How to Handle Your Finances in Marriage, Why Caution is Best, And My Three Money Rules for Getting Married

In this blog post, I’ll talk about an extremely controversial subject that is very likely to create some chaos among my readers, which is how to handle your finances in marriage, and of why caution is best, as well as my three financial rules for getting married. The rules boil down to a few simple things, including, rule number 1. you’re getting a prenup. Rule number two, always keep your finances separate, and have one joint bank account that you fund together. Rule number 3. Tell your spouse the truth 95% of the time.

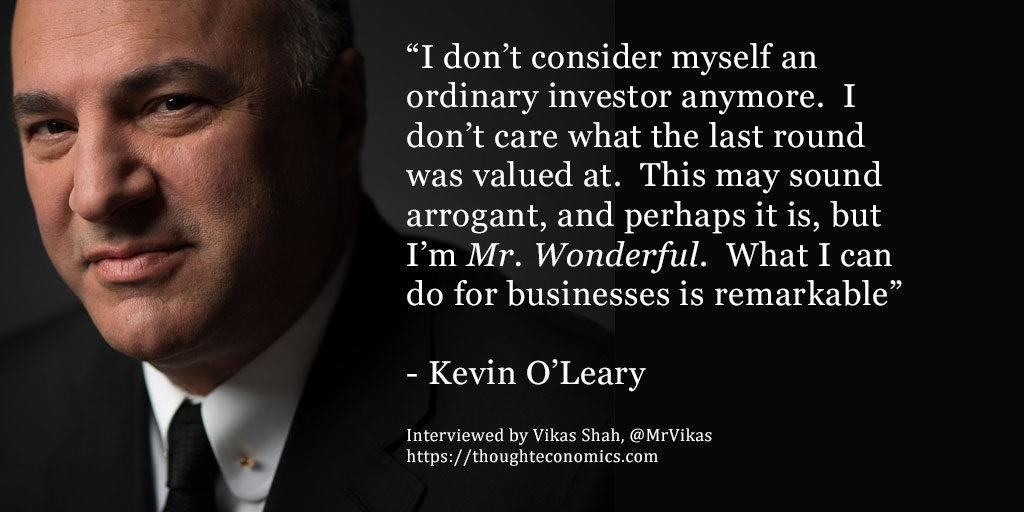

Rule number 4. Never get divorced, but if you do, do whatever it takes to keep the money. Like I said when I started this blog post, this is going to be a ruthless blog post and is going to be the harsh truth, but just like Kevin O’Leary says, the thing that breaks up marriages is not infidelity, it’s money, and that in life, there’s only three things, MEN, WOMEN, and MONEY.

In this blog post, we’ll look at the Men, Women and Money Philosophy of Kevin O’Leary, and will walk through why I whole heartedly agree with his philosophy.

The Kevin O’Leary Youtube video that is listed below basically shows Kevin stating his views on marriage, which are that you are getting a prenuptial agreement, that you are to maintain joint finances your entire time in marriage, while you fund a joint bank account that you both share for the day to day expenses, and that you put it all out in the open and stay honest with each other in marriage, especially when it comes to your finances. He claims, as I rightfully agree with for the most part, that it’s not infidelity that destroys marriages, it’s money.

Some of my other top rules for making money in marriage, keeping your money in marriage, and for growing the money that you have include the following:

Find a cheap way to start your muse, side business, or side hustle.

Find a cheap way to start your muse, side business, or side hustle.

| Related Posts |

|---|

Only invest in index funds or Well Known Blue Chip Companies

Generate forms of Passive Income

Have multiple streams of income

Work in a conservative field for a long time

Get a Prenuptial agreement

minimize taxes wherever possible.

Delay marriage and family as long as possible in life

WORK your butt off

For more information, subscribe to our blog or comment down below for more info.

One other thing to keep in mind for if you do decide to get married, there are multiple things to keep in mind in marriage regarding your finances, and there are actually some benefits to creating a financial union with your spouse. For instance, you get an increased tax deduction for the married filing jointly status, you get an increased deduction for having dependents when you have kids, you get college tuition write offs and the ability to contribute more to retirement accounts (which can work in the higher income spouses favor in that say you make $100,000 per year and you marry someone that makes $40,000.

You can essentially use this to put $12,000 into your Roth IRA through your spouse. The benefit of having two incomes is also something to look out for, in that someone making $80,000 per year that marries someone even making $50,000 per year now theoretically has much more disposable income, which really matters in a marriage.

How to Handle Your Finances in Marriage, The Cold Hard Truth About Managing Your Money While Married

Like Kevin O’Leary says, in life there are only three things, Men, Women and Money. Heed the advice above and you can have a happy, healthy and wealthy marriage ahead of you. The most important steps from the list above, are to get a prenup if you do decide to get married, as it forces out the truth with regards to your finances, ie. if you don’t want to marry someone with $200,000 in student loan debt that is a compulsive gambler, then you’ll find that out when you get a prenup.

I really like the practical advice that Kevin gives on the subject of marriage, in that there is a lot of bad, mushy gushy advice out there on the subject, and he gives it to you straight. For more information, be sure to comment down below and to subscribe to our blog for more details and information!

Cheers!

*Inflation Hedging.com

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

Leave A Comment