How to Get Dividends, And Why You Absolutely Need Dividends in Your Portfolio

Dividends, Dividend Yields, The Yield Shield, Buy and Hold Stocks, in the world of high finance, the hundreds upon hundreds of terms that are thrown around can sometimes make your head spin, and can detract from one of the central themes of finance, which is personal finance and investing. This blog post will show you how to get dividends in your portfolio, and will walk you through why investing is by far the most important part of finance, as managing your personal finances, and growing your own personal wealth, is what your day to day reader is going to be looking for when they’re reading about stock. The following blog post will look into how the everyday man can invest their assets, and will explain why ETF’s, holding a diversified portfolio, and having a steady income stream of dividends in your portfolio, is something that every investor absolutely needs to have. As a side note, if you are studying for the Securities Industry Essentials Exam, this is a really good thing to know for the exam!

–>

| Related Posts |

|---|

My General Take on Asset Allocation and Investing, and Of How to Get Dividends In Your Portfolio

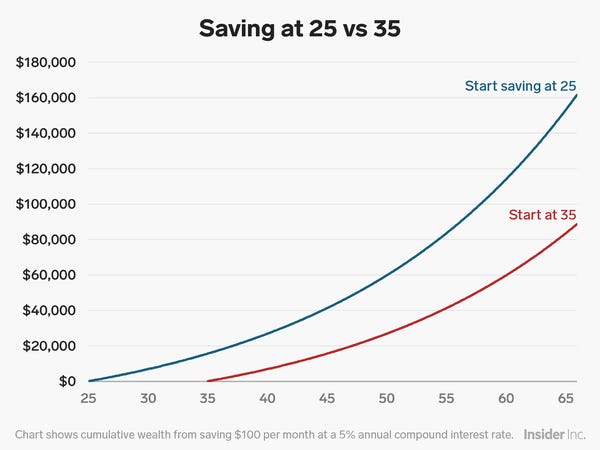

Most experts will tell you that asset allocation accounts for 90% of your total returns and will say that you should allocate your assets based on your stage of life. The general rule is to take 100 minus your age and use that number to determine the amount of equities in your portfolio. For instance, being that I’m 25 years old, I’d be looking at a portfolio comprised of 75% equities, while my parents, who are in their 50s, would be looking at something closer to a portfolio with 50% equities, and 50% cash or fixed income. My take on this however, is that if you can buy and hold equities for the long haul, given the risk reduction that this entails, that you can drastically increase the amount of your portfolio that is in equities, even as you age. Using my model for dividend stocks, and for building an annuity out of your portfolio, you can probably keep your portfolio at closer to 75% equities and 25% cash, even as you approach the age of retirement, due to the financial security and regular income that dividend stocks will provide.

A quick add on for this is that the OUSA ticker, which is the Kevin O’Leary ETF fund company, pays out monthly dividends! I am definitely going to throw this into my portfolio so that I can start reaping the rewards of more frequent and consistent cash flow.

Why Dividends Are Essential to Your Portfolio, How to Get Dividends

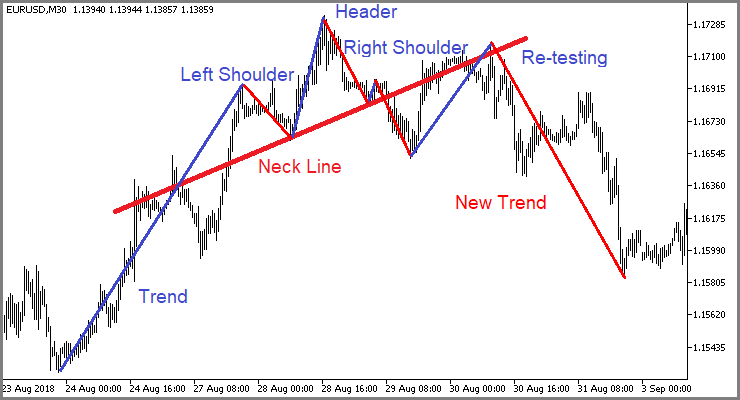

One of the major issues people have with buying stock, is being able to buy and hold them over the long term. The market constantly fluctuates every single day and has been known to swing as much as 20-50% per year in either direction. A savvy and well-educated investor that sees this for what it is, holds their portfolio, and rides out the huge market swings across decades, reaping a hearty return of usually close to 8-10% per year. Those that end up pulling their money out early, or that try and engage in “market timing,” however, usually end up getting swallowed, and not only miss out on most of the markets gains over time, but also will lose money on additional taxes, transaction fees and commissions, not to mention on anxiety and sleep loss. Using dividends however, the everyday investor can feel safe and comfortable no matter what the market is doing, due to the peace of mind that having a regular income will provide.

