How Much Can I Deduct from a Capital Loss on My Tax Return? And Why Losses can 100% Offset All Gains on Sales of Stock

How much can I deduct from a capital loss on my tax return, and is it wise to sell stock at a loss for a tax deduction? In this blog post, we’ll look into the thick and the thin regarding what happens when you deduct capital losses on your tax return, how much you can deduct from ordinary income, and if you can use these to fully offset any capital gains that you would otherwise have to report on your tax return. As far as taxes and investing goes, they are one in the same, and it is extremely important to understand the tax implications of trading decisions in the world of finance, in that it can actually be enough money to dictate certain trading situations, and due to the fact that if you do not understand the tax implications, your $100 capital gain can become a $1,000 loss really quickly. For more information, subscribe to our blog or comment down below for more details and information.

Other tax related concepts that we’ll be covering on this blog shortly include the following:

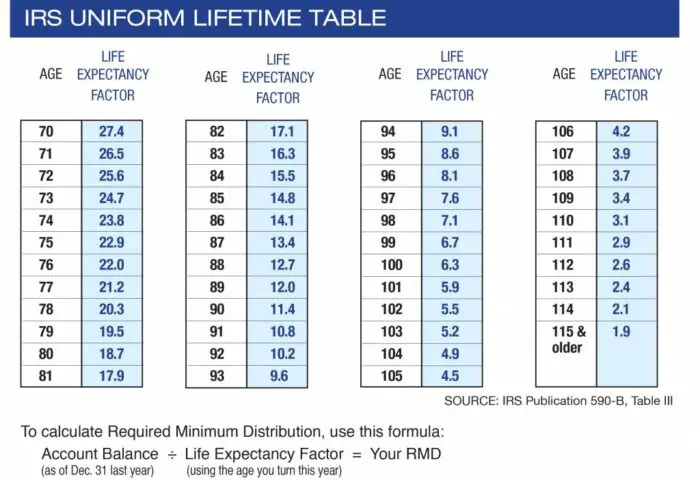

How RMDs work

when you’ll need to issue a 1099-MISC

the IRS dirty dozen list

Why you should not set up a Captive Insurance company

What is Form 1099-G?

How do Social Security Taxes Work?

Onlyfans taxes

how to sit for the CPA exam

The IRS Free File Alliance

De Minimis Fringe Benefits

The De Minimis Safe Harbor Rule

Section 179 Depreciation

When you’ll need to file form 1065

How to setup an S-Corporation with the IRS

And much more, read on or subscribe to our blog for additional details and information.

How Much Can I Deduct from a Capital Loss? $3,000 per year from Earned Income with an unlimited carry forward rule

So, the general rule with regards to deducting capital losses from the sale of stock on your tax return goes as follows. You can offset an unlimited amount with regards to offsetting capital gains until you hit 0 in that particular tax year. So if I made $50,000 in capital gains in tax year 2020, I would typically have to pay whatever the corresponding tax rate would be on that money. However, if I also sell stock at a loss in that tax year and take the loss on my books, I can use this $50,000 loss to bring my capital gains for the year down to zero (it’s the same with gambling losses, losses from gambling can only zero out gains and never reduce ordinary income) and can completely zero out any tax consequences for the year On top of this, if you say have Capital losses of $100,000 in a particular tax year, and only $50,000 worth of gains to be zeroed out in that year, then you can carry forward the capital losses, and can use them to offset any future capital gains up to the $50,000 worth of losses remaining indefinitely until your loss deduction is depleted.

| Related Posts |

|---|

How Much Can I Deduct from a Capital Loss to Offset Capital Gains? Enough to Make your Gains Hit 0 in The Year The Loss Occurred

As stated in the former, you can deduct enough so that your capital gains hit 0 for the year, or for future tax years until the total amount of your loss is depleted. So say you have a $100,000 capital loss in 2019 and $50K in gains in both 2019 and 2020, you can use this loss to completely zero out your capital gains for tax years 2019 and 2020, because it is just offsetting your capital gains (the IRS is basically saying you didn’t really realize a gain here, and therefore it can be zeroed out.) The IRS does however have stricter rules when it comes to zeroing out earned income. So lets say that you make $50,000 in a single year, but also have $50,000 in capital losses, can you deduct $50,000 from your income? Heck no! You can however deduct $3,000 off of your earned income each year until your capital losses deduction is singled out, which really makes sense because otherwise I could realize stock losses from my portfolio and completely offset my federal income taxes for the year. Given how those in the higher tax brackets pay taxes, then it makes sense that there is a strict $3,000 per year limit on your taxes.

Final Thoughts on Deducting Losses from Stock Sells, How Much Can I Deduct from a Capital Loss in a Single Year?

And so, there ya have it, you can either deduct enough to completely zero out a gain for the year, or you can deduct and carry forward $3,000 per year against your earned income until your deduction runs out, and that’s pretty much the gist of how that works. Need more information, stay tuned for more blog posts on all things Tax, Finance and Accounting.

Cheers!

*Inflation Hedging.com

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

[…] beginning pilot lessons, going on Tinder Dates, and being a relative expert at SEO, accounting and tax, as well as an expert on finance (not to brag but I can really hold my own in the realm of finance […]