The short answer is, yes, Apple shares are currently overvalued. Today we will answer for you, are apple shares overvalued? We will be doing the math behind the question, so you don’t have to. Hopefully, this article will give you a little look at why it is overvalued, and how we came to that conclusion.

Price earnings ratio, aka the P/E ratio, is a surefire indication of whether or not a company’s stock price is too high, and the stock is overvalued. So, if the P/E ratio of a company is currently 10 that means that an investor is willing to pay 10 times the earnings per share. This is fine if a company is expected to increase their earnings significantly in the coming quarters however in Apple’s case and due to coronavirus concerns it has been estimated that Apple device sales may drop 36% in the second quarter. Just check out this MarketWatch article on Goldman Sachs downgrading Apple to a sell. This is an indication for Apple that its earnings will likely decrease. And given that Apple’s current P/E ratio sits right around 22 it is obvious that Apple’s share price is too high.

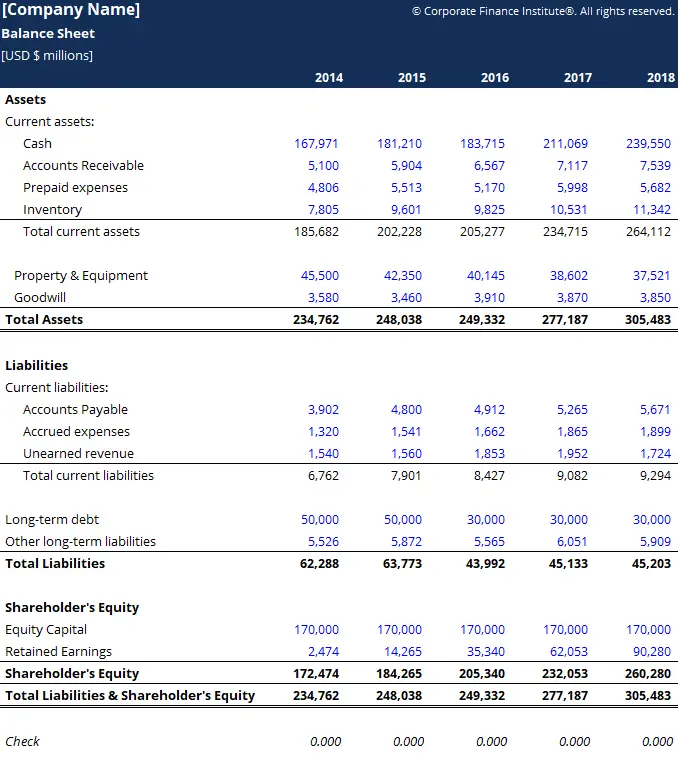

P/B ratio or price to book ratio is a good way of telling if a stock is overvalued as well. The P/B ratio is typically defined as the stock price divided by the total assets minus liabilities. So, it has roughly the same tell as P/E ratio however it does not take into account future earnings that a stock could make. Apple’s current price to book ratio is 13.4. Take for example IBM sitting at a P/B ratio of 5 and that the current industry median for P/B ratio is 2.4. 13.4 is a very high P/B ratio and is a good indicator that Apple stock is overvalued.

| Related Posts |

|---|

Apple’s Dividend Yield

Apple’s dividend yield is another good way of telling whether or not a stock is overvalued. The dividend yield is determined by dividing the dividend per share buy share price. Typically, if a dividend yield is high the valuation of a company is low and if the dividend yield is low and the valuation is high. Apple, as opposed to many other tech companies, has a fairly low dividend yield at about 1.1%, this is significantly lower than the industry median of three percent. Now all this could be an indicator to some that Apple’s stock price is not too high, however, given its current P/E and P/B ratios it is obvious that Apple’s stock price is too high and its dividend yield may not have adjusted to that fact.

Sources:

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

Using P/E Ratio to Determine if Apple Shares are Overvalued

Using P/E Ratio to Determine if Apple Shares are Overvalued

[…] Previous What is The Tax Form for Dividend Payments, How Are Dividends Reported? […]

[…] Degree in Finance, so I was very familiar with the world of Finance, and I also had worked as a Financial Analyst for a year prior, so I was no stranger to the world of Finance, Excel Spreadsheets, numbers and the […]

[…] value indicates that it is between fair value and overvalued. We have a recent blog post on why Apple stock is overvalued that you can check out here. Currently, Google stock is undervalued meaning that you are getting a […]

[…] and you get a $40 million fee for the year. So you actually only have one billion sixty million dollars In your bank accounts, and as such, gave up a lot of capital gains by putting your money into […]