How Do Required Minimum Distributions Work, And How Can You Make Sure You Hit Yours Correctly?

Preface on this blog post by saying that I am not a CPA or an accountant, I am a candidate for the IRS Enrolled Agent exam, and am currently also sitting for my CFP exam in the field of Wealth Management, so don’t necessarily take what I say here as financial advice, but more for your general financial information. With this in mind, I have been working in the field of banking for several years now, and have helped clients to calculate their Required Minimum Distributions before, even though we pretty much just have a software at the office that takes care of this for clients in large parts. All of this aside, I do pretty much understand how RMDs work and I will do my best to explain how you can read the tables here in this blog post. Need to take your RMDs for tax year 2021, or need to know if you can still put your distribution back into your IRA due to the cares act of 2020? Keep reading to find out more, because in this blog post, I’m answering the question of how do required minimum distributions work, stay tuned for more info.

Other income tax and retirement tax related topics that we’ll be covering on this blog include the following:

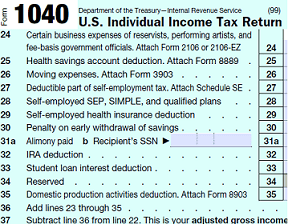

How to file your 1040

What forms you use for basic income taxes

How to become an Enrolled Agent

How to become a CPA

how long it takes to become a CPA

How taxes will benefit you as a financial advisor

Why you should become an enrolled agent for Wealth Management

Starting your own tax practice

And much more, read on or subscribe to our blog for additional details and information.

How Do Required Minimum Distributions Work? How You Can Read the Tables Without a CPA

So the gist of a Required Minimum Distribution is as follows, essentially once you turn age 72, you’ll need to start taking distributions from your Traditional IRA. With a Roth Individual Retirement Account, this is not the case, in that essentially the IRS could not care less when or if you ever pull the money out, since it is tax free, because it is your money compounding, because you already paid taxes on this money when you contributed it to the Roth IRA. The IRS has essentially already gotten their money in this case, and so they could not care less about taxing you more on already taxed money. With the Traditional IRA, the more common of the two, albeit the least effective, this is not the case, and in fact the IRS cares very much about WHEN and HOW they get their money, and they will start to impose hefty penalties if they do not get this money on time and in the proper way. After all, it was kind of in the implied contract with the IRS when you contributed pre-tax income into a tax DEFERRED account that eventually that later date would come about, and the IRS would get their money on the total balance, employer matches, gains and all, it all is taxed at the ordinary income tax rate once you pull funds out of your Traditional IRA.

The tables typically say something along the lines of “take the balance in your traditional IRA and divide it by 27.4.” If you don’t take a distribution of at least this amount, then the IRS taxes you by FIFTY PERCENT on the amount left that you didn’t withdraw. So say that you have $1,000,000.00 in your Traditional IRA, and this is the year that you are turning 72. You need to withdraw $1,000,000/27.4 for a total balance of $36,497….so call it $36,500, roughly speaking, in order to pay your taxes properly and avoid IRS penalties. Suppose you decide to withdraw only $20,000, and forget to move the rest of the money by the end of the year, you would be hit with a 50% penalty by the IRS on $16,497, for an approximate penalty of $8249, plus you’ll still have to take the additional $16,500 distribution and pay taxes on it. So by taking your RMD late, rather than a $5,000 tax bill on this $36,500 withdrawal (probably more like $3,000), you’d be paying closer to $13,000 in total taxes and penalties, or 1/3rd your money even if that was your only income for the year, just to take your RMD. The IRS wants their money and they want it on time, they do not mess around, so make sure that you take your RMDs properly no matter what it takes!

| Related Posts |

|---|

What Age do I Need to Start Taking RMDs?

While age 70 1/2 used to be the age old idiom that every single boomer would typically tell you, due to the Tax Cuts and Jobs Act from the good old President Donald Trump in late 2017, the new age for Required Minimum Distributions is now age 72, this allows folks to stay invested longer and to make more money. With the Cares act of 2020 causing RMDs to be suspended for tax year 2020, we also have this getting kicked down the road even further, with some individuals now not having to take RMDs until they are almost 74 years of age, not a bad extra boost before you have to start paying taxes to get say 4 more years of compounding on that money before it needs to be withdrawn.

How Do Required Minimum Distributions Work in a Roth IRA?

With a Roth IRA, theoretically you would never have to withdraw the money as far as the IRS and the government is concerned, and you would be able to hold that money with no distribution requirements until your last day on this earth. There are some subtle differences on this regarding when it is passed down to your next of kin, but from what I understand (again not a CPA here, take this with a grain of salt), there should still be no taxes or withdrawal requirements.

Final Thoughts on How Do Required Minimum Distributions Work? Everything You’ll Need to Know on the Subject

So, this is pretty much the gist of how RMDs work. Be sure to take at least the amount of your required minimum distribution from your Traditional IRA in this upcoming year 2021, and I would often say that it is better to take a little bit over the required amount, than to go just under and be penalized. So if it looks like your RMD is $36,000, rather than spend $1,000 on a CPA to verify this for you, maybe take $40,000 just to be safe, from here you can park the money into a naked brokerage account and put it into some global index funds, so only some of your money no longer has exposure due to it being paid out for taxes. RMDs can be a good thing if you work them to your advantage, one way of looking at them is that it’s you finally cashing in on all your hard earned retirement money so that you can allocate it for the future, take a vacation, or do whatever else you want to do with the money. For more information, be sure to subscribe to our blog for regular tax and finance updates, and to comment down below with your thoughts and opinions on the article, and we’ll get back to you within one business day with a response.

Cheers!

*Inflation Hedging.com

Sources:

https://code.org/

https://www.freecodecamp.org/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

[…] Previous How Does After Hours Trading Work? […]

[…] Minimum Distributions […]