How to Get Qualified Tax Treatment for Your Dividends, and How You Can Make the Absolute Most of Your 1099-DIV Payments

Dividends are payments made by a company to its shareholders. This is usually a distribution of profits. When the company continues to do well in the market, the number and amount of each dividend can increase over time. Aside from the financial side of Dividend payments, one of my favorite things to talk about with regards to dividends is how they are taxed, the tax consequences of taking dividend distributions over say, reinvesting those profits back into an index fund without having had the distribution in the first place, if reinvesting dividends into a DRIP plan still causes you to pay ordinary income tax rates (or any taxes at all) and of how you can get qualified tax rates on your dividends rather than the higher, short term ordinary income tax rate that most will pay on their Dividends. All this and more in the blog post below, be sure to subscribe to our blog for more details and information on taxable dividend distributions, and to comment down below with your thoughts and opinions on the article, and we’ll get back to you within one business day with a response. And now, lets answer the question of how to get qualified tax treatment for your dividends, and why this is significantly favorable to the ordinary income tax rate.

–>

| Related Posts |

|---|

Among the Dividend related tax topics I will try to discuss in this article include the following:

Why REIT Dividends Can Never Be Qualified Dividends

Qualified vs Non Qualified Dividends

Ordinary Income Tax Rates vs Capital Gains Tax Rates

How to Get Qualified Dividend Tax Treatment

How to Get Ordinary Income Tax Treatment for Dividends (IDK why you would want this)

How A Possible Alternative Minimum Tax (AMT) May Affect Your Dividend Distributions

Let’s get started! And be sure to comment any tax or dividend questions down below and we will get back to you ASAP!

How do dividends work, and How Can I Get Qualified Dividends?

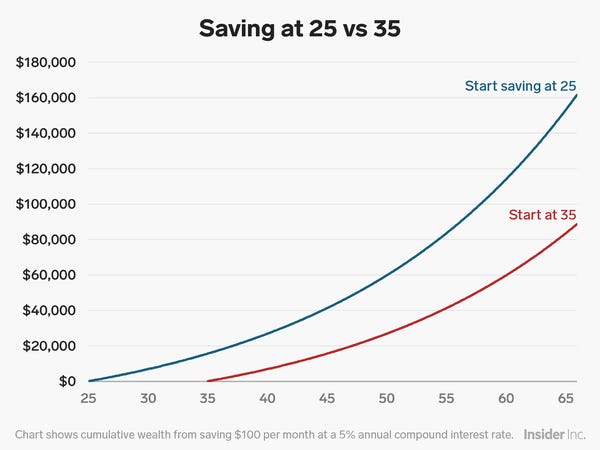

Most dividends are paid out quarterly. For example, if a stock has a $10 annual dividend, a quarterly dividend of $2.50 is paid out each quarter to its shareholders. Some dividends are paid out annually. Other companies prefer to pay out dividends on a non-cash basis. Instead, they distribute property or added shares of stock to their shareholders as dividends. In looking at how you can get qualified dividends vs non qualified dividends however, this is a tax issue, and a holding period issue more than a financial issue. Let’s look at how you can get qualified Dividend treatment, in order to pay the more favorable Capital Gains Taxes on your dividends, as opposed to the ordinary income tax rates, such as in the chart above ^.

- The only way that you can get qualified dividend tax treatment and pay just capital gains taxes on your dividends, is to hold the stock for more than one year. If you hold the stock for 1 year, you will be able to pay capital gains taxes on both your dividends, and any capital gains that you have on the stock should you choose to realize those capital gains (ie. by selling your stock) with the only exception being a REIT, as REIT dividends are always taxed at the ordinary income tax rates no matter what the holding period is. The exact reason why this is I am unfamiliar with, however I would speculate that it has something to do with the fact that REIT’s are a different type of corporate tax structure that is used to avoid taxes and obtain more favorable treatment as it is. On top of this, REIT’s pay out a huge percentage of their profits as a dividend, and sometimes even pay out a liquidating dividend (when the dividend paid out is more than the retained earnings of the company for that period, Quarter, Year, etc.) and have a very high dividend yield, On this note, the IRS definitely wants their money when you get high yield dividends like this, which is another reason why they are taxed at the less favorable rate.

What is the Dividend Yield, and Does it Affect My Cost Basis for Taxes?

The dividend yield is the ratio of a company’s annual dividend compared to its per share price. This is usually expressed as a percentage. A good dividend yield is ten percent or more. The average dividend yield is usually around 2.22% as a whole. The average dividend yield for most stocks listed in the S&P is 2.5%, although some stocks can have higher dividend yields, depending on the industry. Regarding your Dividend Yield, there are a few things to keep in mind regarding how the check you receive from your dividend is taxed, and they are the marginal tax brackets that you will pay on the dividend depending on the holding period that you choose. The tax brackets are below:

Ordinary Income Tax Rates: (For Single Filers, not Doing Joint…too much work 🙂

10%>>>>>>>>>>>>>>>>>>>>>>>>>>$0.00 to $9700.00

12%>>>>>>>>>>>>>>>>>>>>>>>>>>$9701 to $39,475

22%>>>>>>>>>>>>>>>>>>>>>>>>>>$39,746 to $84,200

24%>>>>>>>>>>>>>>>>>>>>>>>>>>$84,201 to $160,725

32%>>>>>>>>>>>>>>>>>>>>>>>>>>$160,726 to $204,100

35%>>>>>>>>>>>>>>>>>>>>>>>>>>$204,101 to $510,300

37%>>>>>>>>>>>>>>>>>>>>>>>>>>$510,301+

It’s important to keep in mind that these are taxed at the margin, and that the Capital Gains rates listed below, are not taxed at the margin.

