Technical Analysis vs Fundamental Analysis, What is Technical Analysis, and Why I am More of a Fundamentalist

Technical analysis is a fundamental trading discipline employed in evaluating investments and identifying trading opportunities through analysis of statistical trends collected from trading activities, like price movement and volume. Technical analyst mainly focuses on patterns of trading signals, price movements, among other analytical charting tools used to evaluate strength or weakness of security. Perhaps this is entirely different from the analyst who attempts to the intrinsic value of a security. Technical analysis can also be used on any other security provided it has historical trading data. Some of these securities include currencies, fixed-income, commodities, futures, stocks, and others. The following blog post will walk through the debate of Technical Analysis vs Fundamental Analysis, and of why I am more of a fundamentalist investor. Subscribe to our blog or comment down below with any questions and we’ll get back to you within one business day with a response.

The Benefits of Trading on Technicals vs. Fundamentals

The most beneficial factor about technical analysis is that it’s virtually applied to any trading instrument regardless of any time frame. Other essential benefits of trading on technical are:

• It can be applied from a short term perspective to long term time frame

• Used to analyze anything from forex, interest rates, stock, or commodities

• Used as a standalone method or incorporated with other methods

• Used to create a set of rules and guidelines essential in the decision-making process

• Also used to find potential trading opportunities in financial markets for successful trading

What are the most popular charts patterns used?

Chart patterns are a valuable part applied to the technical analysis. Most of the traders are using them in identifying potential trades and confirm with other forms of analysis aimed at maximizing their odds of success. Some of the popular chart patterns found across any time frame and used in technical analysis includes:

Triangles

| Related Posts |

|---|

Triangles occur frequently as compared to other patterns making them the most popular chart patterns. These types of charts can last from a couple of weeks to several months. The three most common triangles available include ascending triangles, descending triangles, and symmetrical triangles.

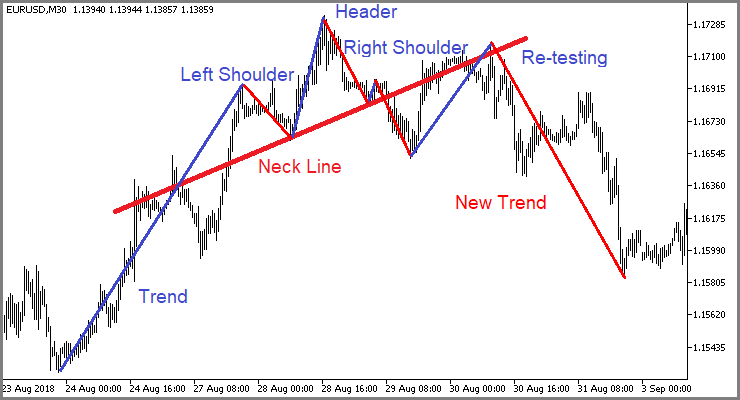

Head and Shoulder

This is a chart pattern characterized by three peaks, head being the highest peak at the middle and the other two roughly equal shoulders being the lowest peaks. The lows lying between the peaks are connected by trend line known as the neckline; it represents an essential support level used for watching breakdown and the trend reversal.

This is a chart pattern characterized by three peaks, head being the highest peak at the middle and the other two roughly equal shoulders being the lowest peaks. The lows lying between the peaks are connected by trend line known as the neckline; it represents an essential support level used for watching breakdown and the trend reversal.

Cup and Handle

This is a bullish continuation pattern that pauses on an upward trend and then continues after confirming the pattern.

Double Tops and Bottoms

This type of charts is the most reliable and easy to recognize and thus they are favorite for most of the technically-oriented traders. Pattern formation is obtained when the price tests the same support after a sustained trend or resistance level twice without any breakthrough.

Final thoughts on Technical Analysis vs Fundamental Analysis, Which Has a Higher Probability of Success

Many investor and traders make use of technical analysis as a way of getting the direction of the markets. When the patterns occur, chances are many others can emerge because markets aren’t entirely random. Therefore, investors and traders can create patterns on market prices making it a self-fulfilling trend.

Sources:

https://finance.fandom.com/wiki/Firm_Foundation_Theory

https://finance.fandom.com/wiki/Castle-in-the-Air_Theory

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

Leave A Comment