What is a Money Market Account? Get a higher interest rate than a savings account with none of the long-term commitment of a CD!

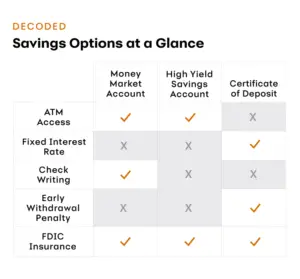

A money market account is a combination of a checking and savings account that limits your check writing and withdrawal capabilities while offering you a higher interest rate than both savings accounts and checking accounts. In this article we’ll discuss more in depth what is a money market account and in what situations it’s better than a checking or savings account and in which situations it is not better than a checking or savings account. The following blog post will look into the benefits and uses of a money market account, and will show you why it is essentially a “liquid CD,” that allows you to have easy access to your money, with as much as a 2-3% rate of interest! For more information, subscribe to our blog for more details and information, or comment down below and leave us your thoughts.

| Related Posts |

|---|

Why Should I Invest in a Money Market Account

Money market accounts give a higher interest rates than both savings and checking accounts. Savings accounts will typically give you a much higher interest rate than checking accounts, but savings accounts will limit your access to your money, much like money market accounts, often times only letting you withdrawal around six times each month. Checking accounts, while they offer low interest rates or no interest, allow you full access to your money and no limits on purchases or withdrawals. This is something to take into consideration when thinking of opening a money market account.

Is it Safe?

Is it Safe?

Money market accounts, much like savings accounts and checking accounts, are FDIC backed. This means that you will have as safe of an investment as with any other account at a bank. Brokerages will also often offer money market accounts, many of these are also FDIC insured. Money market accounts are safe, convenient, and easy to open.

Why is a Money Market Account Better than a Checking or Savings Account?

If you have a large principle that you’d like to put into an account and make more interest without the extreme commitment of a long-term CD, then this type of account is right for you. Savings accounts have the same limits on purchases and withdrawals from the account as money market accounts but have lower interest rates than money market accounts. Checking accounts also have lower interest rates than money market accounts, but allow you to have more freedom with your money. A money market account is great for people who want a safe method of investing their money with a high interest rate without long term commitment.

My how the time has passed! Reading this again in 2023 now, it looks like we’re up to 4.5 to 5% interest rates and you can even buy Money Market funds just like you would purchase a basic stock in your account!

Why is it Worse than a Checking or Savings Account

If you’re in a situation where your initial deposit will be fairly low, then you may not qualify for a money market account. Most money market accounts, similarly to a CD, have an initial deposit requirement. This varies from bank to bank and account to account, but most of the time if you plan on investing less than $5000 you’re better off with a savings account or a CD or CD ladder. Another scenario where you’d be better off with just a savings account or high interest checking account is if you live paycheck to paycheck or have many different expenses throughout the month. Though, if you have the money to meet the initial deposit requirement for a money market account you can combine a checking account with a money market account and get more bang for your buck.

Sources:

https://www.investopedia.com/terms/m/moneymarketaccount.asp

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

Is it Safe?

Is it Safe?

[…] Money Market Account […]