns on, which one allows for better diversification? There are thousands of questions associated with these accounts, but they are much simpler than many finance gurus will lead you to believe.

| Related Posts |

|---|

What is a Mutual Fund?

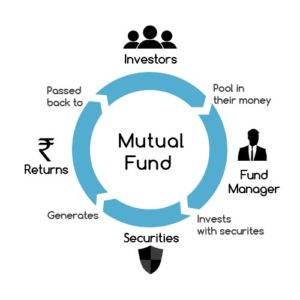

A mutual fund is a pool of money from many investors, you being one of the investors, that is subsequently invested into a portfolio that is highly diversified with specific stocks and bonds. Mutual funds, if shopped for smartly will allow you to customize your portfolio to target stocks that you want while maintaining diversity. Mutual funds are a great way to invest in a wide assortment of different stocks and get great diversification without having to pay massive brokerage fees on individual stock trades for each purchase of these stocks.

What is an Index Fund?

An index fund is a type of mutual fund and has all the same perks as a regular mutual fund. The only difference between the two types of funds are that mutual funds that are not index funds are managed slightly differently. Mutual funds, as previously mentioned, consist of a brokerage firm’s selected investments that are diversified and will allow you the ability to shop around and find those that are close to what you are looking for. Index funds, however, are a mutual fund, a collection of stocks and bonds, that track a specific index. These indexes can include the S&P 500, the Dow Jones, NASDAQ, or the Russell 2000 to name a few. There are many indexes that many different index funds track. So, depending on your particular interest, you can pick a fund that has the stocks that you would like to invest in and see returns from those stocks, however, you’ll have to deal with whatever small cap stocks may be throwing off the earnings of the large cap stocks that you were looking at.

What Are the Fees of an Index Fund vs Mutual Fund?

What Are the Fees of an Index Fund vs Mutual Fund?

Fees on mutual funds are typically based on which mutual fund you invest in, much like with index funds and ETF’s. Because index funds are mutual funds, they tend to have similar fees. In order to avoid some of these fees savvy investors have begun investing in commission free ETF’s, or standard ETF’s that will offer a lower expense ratio and therefore give higher profit. But, as I mentioned, it is important to remember that the fees associated with index funds and mutual funds will both be based entirely on the funds that you are investing in and different brokerage firms will take different amounts on commission. Some may offer no transaction fee funds which could certainly reduce the amount you would owe on your earnings. Many discount brokers such as Charles Schwab, Fidelity, and TD Ameritrade will offer Commission free ETF’s or no transaction fee mutual funds. These are some good brokerages to look into if you’d like to avoid excess fees.

What Should You Pick?

Picking between index funds and mutual funds really comes down to one thing: which stocks do you want to invest in. If you are picky about which stocks you’ll be investing in and only want to invest in a select few and keep the rest in bonds and make sure that it’s safe, a wise retirement or market turmoil investment strategy, then it may be better to find a mutual fund that is aimed more at bonds that will give you less growth but still save money long term. If you are looking to invest to get the average 10% annual increase of the S&P 500 or some other index, then an index fund is more up your alley. I recommend index funds for anyone who will be starting to invest in stocks for the first time. Make sure to check the expense ratio and brokerage fees on the index fund and broker you intend on investing in and with because there may be an ETF out there that tracks the same index at a lower cost.

Sources:

https://www.bankrate.com/banking/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

What Are the Fees of an Index Fund vs Mutual Fund?

What Are the Fees of an Index Fund vs Mutual Fund?

[…] The simple answer is no. Quite frankly, Dropbox has never been a profitable company. It will stick around for a long time, but it is unlikely that this company will suddenly begin making money unless it does something truly groundbreaking. Investing in this stock short-term and long-term is ill advised, however, investing from six weeks to nine months could have a small gain, but you’re likely better off sticking your money in an S&P 500 index fund. […]

[…] through Academic research papers and the latest academic research from top PHDs in the field about index funds and about how a proper portfolio needs to be correlated across asset classes and sectors. One of […]

[…] Index vs Mutual Fund […]