How Many People In The United States Are Worth 10 Million Dollars? 1.5 million households, or about 1.13% of Households

How many people in the United States are worth 10 million dollars? $10,000,000.00 is the new $1,000,000 given inflation, and given how much the housing market etc. has appreciated. Billionaires are saying that $10MM is really the number where you are actually considered rich. This is where you can give yourself all the healthcare that you could possibly need, it is where you can provide proper legal defense in the United States (quoting Peter Thiel here, who said if you have $5,000,000.00 in America right now you cannot provide yourself with proper legal defense. Bit of an exaggeration but there is definitely some truth here), it’s where you can stop working, yes you heard me right, prior to $10,000,000.00 you should probably be working, otherwise you are a single digit millionaire and you are in the realm of wealthy anxiety, terrified to lose the money that you do have. In this blog post, I’ll tell you why only the richest 1% of American households have $10,000,000.00, and of what I am planning on doing to get to $10,000,000.00 as soon as possible.

How to Get to $10,000,000.00, My Plan, The Big 3 Companies I Plan to Start

Here’s my finances right now, most people would say that I am doing pretty well but to tell you the truth, I feel dead broke. My net worth right now is about $50,000, this is between my 401K, my HSA, my Investment portfolio, and my bonds, CDs and Cash Reserves. And my income sources are below:

Portfolio Income: $700 per year

This Website: $625 per year

Youtube Channel: $4200 per year

Savings Account Interest: $242.25 per year

Job, CSA in Wealth Management: $70,000 per year

In total my income is $75,767.25, not bad for someone that’s only 27 years old, but if I want to get this up to $10,000,000, I seriously have a ways to go to pull this off.

Here’s my plan to pull this off. I am going to pivot from Wealth Management to Public Accounting, taking a small pay cut initially, from $70,000 down to about $55,000, which should go back up to around $60,000 in 4 months, for an annual income of probably $60,000 down from $70,000. With this I am really going to start to scale my Youtube channel, hopefully growing it to something that makes $2500 per month by the end of next year, and $5,000 per month by the end of 2024. This website should also scale accordingly, and should ramp up to something like $1500 per year. Salary should also be something like $77,000 by the end of the year 2024, portfolio income should increase, moving up to $5,000 per year in dividends. Interest income will stay the same. So by the end of 2024, my aggressively realistic financial frame looks like the below:

Salary: $77,000 per year as a CPA

Portfolio Income: $4,000 per year

| Related Posts |

|---|

This Website: $1500 per year

Youtube Channel: $60,000 per year

Savings Account Interest: $250 per year

Net Worth should also be about $150,000 at this point. Now we are really getting somewhere and we are starting to see the fruits of our labors compound here. The new income here would be:

$142,750.

At this point I am also going to do 2 things, start a second Youtube channel in the finance niche, and put $175,000 for half a duplex which should cash flow $18,000 per year. I am hoping the Channel can crack $2400 its first year in operation. Another raise should also kick in here, moving me up to $87,000, portfolio income should rise to $5,000 per year, the website should be cash flowing $2500 per year, and the Youtube channel should be making say $90,000 per year. Let’s look at the new numbers.

Salary: $87,000 per year

Portfolio Income: $5,000 per year

Website: $2500 per year

Primary Channel: $90,000 per year

Youtube Channel 2: $2400 per year

Rental Property: $18,000 per year

Savings Account Interest: $250 per year

Net Worth should be around $200,000 at this point. $205,150 is the new income per year. After taxes this should be around $150,000 after 401K contributions and the depreciation write offs etc. I am hoping to save myself tax fees by being a CPA that can file all of the returns myself for this business also. If I keep my living expenses still at around $30,000 per year, we are looking at $120,000 per year in savings.

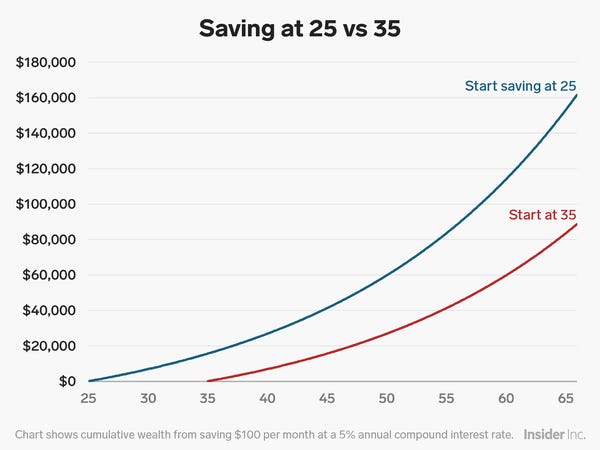

So Now I am like 30 or 31 years old, but should be able to be stacking away $100,000 per year. In five years, with property appreciation, stock market appreciation, and the like, net worth should be around $1,000,000.00, this is if all of this holds perfectly, and I probably need to stay relatively single during this too to save time and money, and I cannot have a kid during any of this or a massive portion of those goes south, due to the cost of time and money involved. If I have a net worth of a million at 35, I can’t even imagine how long it will take me to get to $10,000,000.00 as it seems somewhat insurmountable. It will likely take me until I am almost 50 years old working like a maniac and splitting gains between the stock market and the real estate portfolio to pull this off.

With $1,000,000 at age 35, leaving that in the stock market until I am 55 gives me a net worth of around $5,000,000.00 assuming that I add $0.00 to the principal. $100,000 per year additions likely bumps this number up to $10,000,000. Investing all of this into Duplexes however with all of the market appreciation on the homes and with the rent being cash flowed all of this time and being put back into additional duplexes, net worth could be as high as like $15,000,000.00 or $20,000,000.00. The returns on Real Estate are something like 16% per year versus 8% to 9% in the stock market, non inflation adjusted on both sides.

Anyway, that’s my plan, as I am writing this out now, it looks like it’s going to take me until I am like 55 years old at best to pull this off.

What Is The Average Age of a Deca Millionaire Worth $10,000,000.00?

The average age of US millionaires is 62 years old. Yes you read that correctly, so anytime you are reading a magazine article saying that everyone is a millionaire, they are lying. If you stayed employed and lived below your means for this long, then you probably would have just hit a million dollars. I will give billionaires and hundred million dollar Youtubers one thing, you definitely need multiple streams of income in order to make it up to $1,000,000, $2,000,000, $10,000,000, $20,000,000 and beyond. Even with $1,000,000 you are only just starting to really play monopoly, it is at $10,000,000 that you can really take risk, live your life, and win the game.

Final Thoughts On How Many People In the United States Are Worth 10 Million Dollars?

Those are my thoughts on deca millionaires, 1.4 million households means there are about 700,000 individuals with a net worth of $10,000,000.00 If you want to hit this number in your 20s or 30s, the number of people that have done this is even smaller. There are probably only 30,000 people in the entire country that have $10,000,000 that are under age 30, or that are in there early 30s. For a percentage, that is 1/100th of 1% of the US population. Very low odds of pulling this off. Thanks for reading and hope you enjoyed!

Cheers!

*Inflation Hedging.com

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

[…] Previous Why Does Andrew Tate Wear Sunglasses All The Time? […]

[…] Tate and his brother Tristan Tate, from various business ventures that they both participate in, look to each have a net worth of around $50,000,000, for a […]