Traditional vs Roth 401K, Which is Better for Long Term Gains?

The traditional vs Roth 401K argument is pretty simple, invest as much as you possibly can into the Roth IRA while you are young, and while your tax bracket and the stock market is low, in order to maximize a ton of your gains tax free as you age. Use the Traditional IRA if you need the tax write off for additional cash flow, because Tax Deferred is still better than being in a naked brokerage account (you still have additional money in their generating compound interest, and interest on interest is powerful no matter how tax advantaged it is.)

The Roth IRA also has the benefit of being almost entirely liquid, at least in terms of your principal – after all it is your money since you have already paid taxes on it, so you can pull from it if you need to largely without penalty. With regard to the 401K however, there are additional concepts to put into place, such as access to your money, liquidity, and quite frankly control over your money if you are ever planning to hop employers. For more information on all things tax and retirement, read on or subscribe to our blog for additional details and information!

Other related types of retirement accounts that we’ll be covering on this blog include the following:

Traditional IRA

Traditional IRA

Roth IRA

Traditional 401K

Roth 401K

SIMPLE IRA

SEP IRA

Solo 401K

457

403B plan

| Related Posts |

|---|

Defined Contribution Plans

Defined Benefit Plans

Corporate Pensions

Government Pension Plans

Employer Sponsored IRA’s

And a host of other similar and related accounts, read on or subscribe to our blog for additional details and information.

Traditional 401K vs Roth 401K, When Should you Choose The Traditional?

My general take on this, is that when you are young and broke and starting a brand new job, say someone who is 23 years old and right out of college and who is making $50,000 per year, that you should choose the Traditional 401K. My reason for this is pragmatic, first off, the steps to maxing out your personal finances should go something like the below:

- Pay off ALL debt first

- Build up a $24,000 to $30,000 cash Emergency Fund First (12-18 months of living expenses, I am very cautious on this since COVID)

- Attack a Traditional 401K and put the tax write off into cash from here

- If you have a mortgage, pay this off before scaling your 401K anymore.

- If you do not have a mortgage, Start scaling up a Roth IRA or Roth 401K as much as possible at this point.

When you are young….99.9% of the time, you are broke. Even if you have $10,000, or $20,000, your finances are somewhat fragile, you aren’t really fiscally prepared for a job loss, you have less experience so it is very difficult to pivot if you need to in most cases, etc. etc. I applaud you wanting to setup your retirement savings at this age, however in order to do this successfully, you are going to need to be able to sustain a job for a LONG time, until you can do this, capture the tax write off from the Traditional 401K and put it into cash, up until you have almost $100,000 liquid.

Roth 401K vs Traditional 401K, When You Should Choose the Roth

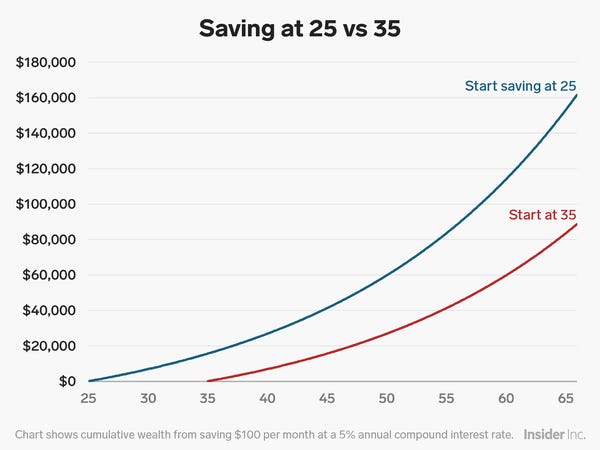

Now as you get older, say into your early 30s, mid 30s, and 40s, you are going to start feeling pressure mount more and more to build up those retirement accounts, as you are not getting any younger, and 40, 50 and 60 is in fact starting to chase you more at this point. For this reason, put as much as the IRS will allow you to in Roth IRA and Roth 401k accounts. If you are at a good enough salary where you can max these out, say $6,000 for the personal Roth IRA, and $19,000 for the Roth 401K, then keep putting this in every year, and invest into S and P 500 Index funds, your future self will thank you. 20 years of doing this, and if my math is right, you should have something like $1,000,000.00 sitting in your Roth IRA. It’s HARD, but it’s not impossible, and being a millionaire when you start collecting social security, let alone just out of your Roth IRA, is indeed nothing to sneeze at.

Final Thoughts on the Traditional 401K vs Roth 401K Argument, And My Final Take

And that’s the gist of my Traditional vs Roth IRA argument, when you are really young, invest in the Traditional. It has an immediate benefit to you by way of capturing a tax write off, enabling you to build up your cash reserves should you need them for something. On top of this, it gives you more of a cushion to keep pressing the needle once you turn 30 and 40, and for you to be able to attack your Roth retirement accounts>>now you can really go to work building wealth for your future self. For more information on all things Finance, read on or subscribe to our blog for additional details and information.

Cheers!

*Inflation Hedging.com

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

Leave A Comment