With this in mind, the Capital Gains Tax Rates Are Listed Below:

0%>>>>>>>>>>>>>>>>>>>>>>>>>>$0.00 to $39,375

15%>>>>>>>>>>>>>>>>>>>>>>>>>$39,376 to $434,550

20%>>>>>>>>>>>>>>>>>>>>>>>>>$434,551+

Again, these are for single filers only, but you can see how these capital gains rates are much more favorable in terms of paying less taxes overall. Be smart, hold your stocks for longer and don’t trade! Buy and Hold for the win!

Why are Dividend Stocks Good, and Why Are They Bad for Tax Purposes?

Some of the advantages of dividend stocks are:

- Financial flexibility. If a stock generally has a low dividend payout ratio, but is performing well in the market and is generating higher levels of cash flow, they have more flexibility to be able to increase their dividend. On the other hand, if a company is going into or taking on added debt to fund their dividend payouts, that’s a sure sign of trouble.

- Less tax. Another benefit of owning stocks that have dividend payouts is that shareholders generally do not have to pay taxes on the value. The only time taxes would be assessed are for stocks with a cash dividend option. Taxes must be paid annually in this instance, even if additional shares are received instead of cash.

Here are some of the most popular dividend stocks on the market today, with current dividend yields over 4%:

- TC Energy (NYSE symbol: TRP). Formerly known as TransCanada, this energy company currently has dividend yields at 4.6%. They have worked to ensure higher payouts by selling off assets that have typically had more volatile cash flows and replacing them with assets that generate more consistent and stable earnings.

- IBM (NYSE: IBM). International Business Machines has been in business since the 1880s. and is one of the best known and largest technology companies in the world. Their current dividend yield is at 4.8%. IBM is working to adapt and evolve as market conditions change and technology improves. They are currently focused on cloud computing and their recent acquisition of RedHat, an industry leader in open source computing solutions.

- WestRock (NYSE: WRK). This Atlanta, Georgia-based packaging company has also seen significant growth in recent years. Their current dividend yield is at 4.7%. Their recent acquisitions of competitor KapStone and efforts to produce more environmentally friendly packaging that is popular with consumers have helped to increase their earnings by double digits.

Final Thoughts on My Dividend Payments, and How To Get Qualified Tax Treatment For Your Dividends Just Like I Do!

Well if you couldn’t tell by the length of this blog post compared to my other blog posts (on Finance vs. Tax and Accounting mainly) evidently I like writing about Tax and Accounting even more than Finance, who would’ve thought! In any case, if you have any questions about Dividends and how they work, comment down below with any concerns that you may have. I am NOT a CPA at the moment…yet (work in progress, have only taken some basic level accounting courses so far though) so I’m not 100% sure if I can legally answer your tax questions (I can give it my best shot though!) But any finance related ones I definitely can! Comment down below and subscribe, thanks for reading.

Cheers!

Sources:

https://finance.fandom.com/wiki/Firm_Foundation_Theory

https://finance.fandom.com/wiki/Castle-in-the-Air_Theory

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

[…] Previous Top 10 High Dividend Yield Stocks, Great Returns on Stocks […]

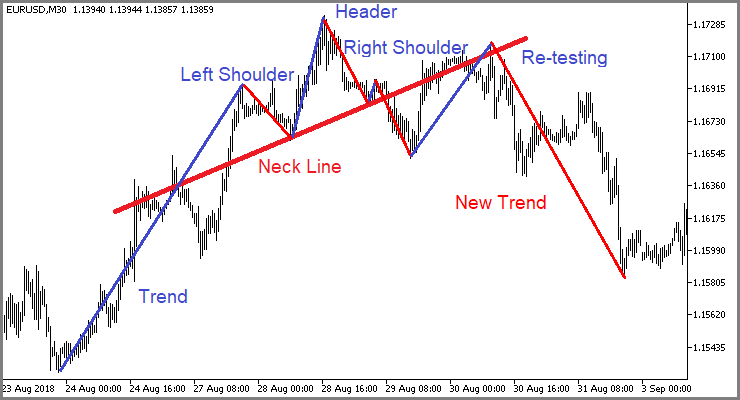

[…] analysis is a fundamental trading discipline employed in evaluating investments and identifying trading opportunities through analysis of statistical trends collected from trading […]

[…] Previous Next Top 10 High Dividend Yield Stocks, Great Returns on Stocks […]