Technical Analysis Review, My Review of Technicians and Chartists In The Market And How I Feel That They Usually Perform

Technical analysis is a procedure that chooses and evaluates about purchase and sells utilizing market insights. To perform technical analysis, investors study charts which demonstrate the cost and trading volume history of a specific security or index. After this, they consider other factual estimates, for example, moving midpoints, maximums and minimums, and rate changes in a specific time duration. In going further on this topic, the following blog post will walk readers through my full and entire Technical Analysis review, will explain why I don’t really consider myself a “Technician” or a “Chartist,” and will walk through why I prefer passive index fund investing and firm fundamentals, in comparison to the use of technical analysis to “speculate” and try and time the market. For more information, be sure to subscribe to our blog for additional details and information, and to comment down below with your thoughts and opinions on the article, and we’ll get back to you within one business day with a response.

The Benefits of Trading on Technicals, But Why I Still Don’t Use This Very Frequently

-

Trend Analysis: My Favorite Factor of My Technical Analysis Review

The greatest benefit of technical analysis is that it enables investors and dealers to foresee the trends of the market. Uptrends, downtrend, and sideways moves of the market are always too difficult to anticipate, but with the help of technical analysis, it is made easy.

-

Entry/Exit Point, My Technical Analysis Review of This Trend Analysis

Timing possesses a vital role in trading and business. With the assistance of technical analysis, dealers and investors can anticipate the opportune time to enter and leave trading to get high returns.

-

Provides Early Signal

Technical analysis gives early flags and paints an image of the thinking of investors and gives an idea about what they are doing. Price volume also demonstrates the movements of market producers, and it provides an early indication with regards to a trend reversal. (This exact pattern is on the Series 7 exam for those of you that are interested in pursuing wealth management.)

-

Quick and Less Expensive

| Related Posts |

|---|

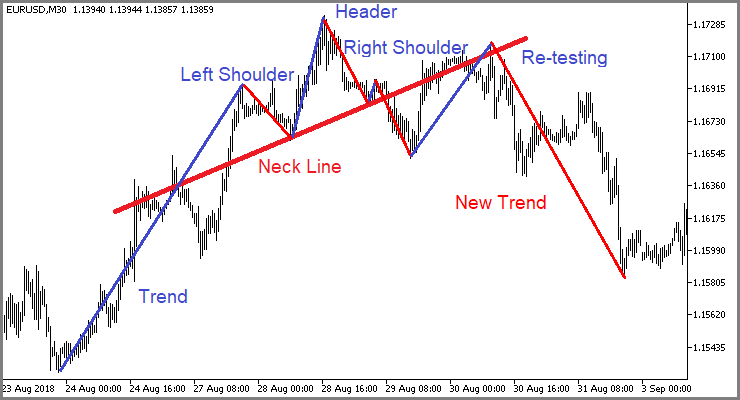

In money trading, technical analysis is more affordable when contrasted with the fundamental analysis and there are such vast numbers of companies that give free charting programming. Technical analysis provides a fast outcome for traders. For example, the chart of head and shoulder shows results in 1 to 5 minutes.

What are the most popular chart patterns used? The Analysis of My Technical Analysis Review

The two most prominent chart designs are reversals and continuations.

A reversal pattern indicates that a prior trend will reverse when the pattern is completed, whereas, a continuation pattern indicates that the trend will continue when the pattern is completed.

Reversals include:

- Head and Shoulders

• Wedge

• Double tops and Bottom

• Triple Tops and bottoms

• Rounding Bottom

Famous Continuations include:

• Cup and Handles

• Flag and Pennants

Final thoughts on Technical Analysis, And Why My Review of Technical Analysis Wouldn’t Be Complete Without explaining My Favorite Pattern of them All!

Some frequently questions that are being asked by traders like “Is the market overpriced?” “Which levels are the good entry points?” are difficult to be answered but technical analysis makes it obvious to get these. Technical analysis, while being quick and less expensive, has made trading so easy and foreseen. It has saved traders from plenty of manipulations in business. In short, I really am not a huge fan of technical analysis overall, and definitely prefer to go with Fundamental Analysis or simply passive index fund investing as my go to strategy. Subscribe or comment down below for more details and information!

Cheers!

*Inflation Hedging.com

Sources:

https://finance.fandom.com/wiki/Firm_Foundation_Theory

https://finance.fandom.com/wiki/Castle-in-the-Air_Theory

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

Leave A Comment