How to Learn Financial Mathematics, The Dividend Discount Model And How This Works

In this blog post, I’ll teach you how to learn financial mathematics, and of how you can become a Financial Wizard. I’ll be honest, I have sacrificed a good portion of my time the last 5-7 years learning Finance, doing financial math, and getting as smart and educated as possible in the field of Finance, and to be honest it has paid some really awesome dividends as a result. But it was extremely difficult to get this math through my head in the initial stages of doing so, and I’ll be honest that it was quite a sacrifice (I can’t even tell you how many nights I sacrificed going out drinking and having fun in order to stay in and learn financial math, which is far more profitable, but definitely not nearly as much fun.) And so, in this blog post, lets learn some financial mathematics, and lets run through some of the top math concepts in the field of finance. For more details and information on all things Finance, read on and subscribe to our blog for additional details and information!

Among the types of math we’ll be covering include:

The Dividend Discount Model

EBITDA and Enterprise Value Models

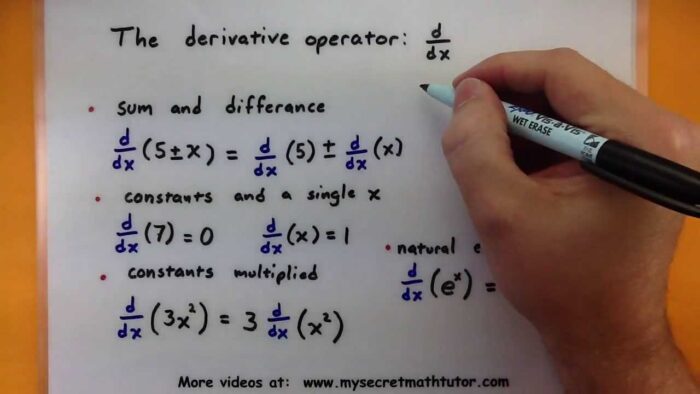

How to do Derivatives in Calculus

The math of the Balance Sheet

Math of the Income Statement

Math of a 1040 Tax Statement

Math of the Statement of Cash Flows

And much more, read on or subscribe to our blog for additional details and information.

| Related Posts |

|---|

How to Learn Financial Mathematics, And Why The Dividend Discount Model Should be First

The dividend discount model, when you are learning financial mathematics, is one of the arithmetic formulas of Finance that I find is one of the most pivotal to learn right off the back, as a lot of other formulas build off of it. Enterprise value to EBITDA, the Capital Asset Pricing Model formula, all of these are related to the Dividend Discount Model Equation, which is shown below:

R= D1/P0 + G

This is denoted as Returns are equal to D1, which is next years dividend divided by P0, which is the current price of the stock, + G, which is the annualized growth of the security. The math of how this concept would work goes something like this. Say we have a stock that is paying a dividend of $2.50 per share next year, with a current stock price of $111.25. The annualized growth of the stock is 5.5%, what is the return going to be on this security.

Plugging in some simple math, you get: R=$2.50/$111.25 + .055= .0775

Multiply this number by 100, and you will end up with 7.75% as your final return number. And that is the gist of the Dividend Discount Model. This formula is important because it lets you know what the annual return will be on the stock, by taking a simple formula and basically taking the Dividends + the Capital Gains for your total returns, or your holding period return. From here, we can branch off into learning the CAPM formula, also known as the Capital Asset Pricing Model, this is as indicated below:

R = Rf + B(Rm-Rf)

This formula comes out to be the Return on a given security is equal to the Risk Free rate (the return on a Short Term Treasury Bill), + the Beta of the stock multipled by the Return on the Market minus the risk free rate, will give you the return on the stock, once again in terms of the total return at any given time. This model actually is a projection, right up there with the academic intrinsic return value formula of the WACC, or the Weighted Average Cost of Capital, and breaks down upon further research. Most financial mathematics, tie back to finding the return on the stock before it happens, essentially Financial Analysis based on projections.

How to Learn Financial Mathematics for Actuarial Science, My Thoughts

Learning Financial Mathematics is huge with regards to the field of Actuarial Science. It is one of the top 3 Actuarial Exams that you will need to pass, mathematically wise, in order to become a fully licensed actuary. By learning the field of Finance, like say some of the formulas listed above that you would find in a typical BA in Finance program, and by blending in say Statistics I and Statistics II from any state college, you can absolutely give yourself a marked advantage for the Actuarial exams!

Final Thoughts on How to Learn Financial Mathematics, My Opinion

So, to learn financial mathematics, start with the above two formulas, and branch off into either a BA in Accounting or a BA in Finance. From here, you can most definitely give yourself a huge leg up in terms of learning finance, you will have a better math background and will be smarter in the field of Finance and with managing your capital for it, and you will be equipped to pivot to a variety of fields, like the Actuarial Sciences or becoming a CPA. Hope you enjoyed reading, and for more information on all things Finance, Business and Skills, read on or subscribe to our blog for additional details and information.

Cheers!

*Inflation Hedging.com

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

Leave A Comment