How to Beat Inflation, Guarantee You Always Make Money

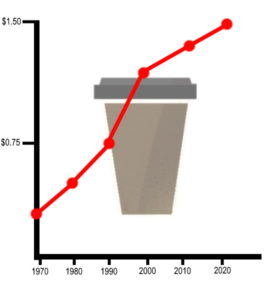

Inflation over the past 20 years has fluctuated between -2% and 6% however it has averaged roughly. So, for the sake of convenience, in this article we’ll be taking a look at different ways to invest and save your money that will get you returns greater than 3%. Now in this guide on how to beat inflation will be covering three of the most effective and time-tested methods for saving and earning interest on money.

| Related Posts |

|---|

Long Term CDs

Long Term CDs

Long term CDs between two and five years are a great way for an investor to get a higher interest rate. However, even three-year and five-year CDs typically do not beat inflation, and as of right now are a little under a percentage point below the inflation rate. Now there are two ways to invest in CDs to beat inflation. One of which is to invest in high yield CDs. Now this can be difficult for some people given that high yield CDs typically require a much larger principle. sometimes between $5,000 and $10,000. Now, tying up $5000 to $10,000 for three to five years is not usually appealing for most people. Luckily, there is another option that will similarly beat inflation, and that is a CD ladder.

How to Beat Inflation with CD Ladders

A CD ladder is made up of multiple CDs, each with different interest rates and each with different principle investments. The simplest CD ladder that one can make consists of taking the amount you’d like to invest, dividing it by the number of CDs you would like to have in your CD ladder, typically four or five, and investing the quotient into each of these CDs. The best method for this is to have four CDs, two short term and two long term, or five CDs two short term, two mid term, and two long term. in this way you should be able to ensure that the money you make from CD interest beats inflation.

ETF/Index Funds/Mutual Funds

One of the best ways to beat the inflation rate by a significant amount is to invest in an ETF, index fund, or mutual fund that tracks one of the major indexes such as the S&P 500 , NASDAQ, or Dow Jones. Since 1928 the S&P 500 has made 10% annually on average. This means that if you were to put $1000 in the S&P 500 at the age of 20 and take it out at the age of 60, with 40 years to grow and an average 10% interest yearly, so long as you reinvest whatever profits you make from it into the fund, you would have 45,259.26 waiting in that account at 60. There are several different ETF’s, index funds, and mutual funds that track these indexes. ETF’s and index funds are recommended given that mutual funds typically have a much higher expense ratio than ETFs and index funds. Now, with whichever account you pick you will beat the inflation rate so long as you invest in a highly diversified index. Our recommendation, if not clear from the example we used, is an index fund or ETF that tracks the S&P 500.

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

Long Term CDs

Long Term CDs

[…] Previous Wasmer Schroeder Review, My Research Paper on a Muni Bond Legend […]