Why Do We Put Money Into Piggy Banks? My Take on This Ancient Ritual

I came across an article from mentalfloss.com on this exact subject that answers the question of Why do we put money into Piggy Banks, and of how this time honored practice came to be. For me, reading an article like this is bringing back tons of memories of me being greedy as a child, picking up every single penny that I could find on the ground, putting birthday money into an interest baring CD, and watching it grow over time, in fact by the time I went to college I had about $9,000.00 in cash sitting in my CD, this paid for my first car, which led me to graduate from college, and which led me to getting my first job after college, not a bad deal. It also brings back memories of me stealing my dads change off the counter so I could invest it, or sneaking into my parents room while they were gone and robbing pennies from their owl piggy bank (sorry guys, I was a greedy SOB when I was a kid). Nostalgia aside however, in this blog post, I will run through the history of the piggy bank, and of how it came to be a common household item for hoarding change. For more information on all things money, read on or subscribe to our blog for additional details and information.

Other topics we’ll be covering on this blog include the following:

Insurance

Financial Planning

Financial Planning

Financial Analysis

Character Comparisons

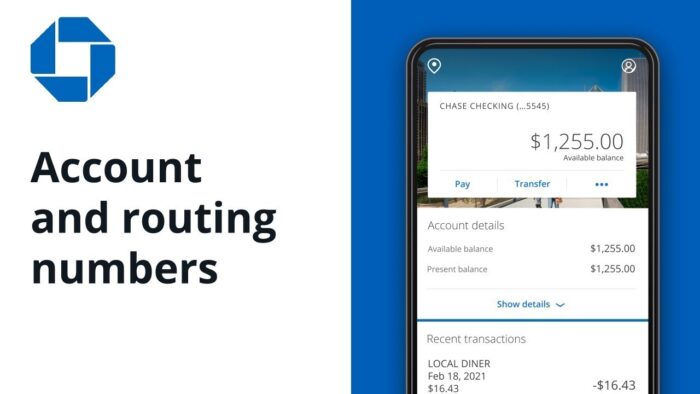

Banking

Wealth Management

SEO

Internet Marketing

Computer Programming

Accounting

Tax

Skills Acquisition

Book Reviews

Index Funds

| Related Posts |

|---|

How to use Excel

And much more, read on or subscribe to our blog for additional details and information.

The History of the Piggy Bank, An Old Wives Tale

The history of the Piggy Bank, per the mental floss article above, appears to be related to something with clay. Apparently there was a type of clay called Pygg, that people started to pronounce “Pig” because of how it was spelled. This type of clay had been molded into jars called “Pygg containers” where they would put coins in to save money, this was back in like the 16th and 17th century. Anyhow, you can kind of see how a Pygg container that you put coins in in order to save money, that was being pronounced “Pig” could sort of morph into the 20th century form of the original Piggy Bank from there.

Apparently, no one knows when they actually went mainstream, although the 19th and 20th century is a speculation, with the classic pink pig with a slot at the top and a cork at the bottom seems to have appeared around the 20th century turn. I…however…have a different theory on how this emerged, greed!

How I Think the Piggy Bank Came to Be And Why It Stuck Around – Greed!

I think that the Piggy Bank came to be because of greed, in two ways. First of all, once manufacturers saw that market segments started to see this as a valued item that was in demand, they mass produced it and were able to reap a heavy profit off of doing so, with millions sold so far.

On top of this, the “pig” is typically symbolized as greed, in other words “greedy pigs” however on Wall Street, the term goes as “Pigs get slaughtered.” I think that the concept of a Piggy Bank came about because you are being a Pig and are being greedy by saving your money, even to the point of saving pennies. But probably the first historical reason is much more accurate, just my 2 cents (which ironically would go into my piggy bank.)

Final Thoughts On Why Do We Put Money Into Piggy Banks? My Take

And so that’s the gist of my take on why we put money into Piggy Banks, it’s not a good reason, but its probably about the gist of why we do this. Be sure to read on or subscribe to our blog for more details and information, or click the affiliate links to make us some cash that we’ll be posting shorty, since for some reason, even on 20,000 visitors per month, our subscribe rate seems to be like nill.

Cheers!

*Inflation Hedging.com

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

Leave A Comment