What is The Tax Form for Dividend Payments, How Are Dividends Reported on Your Tax Return?

Have you been wondering what dividends are? Well, let me explain a dividend is a share of a company’s profits which is distributed to company stockholder or shareholders and is normally paid annually or quarterly based on a certain percentage of the profit margin. A shareholder is a person who has bought shares in the company and that means they own part of the company and therefore they are entitled to share in the company’s profit. The dividends payment varies from one company to another and its payment is dependent on whether a company makes a profit or not, for instance, a dividend payout may vary or be different amounts even in the same company depending on the profits they make in subsequent years. The following blog post will seek to explain exactly what a Dividend payment is, how companies use them, and of how you can potentially file them correctly on your tax returns. For more information about Dividends and Dividend taxes, be sure to subscribe to our blog or comment down below with your thoughts and opinions on the article and we’ll get back to you within one business day with a response. In this blog post, we’ll look at the question of “What is the Tax Form for Dividend Payments,” enjoy the post guys!

–>

| Related Posts |

|---|

What is The Tax Form 1099-Div, and How Is It Used for Reporting Dividend Payments

Dividend creates a platform for stockholders or shareholders to participate in as well as enjoy the company’s growth, this sharing of the wealth can come in one of two forms which include cash dividends or stock dividends. The number of shares dictates the Stock dividends and the payment method, one can get a check or cash depending on the number of shares. In the United States of America, for example, shareholders get payment for most dividends in cash based on a per-share price.

For example, a company can pay in $20 in cash for a shareholder with 100 shares if a dividend payout is 20 cents per share. However, dividends payout is a not guaranteed if the company makes losses in subsequent years then it is at the discretion of the board of directors to decide if or not to pay, when and how much to pay.

HOW DIVIDENDS WORK, Via Taxes or Otherwise

Dividends are divided into two broad categories that are; regular and special dividends. Regular are dividends that are paid as recurring  earnings to shareholders consistently over time. A number of companies try to predict a fixed amount that they can afford to pay consistently regardless of whether they make a profit or not. Regular dividends are in most cases paid quarterly. Special dividends are a form of a dividend that is payable once in a year. There are three special instances that the special dividends are issued by companies.

earnings to shareholders consistently over time. A number of companies try to predict a fixed amount that they can afford to pay consistently regardless of whether they make a profit or not. Regular dividends are in most cases paid quarterly. Special dividends are a form of a dividend that is payable once in a year. There are three special instances that the special dividends are issued by companies.

A company will sometimes pay this dividend if they make profit consistently over a number of years or after several profitable quarters. Sometimes a company might pay a special dividend after disposing of assets and the money has not been budgeted for. Companies also pay these special dividends if they accumulate money over time and doesn’t want to plow it back to business since the company is stable. Most companies offering special bond announce in the media their profits and how much they intend to offer to the shareholders.

The total amount of dividends a company pays is referred to as a dividend yield. This dividend yield allows shareholders to make a quick calculation on how much they will earn in the form of dividends. If a stock has a yield of 5%, a shareholder automatically knows she will make $5 per every $100 invested, $50 on every $1,000 invested. Some of the companies that pay good dividends in the USA include the McDonald’s which is 2017 made a profit of $5.2 billion and paid out $3.1 billion in dividends to its shareholders.

BENEFITS OF INVESTING IN DIVIDENDS

Dividends are a source of income for millions of investors or shareholders, Because companies pay their dividends at different times, retirees can create a schedule to receive a dividend check each month of the year,

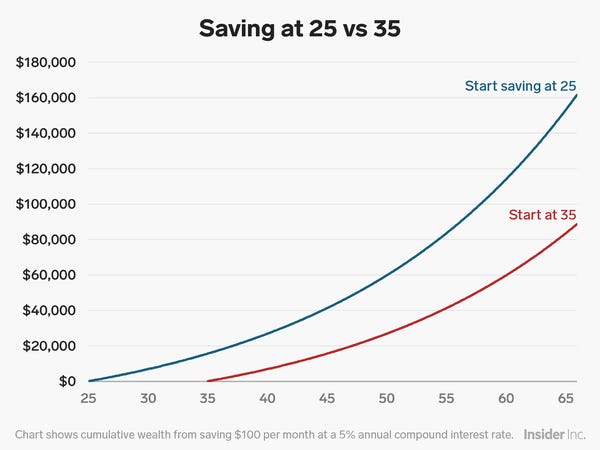

Younger people are also investing in shares as a future source of income since they may have capital now and may not need the income now, can put those dividends to work immediately in their portfolios by reinvesting them. Dividends can be a source of capital for other business for instance if you invest and the company makes quite a lot of money and pays out regular dividends and also offers you a special dividend then one can diversify that money and invest it elsewhere.

How to Pay Your Dividend Taxes Correctly on Your 1040 Through Form 1099-Div

It is good to note that dividends are in a tax-advantaged account like an IRA, meaning your money has a tax free growth until it’s withdrawn this is an advantage unlike in regular business where you pay your taxes very often sometimes on monthly basis

Dividend stocks benefit a lot when the yields are high compared to bonds especially when interest rates are low, Dividends offer possible share price appreciates even with fall of price, the dividend can also protect a portfolio with steady income especially when you plow back in shares dividends, A staple of every income investor’s portfolio is known as a dividend stock, use it properly and get huge dividends with the power of passive income!

Final Thoughts on The Question of “What Is The Tax Form for Dividend Payments,” And Explaining How Dividends Are Reported

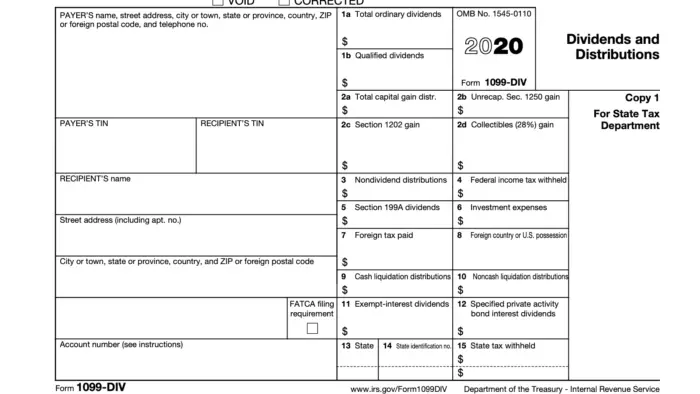

To touch up and wrap up this blog post article, form 1099-Div is essentially going to be your W-2/1099 that you get in the mail for your dividend payments specifically. It is the form that you receive in the mail, and it has nothing to do with filing your taxes other than adding the form to your bottom line. The form 1040, is where you will report this information under the interest income portion of your primary tax form. For more information on Dividends, Taxes, Equities, and all things finance, accounting and equities, comment down below or subscribe to our blog for additional details and information. Until next time, you heard it first right here at Inflation Hedging.com.

Cheers!

Sources:

https://finance.fandom.com/wiki/Firm_Foundation_Theory

https://finance.fandom.com/wiki/Castle-in-the-Air_Theory

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

[…] hedge fund, though it’s a term that is frequently thrown around a lot in the finance game, is actually a legal term. Typical structure of a hedge fund, is related to the ability to […]

[…] 1099-DIV […]

[…] 1099-DIV […]

[…] 1099-DIV […]

[…] 1099-DIV […]