What is a Defined Contribution Plan? And What Are The Odds of Securing a Pension in 2020

| Related Posts |

|---|

A defined contribution plan is essentially just a fancy way of saying a 401(k) plan. It’s called a defined contribution plan, in comparison to the combined benefit plan, which is essentially just a pension, in that tribute the full amount that you get to keep your retirement. If you’ve ever wondered why and how employers usually match your 401(k) up to 6% of your salary or 5% of your salary, or give you a 50% employer match up to 6% of your salary etc., the reason they do this, is that it is in place of what once were pension plans. The following blog post will serve to answer the question of “What is a Defined Contribution Plan?” And will walk you through how you can get your hands on one if you are in a government salaried job. For more information on retirement accounts, portfolio management, index fund investing, and all things finance, be sure to subscribe to our blog for more details and information, and for daily blog posts.

What Does a Defined Contribution Plan Mean for Your Finances? A Fancy Word for a Future Pension

Pension plans, or also known as defined benefit plans, and that rather than contributing to them, you benefit from years of hard work,  through a regular salary throughout the golden years of your life. Defined benefit plans, or go in the way of entitlements, and are becoming something of the past. In fact most pension plans will be obsolete completely in the next 10 years, and most are already gone now. It makes total sense of the private sector, and even government players, and especially municipalities, with their high interest bond rates, and failing cash flow‘s from state and local taxes, would 86 pension plans altogether. Put quite simply, it’s expensive, and it’s expensive as all heck.

through a regular salary throughout the golden years of your life. Defined benefit plans, or go in the way of entitlements, and are becoming something of the past. In fact most pension plans will be obsolete completely in the next 10 years, and most are already gone now. It makes total sense of the private sector, and even government players, and especially municipalities, with their high interest bond rates, and failing cash flow‘s from state and local taxes, would 86 pension plans altogether. Put quite simply, it’s expensive, and it’s expensive as all heck.

Final Thoughts on The Question of “What is a Defined Contribution Plan?” And How to Get One for Yourself

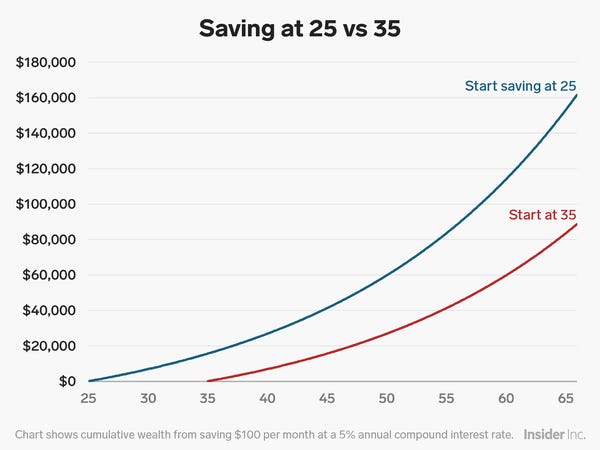

Personally, while I’d you’re reading this finance blog and aren’t already in your late 40s, Then you likely do not have a shot of ever getting a pension. What you can do however, is set yourself up with a fairly high risk free rate of interest year-over-year, to live out your golden years with something like a 50 or $60,000 annual income permanently. To do this, you’ll need about $2 million, which you can put in a combination of stocks, bonds, and risk-free treasury bills, to easily get a 3% rate of return on your money, year-over-year, and have a pension plan that is homemade, of $60,000 per year. To do this, start contributing to your 401(k) early, put whatever percentage in as soon as you get out of college, or start working in general, in and get the full employer match. Put it in a well diversified portfolio like the S&P 500, and never stop contributing. Each year, increase your contribution by the amount of arrays you get. For instance, if you’re making $50,000 a year, and next year you’re making 2000 more, at $52,000, now instead of just contributing 6% to your 401(k), contribute the full 6%, and also contribute the other $2000, do this until you’re 58, 60, or 65, and you will be a very rich man or woman indeed. For more information on defined contribution and defined benefit plans, be sure to subscribe to our blog for more details and information, and comment with your questions and we will get back to you ASAP with a response.

Cheers!

*Inflation Hedging.com

Sources:

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

[…] spare time? End Rant. Nonetheless, it made me realize that the show was largely based on the shady business dealings of Steven Cohen, a real life hedge fund billionaire worth more than $10 billion. And so, […]