Should You Buy the Dip? Why I Say Absolutely

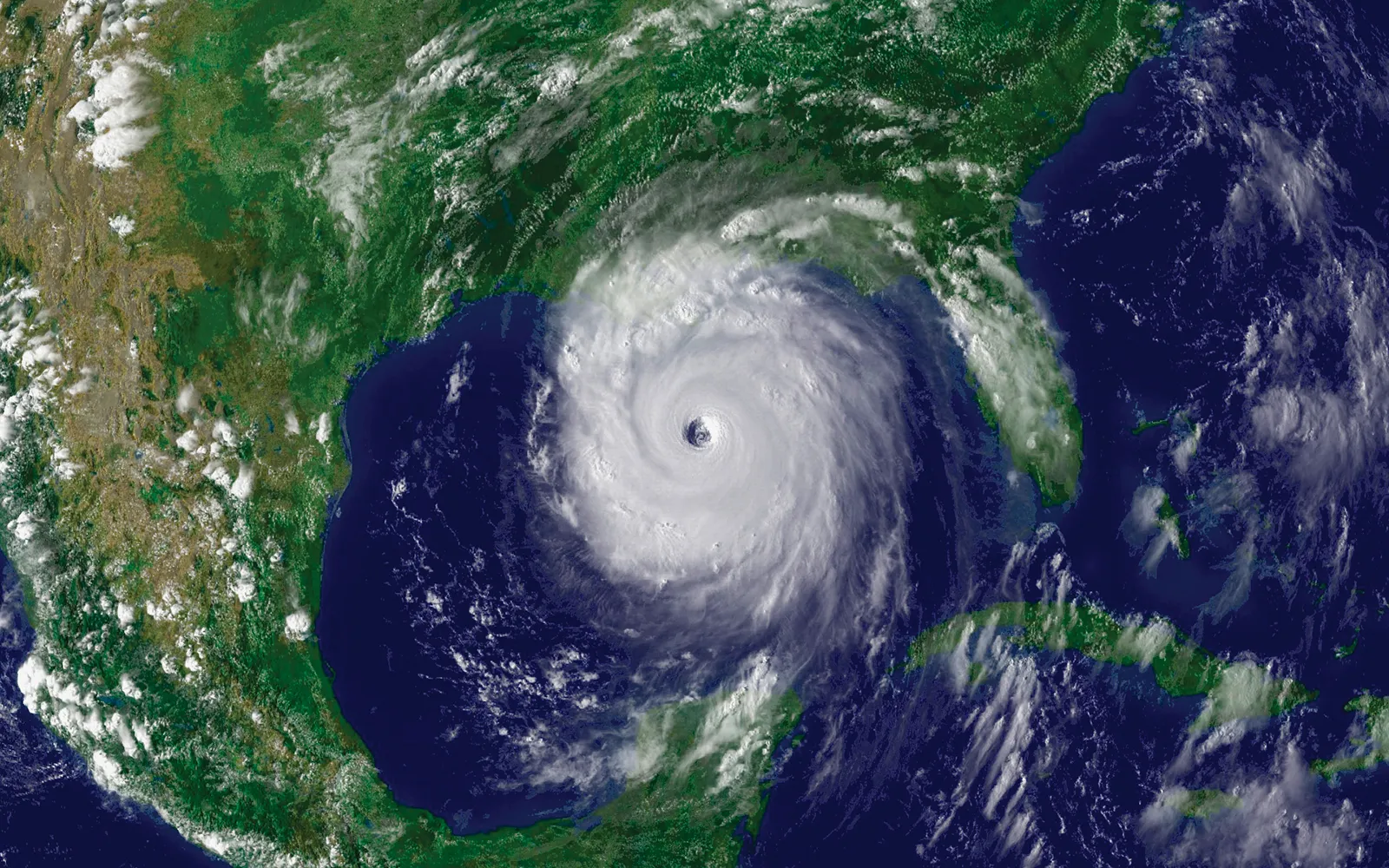

Buy the Dip, Short the Vix, F Bitcoin! That is one of my favorite scenes in the show Industry, and it is actually where I got the idea to write this blog post.In terms of the question of should you buy the dip, I would say that you should buy the dip every single time, but only if it is an index fund, anything short of that and you are speculating, possibly in a major way. Buying the dip when talking about something like the DOW Jones Industrial Average, the S and P 500, a Global Index Fund, or heck even a well known Japanese Index like the Nikkei 225, is completely fine, and will yield you profits literally 100% of the time should you stay the course. With this being said, buying the dip on something more risky, like the American Airlines post in our featured image, or in something like a Penny Stock, could lead to full blown disaster. And so, in this blog post, let’s talk about buying the dip, something that is considered by Wall Street to be an overtly risky strategy but that I still fully believe in. Read on or subscribe to our blog for additional details and information.

Other topics that we’ll be discussing in the high finance category include:

Using Options for leverage

Shorting a stock

Making money with stock trading

Short Term Holdings Tax

Making Money Quickly

Why day trading leads to lower returns

why you probably can’t beat the stock market

Why trading is giving up market returns

And much more, read on or subscribe to our blog for additional details and information.

Should You Buy the Dip, Why I Say Yes in the Right Circumstances

So, buy the dip is actually a strategy that can work, under the right circumstances that is. When you buy the dip, you should only do so if it is an index fund or a benchmark, that or a Blue Chip Stock with fantastic fundamentals. Some examples of stocks or ETF indexes that you should absolutely buy the dip on include

- Global Index Funds

- S and P 500 Index Funds

- Apple Stock

- Any Blue Chip Stock

- KO or Coca Cola Stock

- The Nikkei 225

- Japanese Index Funds

- Any Mutual Funds

| Related Posts |

|---|

Examples of things that you should not Dollar Cost Average, or buy the dip on include:

- Penny Stocks

- Low quality stocks

- Castle in the Air Strategies

And that’s pretty much the gist of buying the dip, buy low and sell high always works when its a quality stock based on firm fundamentals!

My Final Thoughts on Buying the Dip, Once Again Keeping This Short!

So like I said, short and sweet on this one. I have been noticing that on this blog we are getting somewhat unfocused in terms of the content (we’ve been doing a lot of TV show reviews, writing stuff, esoteric blog posts and SEO/Internet Marketing blog posts, and less raw Finance and Accounting, so I am getting back to the original game plan!) Buying the dip should be done only when there is a good security, or an index at hand. In the case of index funds like the S and P 500, buying the dip and holding the index over the long term will certainly result in some drastic profits. For more information on all things Finance and Business, read on or subscribe to our blog for additional details and information.

Cheers!

*Inflation Hedging.com

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

[…] Buy the Dip […]