What Are The Tax Consequences of Fractional Shares When Changing Brokerages? This is a very specific and somewhat interesting question on how fractional shares work when you’re selling them off or you’re moving stock shares between brokerage accounts via ACAT transfer. I’ll give you a hint here, it’s a pain in the ass to do for the fractional share amounts. What is basically going to happen to all of your fractional shares is that you’re going to have all your shares moved and the fractional shares will be held and frozen for a bit longer while in processing. This is true for an ACAT transfer and it’s also true for if you’re just trying to sell off the balance of all your shares. You can tell when you try to do this even one time that these brokerages are literally not built for this kind of trading in and out…as well as the fact that they really want to hang onto your money. They make it a massive hassle administratively to move your founds all out of the account, and aside from that they hit you with early pullout charges, account closing fees, ACAT charges for actually transferring the balance, you name it it’s going to be on your statement and on your tax forms at the end of the year. And speaking of tax forms, make sure you remember your USN and Password for that account because you’ll need all your 1099s at year end and will need to grab them when they become available.

| Related Posts |

|---|

Okay That’s The Administrative Issues, But What Are The Actual Tax Consequences?

Okay That’s The Administrative Issues, But What Are The Actual Tax Consequences?

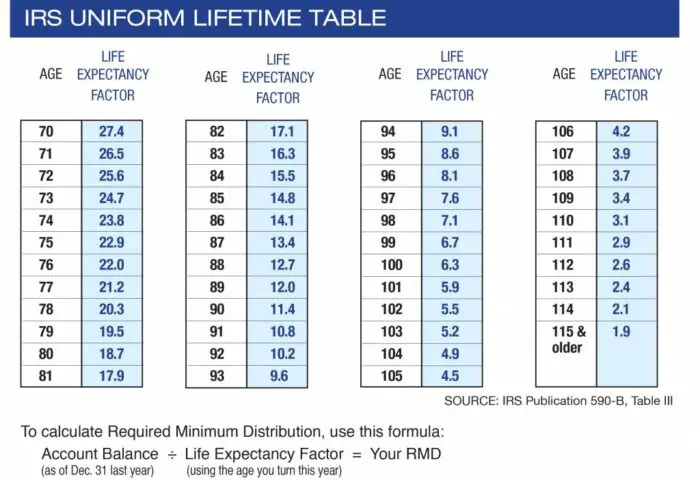

From a tax standpoint, there really aren’t a lot of issues really with having fractional shares, or even with offloading them. Yes you may pay some capital gains taxes since your cost basis on these will be based on whatever price the shares are reinvested at, but aside from that there is no real difference to the actual shares that you purchased. It may make your 1099-DIV and end of year cap gains statement all the messier, but that’s really an issue for your CPA! And that’s the game, not really a huge tax issue with these, more an administrative one when you try to offload your shares and close out the account. For more details and information on all things business and finance, be sure to read on and subscribe to our blog for additional details and information.

Cheers!

*Inflation Hedging.com

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

Okay That’s The Administrative Issues, But What Are The Actual Tax Consequences?

Okay That’s The Administrative Issues, But What Are The Actual Tax Consequences?

Leave A Comment