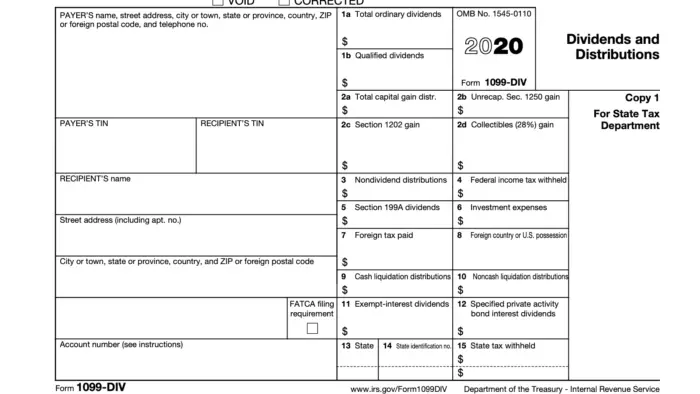

How Are Dividends Taxed By The IRS, Form 1099-DIV Tells All

Dividends refer to the unit of ownership in a company to an individual. They are usually paid quarterly to the company’s investors. The shareholders are shared the amount of profit that the company realizes after a certain period. Upon sharing of the dividends to the shareholders, the duty is obliged by a board of directors who are given the responsibility through voting by the members. The cash dividends are the most common. The bonuses can also be paid to inform of cash payments or through a share of stocks. To summarize, dividends are typically taxed by the IRS in a few ways, first off, they are witheld at around a 15-20% tax rate, and pass this, if for some reason you are exempt from tax witholdings, then you will receive a form 1099-DIV in the mail, and will need to report your dividend wages on form 1040. More on this in the post, subscribe for more details and information!

| Related Posts |

|---|

How do Dividends Work, and Why You Will Need To Report Any Dividends That You’ve Paid Out If You Receive Check Payments

In most cases, usually, in a growing company, dividends are paid in a fixed schedule. They paid quarterly or every month for the example of exclusive bonuses, these paying every month. In most cases, dividends paid in the form of cash, but other companies decide on the mode of payments.

What Is The Meaning of The Dividend Yield?

The dividend yield is also called the dividend-price ratio. It refers to the price per share, which is usually divided by the price per share. It also refers to, in totality the annual company’s payments divided by the capital base specialization in the assumption that the cost of

What are Dividend Stocks?

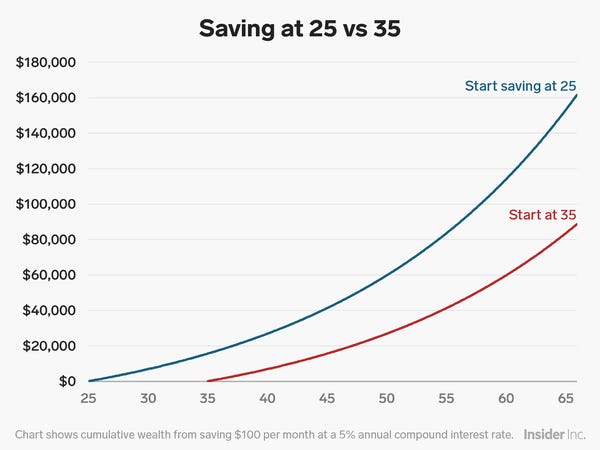

Profit stocks additionally regularly advantage from higher yields than securities when loan costs are low, while at the same time offering the potential for offer value appreciation. Regardless of whether the value falls, the profit can pad a portfolio with relentless salary, and on the off chance that you reinvest those profits, a lower offer cost gets you more offers per dividend.

The Top Dividend Stocks On The Market

1.Altria Group(MO)

2.CVS

It is the newest to buy

3.Intel Corp.(INTC)

There is greatness in investing in dividend ownership!

Final Thoughts on Dividends, There Tax Consequences, and How You Can Correctly Use Them, Final Analysis of How Dividends Are Taxed By The IRS

In short, Dividends can be a very useful way to hedge a portfolio against your downside risk, and can absolutely be useful for adding liquidity to an equity based portfolio. Do you have dividends in your portfolio, or have you incurred any major penalties regarding how much money you made in dividends, or if you under reported? Leave us a comment down below and let us know, and until next time, you heard it first right here at Inflation Hedging.com.

Cheers!

*Inflation Hedging.com

Sources:

https://finance.fandom.com/wiki/Firm_Foundation_Theory

https://finance.fandom.com/wiki/Castle-in-the-Air_Theory

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

[…] for the year, ask yourself if it is really worth it to hunt down an extra tax form in the form of a 1099-INT at the end of the year, just to put a few extra bucks in your pocket, think hard on this question, […]