How to Perform Confidence Interval Analysis in Excel, my take on performing this correctly

In this blog post will look at how to perform confidence interval analysis in excel and my take on performance correctly. Excel is an extremely challenging analytics system when you first try it out, and the further you go in it the more comfortable you’ll get, I personally taught people Excel on a pretty basic level, and while it’s somewhat painful at first, with practice just like anything else, you can definitely get really really good at it. Using excel can have something of a mild compounding effect in your life, almost on the level that being a good writer does.

I think it definitely has a compound effect in the workplace, especially in fields like business, finance or technology, and that in just about any field you go into you are going to need really good Excel skills. I’ve worked in two different jobs in the field of finance, one as a financial analyst for a year, another in the field of wealth management for more than three years, and another as a digital marketing analyst, for several years on top of that.

And every single job I’ve undertaken, I’ve had to use Excel fairly extensively, in that you need to send spreadsheets to clients, you need to send invoices to get billed properly, you need to use it to perform financial analytics and keep your finances in check, and it is a fantastic Accounting software for general book keeping. And so, in this blog post, let’s look at one of the most useful tools for Financial Analysis in Excel, using the statistics of Confidence Intervals to make a comparison case.

| Related Posts |

|---|

How to Use Confidence Intervals in Excel, My Tricks for Performing this Correctly

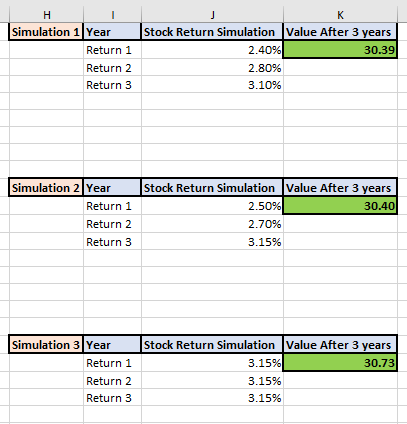

So, a confidence interval is a metric in statistics where you take the Standard Deviation of something, usually with a Financial calculator or a BAII Plus statistics calculator, and where you from there decide what measure of confidence you have behind this. Say the standard deviation of something of 4.5%, with the confidence interval equation. So on 4.5%, with a 95% degree of confidence you have a range of 2 standard deviations. Confidence Intervals work as follows:

So, a confidence interval is a metric in statistics where you take the Standard Deviation of something, usually with a Financial calculator or a BAII Plus statistics calculator, and where you from there decide what measure of confidence you have behind this. Say the standard deviation of something of 4.5%, with the confidence interval equation. So on 4.5%, with a 95% degree of confidence you have a range of 2 standard deviations. Confidence Intervals work as follows:

68% of all values fall within 1 Standard Deviation

95% of all values fall within 2 standard deviations

99.7% of all values fall within 3 Standard Deviations from the mean

A standard deviation, at least on a normal bell curve, is generally going to be about 50%. So for instance, in the IQ bell curve, typically you have an IQ of 85 as kind of the lowest acceptable IQ in society before you are considered cognitively impaired (10% of the population.) This is one standard deviation below average. A college graduate is 1 standard deviation above the mean in terms of intelligence, with an IQ of 115, and a grad student, or basic genius area level, which is an IQ of about 130, is going to be 2 standard deviations above the mean.

How to Perform a Written Analysis of Confidence Interval

Sometimes, the hardest part of making a good Excel spreadsheet, is not just getting the numbers, but is getting the written analysis of what the numbers mean after the fact. This meaning, explaining why you got that confidence interval out of that graph, and what it means. Assuming our example above, say we have 4.5% as our Standard Deviation, and the mean is 100. The problem set wants you to solve for the range at a 95% confidence interval. The answer in this case is going to be somewhere in the range of 91 and 109.

The reason for this is that at a 95% confidence interval, the number falls within 2 standard deviations from the mean, and so you take 2* the Standard Deviation amount, and make the range on both sides (either a positively skewed Standard Deviation or a negatively skewed one.) And that my friends, is what confidence intervals look like in statistics. In Excel, formulas or tools within the program can solve for almost all of this.

Final Thoughts on How to Use Confidence Intervals in Excel, My Opinion

And so, that’s how you use Confidence Intervals in Excel and in Statistics. They are a very useful tool for testing how firm a number is in any given set of numbers. It can tell you how skewed the data set is, and of whether or not the average you get from your data set is significantly skewed from the median or not, or if there are a lot of outliers at the tails of the bell curve. Hope you enjoyed reading, for more details and information on all things Finance and Analysis, read on or subscribe to our blog for additional details and information.

Cheers!

*Inflation Hedging.com

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

Leave A Comment