When Will CD Rates Increase? The First Quarter of 2022 Looks to Be The Answer Here

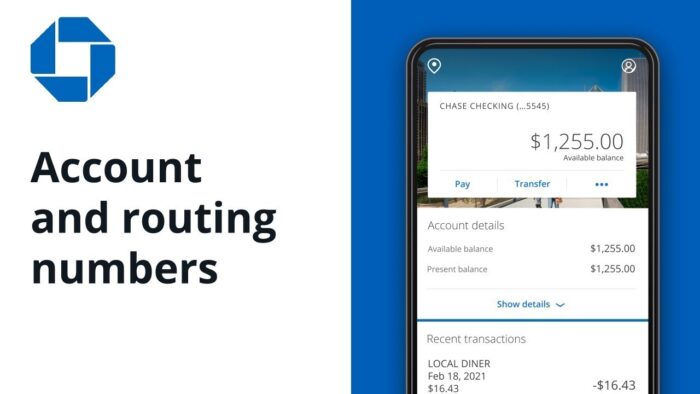

If I was a betting man, in answering the question of when Will CD rates increase, I would say that by the first Quarter of 2022 we will see a 25 to 30% increase in Fed Rates, which will translate to something like a 25 or 35 basis point increase in US CD rates. If we are looking at current High Yield Savings and CD rates in something like Ally, the best currently trustworthy CD rates out there, this translates to a bump from 50 or 80 basis points, to like 75 bps on savings accounts and 1% on 5 year CDs. A very small uptick in rates, but one that will increase further each quarter over the next 2 years, and one that I will welcome to my current CDs that are getting like 60bps. And so, in using this blog post, let’s look at the question of when will CD rates increase?

I think we could see the following CD interest rate increases in 2022:

1st quarter gets us to 60 basis point savings account rates

2nd quarter gets us to 75 basis point CD and savings account rates

By the end of the year 2022 we are at 1.00% per annum in savings account rates.

I remember back in 2016 when I was looking at the growth of my savings account at a 1.5% or a 2.5% annual rate of return on my savings. These days with 40 grand in the bank I am lucky to get a measly $15 per month in interest, an extra $200 per year is very much welcome no doubt, but with inflation at 6.2%,…it is a net loss on your capital indeed. I would be very welcome to interest rates increasing, and though it will be at the behest of decreased company earnings reports and a lower stock market, my CD earnings will like it for certain.

How Will the Market Respond to The Next Fed Meeting?

As rates increase it is something of a double edged sword for me. As someone with a very liquid portfolio currently, I would get an increase on my interest payments each month, which would be nice. However, I would also have some upset clients, because no doubt will we start seeing a market correction down to potentially 33,000 or lower after the Fed raises rates in Q1 2022. I see the market reacting actually moderately badly to the next fed meeting, as it is virtually a well-known fact (and very much this could already be priced into the stock market) that rates are going to increase in the March 2022 decision meeting. A 25 or 50 basis point increase in rates could mean a market correction by as much as 10%, and could mean that CD rates have a significant uptick this year. Good if you are basically all in cash like me, but very bad for your 401K and if you are in a heavily equity based portfolio, at least in the short term.

| Related Posts |

|---|

How Interest Rate Hikes Cause The Stock Market to Rise

There are a number of reasons why Interest Rate hikes cause the stock market to rise. First off, it becomes more attractive to invest in things like CDs and Savings accounts versus an over inflated stock market. Aside from this, the discount rate that companies use to come up with their present value market capitalization numbers (think that the present value of a stock is a number you get by discounting its future cash flows). With higher interest rates, the discount rate is higher, which means that the present value is lower. This means that the market caps are lower and the long term stock market value stops. It reduces inflation, but is definitely bad for earnings in the overall stock market, at least in the short term.

Final Thoughts on When Will CD Rates Increase? Look Out For This In the First Quarter Of 2022

So when will CD rates increase? This finance bloggers opinion has them shooting up about 25 to 50 basis points in the first quarter of 2022, with more rate hikes to continue in later quarters of the year. For more information on all things business and finance, read on or subscribe to our blog for additional details and information.

Cheers!

*Inflation Hedging.com

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

Leave A Comment