How Your 401K Compounds Over Time, What My Future Investment Portfolio Could Look Like

In this blog post, we look at how your 401K compounds over time, as well as how mine might grow over the years given a pretty conservative 7% annualized rate of return. I have just started contributing 6% of my salary so that I can get the full employer match, and I am both loving the extra cash that I am putting in the stock market, as I am putting 100% of it into an S and P 500 Index Fund, and am hating that I am now that much less liquid and mobile if I decide to leave my job (there’s some administrative processing to cash out and roll over my 401K when moving from company to company that is.) And so, in doing the math of how my 401K can compound here, I have come up with a chart for what my returns will look like year over year averaging say an $80,000 per year annual salary. For more information on all things finance, read on or subscribe to our blog for additional details and information.

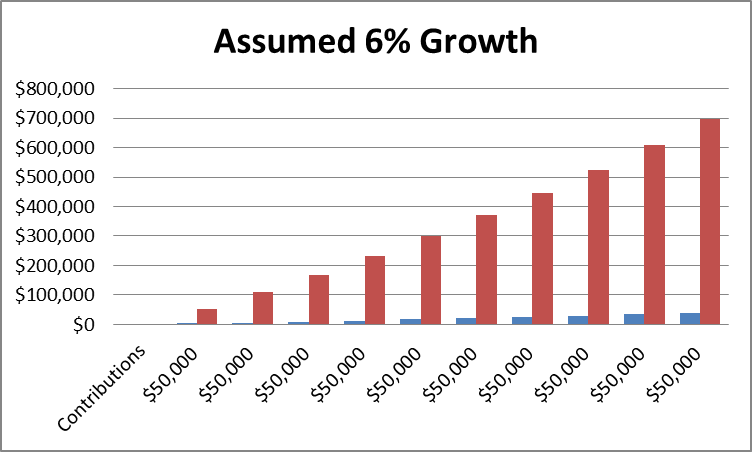

Here’s what my balance should look like over time

at $700 per month being put into the market, here’s what this should look like.

$3,000 in 2021

$3,000 in 2021

$10,000 end of 2022

$20,000

$33,000

$44,000

$56,000

$70,000

$80,000

$90,000

$100,000

| Related Posts |

|---|

This should be my 401K growth over the next 9 years or so, all things considered having $100,000 in retirement savings by the time I’m like 35 years old, and possibly more like $200,000 with some decent liquidity as well, is not a bad deal at all, obviously a lot of things have to go right in order to pull this off.

How Your 401K Compounds Over Time, And Why This Is The Key to Retirement for Most People

Building a company, or hitting it big on something that makes you an extreme outlier is dam near impossible for the vast majority of people on the planet. However with smart investment tactics and a disciplined work ethic, you can actually retire with a pretty solid nest egg. For instance, consider an average market return over the next 35 years, around the time when I should be approaching retirement. if I make an $80,000 per year average salary, and contribute 6% with my employer match up to that level, at a 7% annualized market return, theoretically I should retire with something like $2,300,000.00 by the time I’m about 62 years old and am eligible to start collecting social security.

With the RMD requirements on this as my income, alongside Social Security Income, some cash reserves, and possibly a small family inheritance by then, I should definitely be able to live off of that for the rest of my life. Add in the fact that if I keep writing just 2 blog posts per day on this website that I should have something like 27,000 posts on this blog, and just with this website I should have $7,000.00 per month in income, assuming none of the profits are reinvested. So all I have to do is keep doing what I’m doing for like 40 years and I’ll be a millionaire, easy right? 🙂

Final Thoughts on How Your 401K Compounds Over Time, Your Most Powerful Wealth Building Tool

In looking at this chart, I am actually pretty excited to be starting my 401K and am glad now that I am finally throwing some money in the market. That S and P 500 Index fund should serve me very well over the long term, and I can’t wait to see how that 401K account starts growing over time. Now I just have to figure out how to roll it over or cash it out should I decide to leave, I see a possible call with HR in my future unfortunately. For more information on all things finance, read on or subscribe to our blog for additional details and information.

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

Leave A Comment