Tax Credits vs Tax Deductions, Which is Better?

In this blog post, lets review tax credits vs tax deductions, and walk through which is better to get, which is easier, and why deductions might not actually give you back as much money as you think. So the gist of this, is that a tax deduction, is a write off on your tax statement, so lets say that your Adjusted Gross Income is something like $50,000 per year, and you are a single filer, leading to a $12,400 standard deduction.

This “deducts” your total income that you would pay income taxes on, to a bottom line net income of just $37,600, meaning that this is the number you pay taxes on, which saves you money. So those are the benefits of a tax deduction, as far as a tax credit, for instance the lifetime learning credit of I believe $2500, you get $2500 right in your pocket. So if your tax bill is $4500, the IRS gives you back $2500, making your tax bill just $2,000. There are refundable and non-refundable tax credits, however most are non-refundable. **Edit to this, the Lifetime learning Credit is 20% of one’s educational expenses, up to a maximum of $10,000 in expenses, for $2,000.

What this means, is that you cannot go below $0, if you have a $1,000 tax liability, and a $2500 tax credit>>>you really get a $1,000 tax credit, reducing your liability to $0 (in the majority of cases.) In this blog post, lets take a look at some common tax deductions and tax credits and how to use them.

The top Tax Deductions and Tax Credits Include the Following:

The Standard Deduction

Earned Income Tax Credit

The Lifetime Learning Credit

Child and Dependent Care Credit

Saver’s Credit

Child Tax Credit

Head of Household Deduction

Qualifying Widow with Dependent Exception

Adoption Tax Credit, up to a maximum of $13,810 per child

Medical and Dental Expenses, up to a max of 7.5% of AGI

Residential Energy Credit

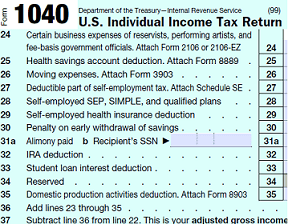

Student Loan Interest Deduction

HSA Contribution Deduction

501C-3 Charitable (QCD) Distributions

And many more, read on and subscribe to our blog for additional details and information.

Tax Credits vs Tax Deductions, What are the Top 5 Tax Credits

| Related Posts |

|---|

So, my top five tax credits, and among some of the most common include the following:

- The Lifetime Learning Credit – The lifetime learning credit gives funding to those looking to head back to school. It gives you a 20% tax credit (which is basically a 20% discount on your tuition) on educational expenses up to a maximum of $10,000. In reminding myself of this>>>I’m thinking maybe I should try and jump on that Accounting degree I’ve been talking about for so long now. So 20% discount on school tuition right in your pocket!

- The Earned Income Tax Credit – The EIC credit is used for low income families to help them get a boost. It reduces the amount of taxes owed by lower income families, and you’ll typically get a letter if you qualify.

- American Opportunity Tax Credit – This is for undergrad college students. It gives you a discount if AGI is not over $80,000 per year, and you can still get partial credit if you’re in between $80K and $90K!

- Child and Dependent Care Credit – This is basically the US Government’s way of helping out working family’s with kids, pretty cool if you ask me. This is if you have a dependent in your household that you pay more than 1/2 of their expenses for, you can get up to $3,000 in tax credits per dependent!

- Child Tax Credit – This one is a little different than the EIC or the Child and Dependent Care Credit, it gives you $2,000 in tax credits for step-children or dependent care children.

Tax Deductions vs Tax Credits, What are the Top 5 Tax Deductions

The top 5 most commonly used deductions are as follows:

- The Standard Deduction – This is by far the most common, since literally everyone gets it. For tax year 2020 it is $12,400. Next year it is set to be $12,550>>even though that’s not quite keeping up with inflation since we are at a 5% annualized inflation right now.

- Business Expenses Deduction – This is one of the most effective. For instance, I’ll use my website. If I’m making say $400 per month off of this blog, and I spend $200 per month outsourcing freelance writers to scale my content, and another $100 per month on web designers and developers to improve my design to try and bump up sales, at the end of the year I will have made $4800 per month in pre-tax revenue, with my Cost of Goods Sold coming out to $3600, in that that’s the amount I invested. My Gross Profit will be $1200, which after taxes comes out to about $960 in net income. Legitimate business expenses is obviously one of the best ways to reduce taxable income.

- Mileage Deduction -This is kind of a sticky one, but you can use things like the Intuit mileage log in order to log your business miles for a set dollar amount write off per mile.

- Home Office Deduction – This is another sticky one, however if you have a legitimate LLC and home office, then you can write off the portion of your home, in square feet, as a tax deduction. So say you have a 2,000 square foot home, and you use one guest room in your house as your primary office space. The room is 300 square feet. As a proportion, you can write off 15.00% of certain expenses. The more simplified version is to write off $5 per square foot of your home office, for a $1500 tax deduction here.

- IRA/HSA/401K Contribution Deduction – This is another no brainer. If you are within certain income limitations for each of these ($290,000 for a 401K deduction, and $105,000 or less for 2021 for a Traditional IRA write off. To my knowledge, the HSA contribution is another tax deduction, but I do not believe there is an income limitation for this.

Final Thoughts on Tax Credits vs Deductions, My Opinion

And so, that’s pretty much the gist of tax credits vs tax deductions. I hope that this blog post served as kind of a 30,000 foot view of the difference between how tax credits and tax deductions work, and of the most popular credits and deductions in each category. Once again, while I am not a CPA or tax professional currently, I am working in the field of Finance, and am currently a candidate for sitting for the Enrolled Agent exam, so be sure to ask a CPA or qualified tax professional if you plan on using any of these and are not 100% sure. And as always, be sure to subscribe to our blog for daily content on all things business!

Cheers!

*Inflation Hedging.com

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

Leave A Comment