What is a CD Ladder? The best way to save money safely and still get the best interest rates!

CD ladders take an initial principle and invest it over multiple CDs with different lengths and different interest rates. This will give you the ability to take advantage of interest rates if they increase and stay safe if they decrease. CD ladders are a different way of investing in order to get the best CD rates while also keeping access to your money without having to leave it all in a long-term CD. The typical way that CD ladders are used allows you to lock in a higher interest rate with long-term CD’s and still get the benefits of short-term CDs reaching maturity earlier, giving you access to your money with no penalty. In the event that there is a sign that interest rates will go down it is better to invest more heavily in long-term CD’s but in the event that it appears that interest rates will increase within the next five years it is better to invest more heavily in short term CD’s from six months to a year. In this article we’ll be helping you figure out what is a CD ladder and how you can use it to get better rates, better returns, and keep peace of mind.

| Related Posts |

|---|

How Can I Create a CD Ladder?

Anyone can create a CD ladder. It takes no financial advisors or accountants, anyone who has an account with a bank or a bank near their house can walk in and create a CD ladder as long as they have the money to put into those CD’s. There are many different ways of creating CD ladders.

Now all of this can seem very confusing at first and make you think still ‘what is a CD ladder’? Well I believe the best way of showing that is with an example. The most common method in an economy where it seems as if though the interest rate is stagnant and will remain that way over the next few years, is to take your initial deposit into the CD ladder divide it by the number of CD’s that you’ll be putting it into, most likely four or five, and then deposit that amount into each of the CD’s.

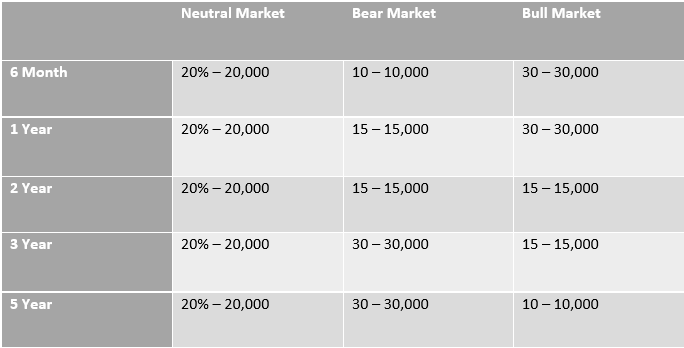

Each of these CD’s should have an increasingly long period. So, take for instance, you had $100,000, and you wanted to divide that over five different CD’s with lengths: six months, one year, two years, three years, and five years. You would be putting $20,000 in each CD and when you got the returns, you would reinvest them into the same CD for the same term. So once the one year CD reached maturity after having an interest rate of 1%, for example, you would have an extra $200 made from putting that $20,000 in the one year CD. So now you would roll that over and you would now have a one year CD with $20,200. This would continue for each of the CDs as they all came up. And you would see the interest that you make off each of these CD’s begin to compound after reinvesting.

The Argument for a CD Ladder Instead of one CD

In the previous example, the six-month CD would come to maturity much sooner than the one year, the two year, the three year, and the five year. Now this is a good thing in two ways: firstly when that six month CD comes up if you are in economic trouble you can use the money in that CD penalty free without touching any of your other CD’s so they will still be gaining interest while you still have access to a part of your money penalty free, Secondly the money that you are not touching in your three year and your five year have much higher interest rates than your six month and your one year CD so when they finally do reach maturity you will have far more to reinvest. It could be that with a five-year CD depending on current interest rates you get an extra $500 to $1000 from it.

Best Configurations for a Bull market

In times of economic turmoil or economic success, the Fed will often decrease or increase interest rates respectively. This can cause CD rates to increase or decrease and will affect how you should be managing your CD ladder. In a bull market when interest rates are increased and look as if though they will continue to increase it is better to invest more heavily in short term CD’s in your ladder then long term CD’s to ensure that you continue reaping the reward of a larger interest rate as it increases. Take for instance the previous example where you had $100,000 as your initial principle and you wanted to divide it up over five different CD’s. In a bull market, you would want to do something other than divide the money evenly among all CD’s. It would be better to put 30% in a six month CD 30% in a one year CD 15% in a 2 year CD 15% in three year CD and 10% in five years CD. This will make sure that in the event interest rates continue to increase you can still take advantage of that in your short-term CDs, And in the case there is a recession you still have the security of 40% of your initial investment in long term CDs.

Can You Lose Your Money in a CD?

One other thing to keep in mind while going through this is the fact that you can sometimes actually lose money to inflation in a CD. The reason being that if CDs are say at around 70 basis points right now, while inflation sits at a modest 2%, your money is typically bleeding out by 1.3% interest per year compounded annually, this means that you are losing money just by keeping money in your bank account and withstanding the sands of time, even if you are getting interest on your money, from a technical finance perspective.

The other thing to keep in mind with regards to losing money in a CD is losing time. If you are someone with a decent chunk of change to put in the CD, and if the interest is going to be $50 to $100 or more for the year, then it is completely worth it to put the cash into the CD and hunt down that extra tax form at the end of the year. However, if the case is something like you getting just a mere $11.00 in in interest for the year, ask yourself if it is really worth it to hunt down an extra tax form in the form of a 1099-INT at the end of the year, just to put a few extra bucks in your pocket, think hard on this question, your future self will thank you around tax time.

Best Configurations for a Bear Market

in a bear market with the economy is not as strong, it is better to invest more heavily in long term CD’s. So with the previous example of what to do in a bear market with your CD ladder, the percentages would simply flip. So you would invest 10% in the six month CD 15% in a one year CD 15% in a 2 year CD 30% in a three years CD and 30% in a five year CD. This would protect your money from being subject to lower interest rates and ensure that you can sleep soundly at night knowing that your money is making money and not losing money.

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

[…] if you plan on investing less than $5000 you’re better off with a savings account or a CD or CD ladder. Another scenario where you’d be better off with just a savings account or high interest checking […]

[…] basis, versus what will happen if you take the more cautious option, the risk free rate on a CD, in cash, right now. A Monte Carlo Analysis is essentially just a simulation of the two scenarios, […]