Benefits of a CD, How to Blend a CD Ladder with a Jumbo CD

CDs are a smart choice for safe investors. CDs typically come with a few of the following: a fixed rate, a fixed period of time, or a minimum deposit. CDs are essentially savings accounts with a higher rate of interest and less accessibility to the money inside. In this way The CD owner sacrifices their ability to move money, except for a fee, for a higher return on their money. CDs are a smart choice if you are trying to save money, limit yourself if you are frequently spending money over budget, or just want a safer alternative to investing in times of market volatility. In this article we’ll be covering the benefits of a CD over different types of bank accounts and investment strategies and how you can get the most bang for your buck with a Jumbo CD, Liquid CD, High Interest CD, and Much More! And as always, be sure to comment down below or subscribe to our blog for additional details and information!

| Related Posts |

|---|

Different Types of CDs

There are many different types of CDs. The three most common are standard CDs, high-yield CDs, and no penalty CDs, AKA liquid CDs. Standard CDs all have the same general qualities. CDs will have a fixed interest rate over the period of time that you have the CD. Different banks offer different interest rates, depending on current Fed regulated interest rates, and different term lengths, ranging anywhere from three months to 10 years. It is a good  idea to shop around for different CDs as many banks offer lower interest rates then credit unions, which are still FDIC insured. A more recent development has shown that several online banks such as Ally are offering higher interest rates on CDs that require a lower initial principle.

idea to shop around for different CDs as many banks offer lower interest rates then credit unions, which are still FDIC insured. A more recent development has shown that several online banks such as Ally are offering higher interest rates on CDs that require a lower initial principle.

High-yield CDs are the same as traditional CDs but have a higher interest rate. The trade-off for this higher interest rate is typically a longer term, or a higher initial deposit. For people who intend to put in more than 3000USD this CD will likely be a better decision than a traditional CD. For those who are only planning on putting in less than 3000USD typically you will get a lower interest rate and only be qualified for traditional CDs.

A liquid CD gives you the flexibility to add and withdraw funds just like you would a normal savings account, in exchange for is significantly reduced interest rate. Many banks have begun doing away with liquid CDs in exchange for savings accounts with an interest rate closer to that of a CD. These savings accounts only have one difference to the liquid CD and that is that the interest rate can fluctuate based on the Fed. It is clear that the benefits of a CD outweigh those of a savings account.

Different Financial Institutions to Get a CD

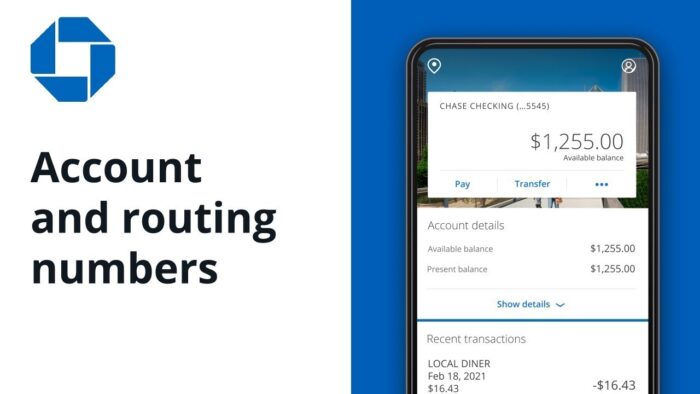

Many different institutions offer CDs. Big banks such as Chase, Capital One, and SunTrust all offer CDs, but their rate is typically lower than that of smaller financial institutions such as local banks or credit unions. In a world of ever-changing technology, it is now possible and completely safe to open a CD online and do banking entirely through an online bank. The financial institutions that typically offer online CDs recognize that a ‘leap of faith’ must be taken with online money management and no in person banks and as a result will offer much higher interest rates for a lower initial principle. Depending on your desires with a financial institution and accounts ease of access, it could be more beneficial to do it online or at a bank in-person.

CD Advantages Over Savings or Money Market Accounts

As previously mentioned, CDs do not have an interest rate that fluctuates. For instance, I had experienced a bit of market turmoil recently in which the Fed had lowered interest rates significantly I opened a CD at 1.5% over the next year, and when I check back the next week I had noticed that the same CD for the same term length had been lowered from one point 1.5% to .9%. My CD would make nearly double that of someone who opened one a week after me with the same principle. Savings accounts, however, are subject to the changing interest rates. In times of market volatility, hedge risk, invest in the safe option, and guarantee a good interest rate for the best return on your money.

CD Advantages Over Investing, and Why Safety of Principal is one of the Main Benefits of a CD

Investing carries with it a ton of risk. Long term and with a diversified portfolio, putting money in the stock market historically guarantees good returns. However, over the span of 1 year and 5 years or in times of market volatility, it is best to proceed with the safe option and invest in a CD. The benefits of a CD are safer short term.

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://www.nerdwallet.com/blog/banking/faq-cd-or-highyield-savings/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

[…] having to leave it all in a long-term CD. The typical way that CD ladders are used allows you to lock in a higher interest rate with long-term CD’s and still get the benefits of short-term CDs reaching maturity earlier, […]