How Does Reporting Capital Gains Work?

OK, so here is how reporting capital gains works on a tax return. Basically what’s gonna happen is any trades are gonna be classified as short-term or long-term depending on both holding. And what type of security you’re selling, Frances pawns in mutual funds are gonna have a slightly different formula new selling Street equity securities. There, it’s going to average out, based on your 1099 for the entire brokerage account, how your long-term gains and losses, get mixed with your short term, gains and losses, and how the two of those counterbalance to create your final realized gain or loss number for the year. Quick example of this, so you know what the heck I’m talking about, let’s say you have $5000 in realized long-term capital gains for tax year 2022, it’s missing means you had Apple stock, you held it for greater than a year and a day, and then you saw the stock reaping, long-term, capital gains, benefits, a lower tax bracket. And so in this blog post, let’s take a look at how does Reporting Capital Gains Work?

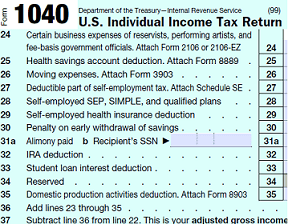

:max_bytes(150000):strip_icc()/ScreenShot2022-12-15at4.43.22PM-a4503f5c2620404db0fe4bb3aee6647d.png) Let’s say you also sold $2000 of Nvidia at a $2000 short term capital gain, because you held a stock for less than a year. How did the two of these offset well the good news is in this case the higher of the two is how the two of them end up bouncing out so you’re essentially have $$5000 of long-term capital gains, and $2000 of shorts of capital gains. Nothing to mix 22 of those. Where it gets complicated is when you’re mixing gains and losses when you’re mixing long-term gains and short-term losses and short-term gains and long-term losses, and when you’re combining all of that together. Let’s say you have $7000 in long-term capital gains and $1000 in short term capital losses what is probably going to end up happening is you’re going to have $6000 in long-term capital gains. My guess is because it is such a small amount of short term losses and balances out to have $6000 in short-term capital gains from this formula. You could literally teach an entire college class and just on how gains and losses bounce around and how they work together. The formula is very complex for our short-term gains and long-term losses work with each other. In unison, add to this retirement, account, distributions, or pension or sap, IRA plan distributions, and you’ve got your health one heck of an accounting formula was gonna lead to a fat bill from a certified public accountant.

Let’s say you also sold $2000 of Nvidia at a $2000 short term capital gain, because you held a stock for less than a year. How did the two of these offset well the good news is in this case the higher of the two is how the two of them end up bouncing out so you’re essentially have $$5000 of long-term capital gains, and $2000 of shorts of capital gains. Nothing to mix 22 of those. Where it gets complicated is when you’re mixing gains and losses when you’re mixing long-term gains and short-term losses and short-term gains and long-term losses, and when you’re combining all of that together. Let’s say you have $7000 in long-term capital gains and $1000 in short term capital losses what is probably going to end up happening is you’re going to have $6000 in long-term capital gains. My guess is because it is such a small amount of short term losses and balances out to have $6000 in short-term capital gains from this formula. You could literally teach an entire college class and just on how gains and losses bounce around and how they work together. The formula is very complex for our short-term gains and long-term losses work with each other. In unison, add to this retirement, account, distributions, or pension or sap, IRA plan distributions, and you’ve got your health one heck of an accounting formula was gonna lead to a fat bill from a certified public accountant.

How Does Capital Gains Reporting Work?

The gist of how reporting your capital gains is going to work, if you’re going to buy or sell any of your trades throughout the year, and then what’s the tax year and you’re going to receive a 1099B, with a full breakdown of your cost basis and your selling price, labeled as cost and proceeds, which she will put on schedule D and attached to your tax return. If you use one of the run-of-the-mill, tax software is like TurboTax, or TaxSlayer, you’ll find that the software is actually very good at taking care of all this for you. It’ll basically have you just input exactly what is on the 1099B, and from there it generates a schedule, D, and also known as an 88,43, and takes care of all the rest from there.

| Related Posts |

|---|

In short, if you want to play with long and short, so I realized gains, either know how to punch in your 1099P, or get yourself a good accountant because any trader is definitely going to need one.

Final Thoughts on Selling Stock for Realized Gains and Losses, How Does Capital Gains Reporting Work

Now you might be thinking what about the market to market in Deduction. This deduction is very rare, and he can only be taken in certain instances where you are a traitor as an active business. You need to have huge chunks of time and revenue with verified statements that you can show to the IRS for years a backlog in order to make this deduction. If you do qualify for this deduction, see your successful D trader that works. Travolta travels a lot, and that’s bad doing this for years and years, you can probably going to Mark to Morgan, Deduction, which lets you deduct expenses like trading software, travel, costs, research, costs, home, office costs, and the lake. Hope you enjoyed reading insurance subscribe for more details information of all things.

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

[…] Governers’ University is a college that operated online. There are many degrees to select from including Bachelors’s and Masters’s programs. […]