My Ally Invest CD Rates Review, My Opinion So Far on Using the Ally High Yield Savings Account

In today’s blog post, I am going to walk you through my Ally Invest CD Rates review, and of what I think of the product so far. I have just transferred some cash from my Suntrust bank account to my new Ally High Yield Savings account, and depending on how they track the interest for me and how I see the interest coming into the account, I will decide whether or not to open up an Ally Invest CD and to get an even higher rate of return on my money. For now, as someone who has been a little paranoid about the economy ever since the stock market crashed in 2020 and who has been keeping literally every single dime to his name in cash, all in a liquid checking account getting $0 in returns since, it feels good to be getting at least something that I can track on my money. Even just a half of a one percent, which is the interest rate that I am getting on my account, can really add up, especially as you put thousands of dollars each month into the account. And so, in this blog post, I’ll tell you about the new savings account I just opened, and my Ally Invest High Yield Savings and CD Rates review, read on or subscribe to our blog for more information on all things business and finance.

Other solid bank accounts that you can get a good interest rate at include the following:

Capital One

Capital One

Synchrony Bank

Ally Invest

Other online-only banks

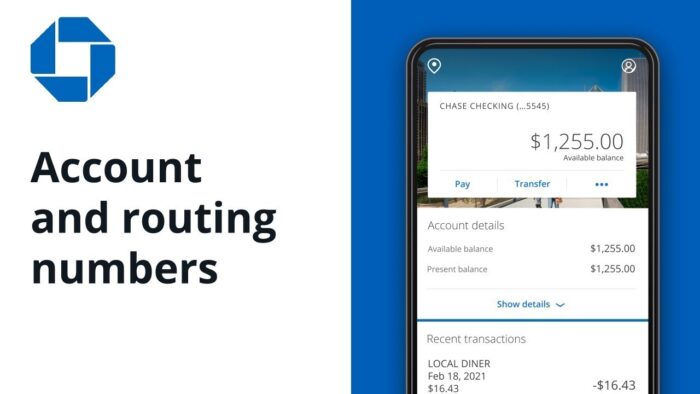

Chase Bank

Suntrust Bank

Charles Schwab (used to get 2% annually on this one back in the day, ah the good old days.)

Goldman Sachs

| Related Posts |

|---|

Morgan Stanley

And a host of other big banks, read on or subscribe to our blog for additional details and information.

My Ally Invest CD Rates Review, Why I Love My New High Yield Savings Account

As someone who has once again, been keeping all of his assets in liquid cash for quite awhile now, with literally a 0% interest rate, it feels really good to finally be getting a rate of return on my money, even if my new High Yield savings account is only at 0.5% interest (although it does compound daily which is dam nice in terms of interest on interest.) So far, I have $2,000 in there, and I plan to move in as much as $20,000 to $30,000 by the end of the year, possibly hitting the $40,000 to $50,000 marks by the end of next year, which at that interest rate would give me something like $20 per month in passive income, which is not too shabby just for changing bank accounts.

And yes, I know this blog is literally called “inflation hedging” so I am well aware of the fact that I am not even close to beating inflation on my money, that’s what my 401K, my job and this website are for, and while I understand the math behind inflation, I also understand that I basically just created a new passive income source out of thin air….which is not bad for a Saturday morning computer session. Now that I am getting an interest rate on my money, I have become more obsessed with filling up that savings account as much as possible, and with putting as much money in there as humanly possible in order to get more interest on interest!

So far my passive income sources are the following:

Savings Account: $10 per year

Website Income: $900 per year

I will revisit those numbers 12 months from now, and I am hoping that they are much closer to something like:

Website Income: $3,000.00 per year

Savings Account Income: $250 per year

Will follow up on this blog with the results!

High Yield Savings vs CD’s and Why I am More a Fan of the Former

Passive income is so powerful that even in low doses it can really change your financial situation. Ignoring inflation, assume your average run of the mill Joe is keeping $200,000 in a checking account at Chase, not only paying him $0 in interest, but charging him $12 per month in fees. Moving that to an Ally Invest High Yield Savings account would literally yield him an additional $750 per year, and just for leaving the money in an Ally account vs a chase account, he would have almost $105,000 in 5 years, vs $99,000>>>yep, pretty amazing what compound interest can do even at low levels.

In Ally Invest, I am much more of a fan of the High Yield Savings over the CDs, in that, aside from being fully liquid, so you can withdraw the money whenever you need to, you can also make more CONTRIBUTIONS and are not locked into one specific amount. For instance, What I’m doing in the Ally Invest savings account is putting in around $20,000 to $30,000 to start, and from here am going to be adding $1500 to $2,000 per month from my salary. Woof will this make that balance go up pretty dramatically, even at just a measly 0.5% interest rate of return.

How Much Money I’m Making and My Savings Strategy, Never Go Without a Savings Account Again

So right now, my possible incomes, as of say February of next year when I get my possible raise include the following:

Job in Finance: $70,000 per year

Passive Income from Website: $1,000 per year

Passive Income from Savings: $200 per year

Not too shabby for a guy still in his 20’s. And I’m not even bragging, looking at those numbers scares the hell out of me, since this is the furthest I have ever been financially, and I hope that I have the energy and the good fortune to be able to sustain it.

Final Thoughts on My Ally Invest CD Rates Review, My Final Opinion on the Company

And so, those are my thoughts on using a Savings Account to grow your wealth, and my review of my new Ally Invest savings account. For more details and information on all things finance, read on or subscribe to our blog for additional details and information.

Cheers!

*Inflation Hedging.com

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

Leave A Comment