Taxslayer Review for Taxes, Why I Just Used Taxslayer to File my 2020 Income Taxes Early

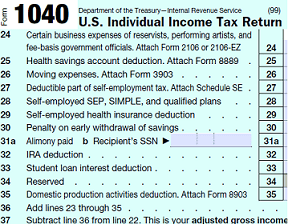

In this blog post, I’ll walk through my Taxslayer review for filing your taxes, and will tell you my exact experience with using this tax software for filing my 2020 income taxes, because I’ve got to tell you, I think that this is probably the absolute best tax filing software that I have ever used and that I will continue to use going forward. So this year, I had a slightly more complex tax return than I would’ve liked, and saw myself likely paying as much as $90.00 for the premium addition of Turbotax. This year, I had a W-2 from my 9 to 5 job in Wealth Management, I had about $2,000 in other earnings, for Schedule C income of $2,000.00, and I had a 1099-R with a 10% penalty for an early retirement account distribution, as well as a form 1099-SA for my Health Savings account contributions that I made for the year.

With all these new forms that I would have to attach to my main tax return, I expected to be hiring the tax professional that I had used in the past for my business tax returns, at a hefty price markup of $600 to $850 for his services. It was either this or take the chance at doing the return myself and screwing it up, which is definitely no fun. I opted to try out Taxslayer instead, which I had read is used by the IRS and is on the IRS free file alliance as the main tax software used for VITA, which is Volunteer Income Tax Assistance, people who have an interest in finance and tax that help seniors and low income earners file their tax returns completely for free.

So, in this blog post, I’ll give you the full rundown of how easy it was to file all these forms with this extremely user friendly tax software, and will explain why I would highly recommend everyone give this software a try, even if you are a loyal Turbotax or H and R Block customer, this software is WAY WAY better, much more user friendly, and has much more features for a far cheaper price. It is even endorsed by the IRS VITA program, which really says something about its usability!

Other tax softwares on the IRS Free File Alliance Include the Following:

Turbotax

Tax Slayer

H and R Block

Tax USA

IRS Free File Alliance

Lacarte Filing Software

Quickbooks

Credit Karma

Tax Act

Jackson Hewitt

And a host of other companies, read on or subscribe to our blog for additional details and information.

Is Taxslayer Any Good? My Official Taxslayer Review

So yes, it’s true, I literally just went ahead and used Taxslayer to file my taxes, and I have to say in total honesty that I thought it was a heck of a lot cheaper and simpler than using Turbotax, and that I will be switching permanently over to Taxslayer for all of my tax returns going forward. Aside from literally being the tax software that the IRS uses in their volunteer tax assistance program for low income workers, I found it to be significantly cheaper and more user friendly than the previous tax software that I was using, being Turbotax. From here, I also found that I could actually file cheaper, and have helped friends file their income taxes already way cheaper, having them only pay $17 through Taxslayer, and being able to use their user friendly forms selection tool to run through all of their income taxes, in comparison to me paying $90 and messing with Turbotax.

| Related Posts |

|---|

Is Taxslayer Trustworthy?

Yes, Taxslayer is extremely trustworthy. Once again, it is used by the IRS Volunteer Tax Assistance program, and has become one of the most powerful tax softwares for those that are trying to get their taxes filed for free, it has even earned itself a spot amongst the other large players in the IRS Free File Alliance.

Is Turbotax Better than TaxSlayer?

No, I would in fact say that Taxslayer is the better dog in this fight. Lets look at a brief comparison of the two in order to prove my argument here, if I have some pretty basic tax forms, a 1099-R for a retirement account distribution, a 1099-SA for my Health Savings account deductions, and a host of other tax forms, for just $17 I can throw these into Taxslayer pretty quickly and easily. With Turbotax, the system is a lot different, it will take me a lot longer, and can cost me as much as $90 to $100 just for having additional tax forms, such as the 1099-R or some basic Schedule C self employment income. with this being said, while I would still say that Taxslayer wins the game here, it is true that Turbotax does have one benefit, in that it is generally faster. What I am noticing with Taxslayer is that often times the website freezes up when I try to file tax returns, which is not so good especially when you have a friend or client counting on you to get a tax return done on a deadline.

Does Taxslayer File State Taxes? My Taxslayer Review for State Tax Filing

Yes, although their system for filing state tax returns is less than efficient in terms of its user experience. Turbotax definitely has a better system for their State tax filing clients, and I personally do not have a super fun time when filing state tax returns, either when helping someone with them or doing them myself, in that it is a pain to find their pin, to input all their information etc. just to be able to file their state tax return, especially when all of the withholding information is already on their W-2.

How do I amend a Tax Return on Tax Slayer?

Amending a tax return, depending on whether or not it is a very complex return (partnership, 1065 information returns where you’ll have to furnish K-1’s, etc.) can actually be pretty simple. Say if you have a second W-2 that you realized you missed adding and went ahead and filed your return accidentally, on either Turbotax or Taxslayer it is actually fairly easy to go ahead and add the other W-2 and file an amended return in the process with either tax software, and can be done free of charge in the majority of cases.

Final Thoughts on My TaxSlayer Review

In short, I would give taxslayer a five star review, they are a highly efficient tax software, are part of the IRS free file syndicate alliance, and are generally going to be much cheaper than using your other run of the mill tax filing software licenses. Also, the fact that the IRS uses Tax Slayer exclusively as a part of their Volunteer Income Tax Assistance program is really saying something, and really gives credit to the merit behind this software as a service. For more information, read on or subscribe to our blog for additional details and information.

Cheers!

*Inflation Hedging.com

Sources:

https://code.org/

https://www.freecodecamp.org/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

[…] Previous Why Do You Need Previous Year AGI? […]

[…] need three electives or so, and I’ll be able to have all of the education requirements for the CPA. After the initial bachelors degree, I will have all 150 credit hours needed, and will have the […]