How do you Report Tips on Your Taxes? And What is the Tax Bracket for Tips?

In this blog post, I’m answering the question of how do you report tips on your taxes, why it is imperative that you always report all of your tips on your tax return, and where and how you can report this income with either TurboTax or by hand filing your tax return, as well as what amount you’ll be taxed on with your tips.

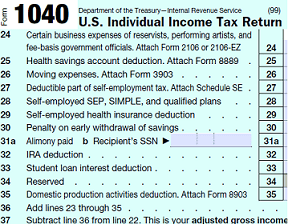

The one piece of good news that I have for anyone who is reading this blog post right now who works at a restaurant collecting tips and who is deciding to actually report this income honestly on your tax return (kudos to you by the way on getting your finances in order!) the one piece of good news that I have for you is that you won’t have to report these on Schedule C, paying double Medicare and social security taxes on all of your tip income, and that you can instead report them by attaching form 4137 to your tax return, Social Security and Medicare tax on unreported tip income to your form 1040 in order to report tips allocated to you by your employer, as shown on box 8 of your W-2. And so, in this blog post, lets run through how you can accurately report your tips on your taxes.

Read on or subscribe to our blog for additional details and information on all things Finance and Business.

Other topics that we’ll be covering on this blog related to taxes include:

What the QBI Deduction is

How to become a CPA

how to become an Enrolled Agent

The five types of filing statuses

How to pass the CFP Exam

how to pass the Series 7 Exam

How to Amend an income tax return

How to file partnership taxes

| Related Posts |

|---|

And a host of other details and information. Read on or subscribe to our blog for additional details and information.

How to Report Tip Income on Your Tax Return, and Why Schedule C is Not Necessary

So, as mentioned in the former, reporting tip income on your taxes generally should not lead to you having to file a Schedule C with your tax return, in that for the most part, those with tips are going to be subject to W-2 wages and therefore employer withholdings on their behalf. It is actually to your benefit to tell your employer your actual tip amounts, in that this way they can withhold your money as W-2 income, rather than making you potentially report it as Schedule C income, in that you will pay twice as much FICA taxes if you are forced to report it in this manner.

How to Make Sure Tip Income is Reported Accurately, How Do You Report Tips on Your Taxes?

The best advice that I can give to anyone to make sure that their tip income is reported accurately on their tax return, is to tell your employer the exact dollar amount that you receive in shifts every single time, right down to the penny, so that it gets reflected on your W-2 and so that you can report your taxes accurately with the correct amount paid.

Get your tips in any other way than this, and when you try to report them you might find yourself paying a potentially higher amount (like if you are an independent contractor getting tips, now you have to file a Schedule C and pay twice as much in Social Security and Medicare taxes) and not to mention the fact that you’ll be probably paying as much as you get hit for in taxes on Tax Software and potential CPA fees in order to accurately file the return, use the W-2 method of tips reporting if at all possible.

Final Thoughts on How to Report Tip Income on Your Tax Return Correctly and Not Pay More In Tax Than You Should

The way that you can report tip income accurately on your tax return, as stated in the former, is typically done by giving the accurate tip amounts to your employer so that you can have it reflected on your W-2. When this is done, the correct amount is withheld on your tax return, and it is very simple to file. Do the right thing and report your tips to your employer, your future self will thank you because there will be a lot less headaches over time. Until next time, you heard it first right here at Inflation Hedging.com.

Cheers!

*Inflation Hedging.com

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

Leave A Comment