To illustrate this concept, lets assume you have $1,000,000 in a portfolio, and that you are currently 35 years old. Your asset allocation looks something like this:

$100,000 Cash (0% interest)

$150,000 CD’s (2% interest)

$750,000 equities (No income, only capital gains)

This is a relatively well-diversified portfolio, and assuming that the $750,000 that is in equities currently is in a good mutual fund or ETF, than this can be something that will give a good, steady return throughout your life span, should you continue to hold onto it across decades. The problem however, is that when a recession hits, when our 35 year

old investor sees a 10% hit on the S and P 500 all in one day, and realizes that his $750,000 is now worth only $675,000, the natural human tendency is to panic, and to begin to pull your money out of equities to prevent further losses. The issue with this, is that this individual will now be paying commission fees on his equities sold, they will be losing time on having anxiety and hustling to pull their money out of their mutual fund at the right time, and they will be getting assessed huge taxes and penalties on any previous gains in their fund (mutual funds also tend to have fairly large exit fees when you move your money out of their account and into another.)

old investor sees a 10% hit on the S and P 500 all in one day, and realizes that his $750,000 is now worth only $675,000, the natural human tendency is to panic, and to begin to pull your money out of equities to prevent further losses. The issue with this, is that this individual will now be paying commission fees on his equities sold, they will be losing time on having anxiety and hustling to pull their money out of their mutual fund at the right time, and they will be getting assessed huge taxes and penalties on any previous gains in their fund (mutual funds also tend to have fairly large exit fees when you move your money out of their account and into another.)

These fees contribute greatly to your returns over time, and also to huge amounts of stress down the line. There is, however, a way to stop this natural human behavior, and it’s done with dividend stocks, and with having the security of a regular dividend payment, each month and each quarter.

Why Buy and Hold Always Wins, and Why Dividends Can Help You Do This Better

To illustrate the concept of why dividends can aid your buy and hold efforts, lets look at the same asset portfolio again, but this time with dividend stocks that are paying you a fixed income every month, and then again, every quarter.

This image is a creative. commons image. Credit to Stock Catalog Artist, link here.

$100,000 in cash (0% interest)

$150,000 in CD’s ($4500 in annual interest)

$750,000 in total equities made up of:

$250,000 in the ETF SPY (tracks the S and P 500 and pays a 2% dividend per year, chunked into quarters, $5000 annually)

$100,000 in a high-risk REIT fund that pays monthly dividends (11% per year, for $11,000 in annual dividends)

$400,000 in a combination of Exxon, and a REIT index fund that pays 6% dividends annually ($24,000 per year, paid quarterly)

This new equity allocation within your portfolio will give you an annual income of $44,500, paid in a mixture of monthly and quarterly dividends, that gets direct deposited straight into your checking account. Given this fixed income every month, and again every quarter, you can start to feel the comfort of your investments, as you have essentially turned your equity assets, into a home-made pension plan. This investor, when he sees the market drop 10% on a given day, or sees that his portfolio is down 18% over the last 2 years, does not panic, he uses his dividend yield to comfort himself, realizing that even though his equities are technically worth less, that he still will be receiving over $40,000 each year in interest, and that he will be riding out the market for the long term, with his money still in tact for the next round of market growth. The combination of security from the income, as well as being able to take your cash dividends and allocate them however you wish (putting them in cash in market down turns, buying more stocks with them in market booms) also continues to add to this feeling of security.

The Best Blue-Chip Dividend Stocks to Buy for Your Portfolio, How to Get Dividends Safely

In the example above, it is easy to see why the investor equipped with dividend payments each month and each quarter, feels much more secure, and is much less likely to pull his money out of the market, regardless of circumstances. When structuring your portfolio, regardless of age, I’d recommend turning your equities into an annuity, much like the savvy investor in the second example did, rather than leaving them purely in a mutual fund that pays no dividends, in that you will save money in fees down the road, and will feel a lot more secure down the line.

Past this however, the question becomes what dividend stocks are safe to invest in, and which stocks won’t lose money over the long term and dig into your asset cushion? The safest bet when buying dividend stocks is to use a combination of diversified ETF funds (such as the SPY, S and P 500 index fund up above which pays dividends, as well as the REIT index fund), and to also buy Blue-Chip dividend stocks, these will give you the peace of mind that you are getting the benefits of diversification, that you own safe stocks that won’t be going bankrupt anytime soon, and that you will still be getting your payments every month, even if the market is in a downturn and a recession. In short, buy Blue Chip stocks that pay dividends, buy ETF index fund stocks that pay dividends, and hold your portfolio for the long haul, reaping all of the rewards in the process.

Final Thoughts on The Importance of Dividends, and on Investing for the Long Haul

The examples above are vastly overgeneralized examples of what a basic dividend-centric portfolio would look like when structuring a long-term equities retirement plan that works, however hopefully you get the gist of the theory from these examples above. My take on the subject, is that using dividends in your portfolio, versus simply putting your money into a mutual fund that may or may not provide any tangible return in the immediate future, is a much better long term strategy, and that you will feel much better having your dividend income versus not having it. For more information on all things finance, be sure to stay posted for regular blog post updates, and to subscribe to the RSS feed for weekly email updates!

Sources:

- https://www.wsj.com/articles/the-day-traders-are-back-now-playing-with-options-11557572401

- https://www.forbes.com/sites/nealegodfrey/2017/07/16/day-trading-smart-or-stupid/

- https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

[…] known as portfolio insurance, which describes the use of put options, to hedge and de-risk a portfolio. If done correctly, even large portfolios, in the dollar amount attuned to millions or billions of […]

[…] Previous Next How to Build a Stock Market Algorithm […]