The Super Bowl Indicator, How Tom Brady’s Touchdown Passes in The Super Bowl Can Time The Market

For those of you reading this blog post that have been long time readers of ours, first of all, we thank you. Secondly, for those that think that I’ve gone off my rocker and that I am now believing in technical analysis, let me assure you, that generally, I do not, and that I am still the same, mostly level headed, rational, index fund investor that you all know and love so much (or hate, either way appreciate the readings.) With all of this being said, I really think that the Super Bowl Indicator was a really funny, super ridiculous, and yet also slightly useful, technical analysis indicator to use when picking stocks via day trading or high frequency trading. Like many other technical analysis indicators out there, one of the main reasons why this might work is because other traders in the market are also trading on it, and believe that it might work, similar to the way that momentum works. Read on for more details and information, and if you’ve enjoyed our blog posts so far, be sure to subscribe to our blog for additional details and information, and to comment down below with your thoughts and opinions on the article, and we’ll get back to you within one business day with a response.

Other popular technical analysis factors that are commonly traded on include the following:

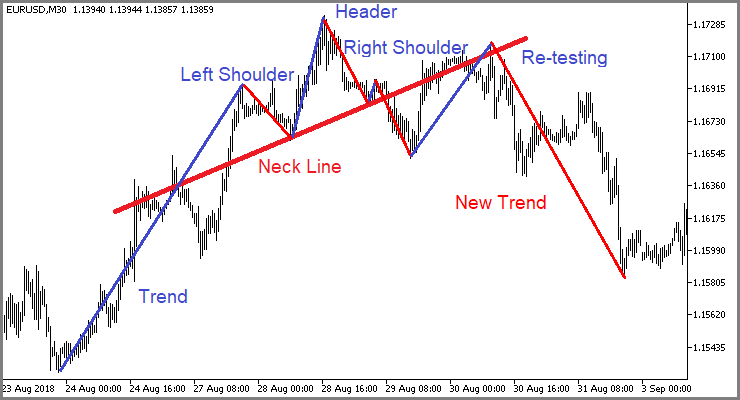

Head and Shoulders Pattern

Reverse Head and Shoulders Pattern

The Castle in the Air Theory

The Firm Foundation Theory

The Firm Foundation Theory

The Odd Lot Theory

Short Interest

Breadth of The Market

The 50 day moving average

The 100 Day Moving Average

The 200 Day Moving Average

And many more technical analysis factors, subscribe to our blog for additional details and information!

| Related Posts |

|---|

The Super Bowl Indicator, What it Entails, and Why Tom Brady Can Actually Slightly Alter The Stock Market

The super bowl indicator basically says the following, that if the AFC wins the super bowl, the market tends to go up for a few weeks after the game, and that if the NFC wins the super bowl, that the market tends to go down for several weeks following the game. What I think this technical analysis factor indicates best is that correlation does not necessarily equal causation, and that traders will come up with almost anything to make a quick buck, much like journalists will. And speaking of journalists (no I’m not talking about me, I consider myself more of a blogger than a journalist anyways) this was actually invented by a journalist of the New York Times, who spread it around and made it popular. This was so long ago, that when it came out the team divisions were called the NFL and the AFL, how the journalist managed to spread this around I will never know, but this is the real, and 100% true story of his this technical anaysis factor became popularized! So popular indeed it has become that it has even been featured in the hit book by Burton Malkiel, A Random Walk Down Wall Street, The best Finance book I have ever read and one that has sold over 1,000,000 copies so far! Great read if you get a chance.

Why This Technical Indicator Is Really Not Worth Trading On

Personally, I actually would not recommend trading on this technical indicator, in that it is pretty much worthless. The only way that I would recommend using it is if 1. you can find a forum of traders that are betting on it heavily, and even then I would be very cautious and wary of its use or 2. if it is blended with a host of other factors. For instance, if you have five other technical indicators that are proving you right, momentum is on your side, the VIX is on your side, and all of the fundamentals are on your side, but you are still not sure of whether or not to take the risk, if the patriots have won the super bowl that year, or vice versa, maybe let it spill you over the top and take the chance, other than that, you are probably best off steering clear.

Final Thoughts on The Super Bowl Indicator, A Take it Or Leave It Technical Analysis Factor With A Very Low Track Record of Success

Overall, one definitely should not be trading on the super bowl indicator, or at least not solely on this uncommon, and rarely still used technical analysis indicator. While it does get some Google searches every month, say between 10 and 50 each 30 day period, meaning people do still use it in the stock market, so it does have a very small effect to it, I think that you are definitely better off trading fundamentals or just trading off of momentum. Have a different opinion of the Tom Brady indicator than I do? Comment down below with your thoughts and opinions on the article and we’ll get back to you within one business day with a response, and be sure to let us know what you think about him joining Tampa Bay. Till next time.

*Inflation Hedging.com

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

[…] Previous Trailing Twelve Months, How to Read a Yahoo Finance Chart […]