What Actually Happens When You Short Sell A Stock?

What actually happens when you short sell a stock? I’ve been thinking about a few equity positions that I could short sell on my account lately, namely due to the Bitcoin crash and the slight dip in the stock market indices over the past few weeks. And so I was inspired to write this post, as I realized that not many people in day to day life actually realize exactly how a short sell works, and I don’t just mean that they know that the share price goes down and you make money, I mean the back end inner workings and exactly why it is that you are profiting from a dip in the share price. And so in this blog post, your friend here at Inflationhedging.com is going to give you the full run down of what actually happens when you short sell a stock! For more details and information on all things business and finance, be sure to read on or subscribe to our blog for additional details and information!

Other Margin Type Trades we will go over on this website include the following:

Margin loans

buying calls

buying calls

writing calls

selling puts

buying puts

writing naked calls

writing uncovered puts

Using Margin loans for long securities

Using margin on short securities

what a short sell is and how it works

And more, read on or subscribe to our blog for additional details and information!

| Related Posts |

|---|

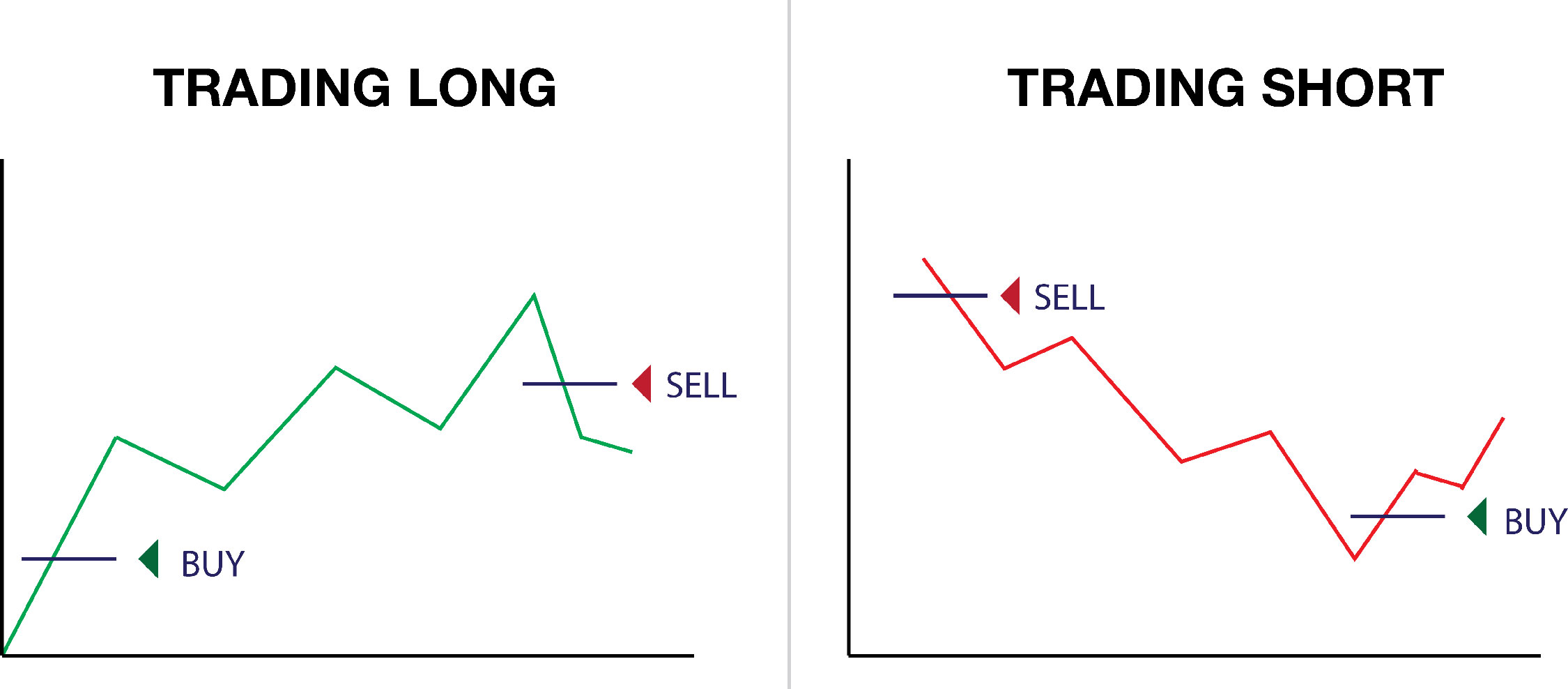

What Short Selling Really Is

Here’s a short sell, you’re betting on the value of the stock to go down. So the gist of it is, say Apple is trading at $180 per share. You place an order to short the stock at $180. If the stock goes down to $160, you can cover your short and take the spread, so you profit 20/180 = 11.11% That’s the overall concept, but why is this happening? Think about it how is the brokerage giving you money with this special order by betting on the stock price to go down, and how is it doing it in the exact way in relation to the dip in the stock price?

Here’s the skinny on this:

You place a short sell on Apple at $180 per share. You have $18,000 to put into the short sale. Boom, 100 shares of Apple, one round lot of shares.

One reason that in order to place a short sell you have to have a margin account, is that you are taking out a loan, every single time that you place a trade for a short sell. But you are taking out a loan of SHARES instead of a loan of direct CAPITAL.

So the reason that brokerage firms make you have a margin account in order to place short sell orders is that every time you short a stock you are taking out a loan of shares. So let’s use 2 parties for this example, customer and fidelity.

Customer “I’d like an $18,000 short position on Apple stock, priced at $180, with no additional leverage please”

Fidelity “certainly. Here’s 100 shares of Apple, just pay me back whenever you’re ready”

Father Time “6 months hath passed”

Customer “okay it’s been 6 months. Looks like Apple is now trading at $160 per share. I’ll buy the shares back on the open market to give to you, so to settle this loan I’m only going to give you $16,000 if that’s cool”

Fidelity “Darn. Yes that’ll settle the loan, you sure you don’t want to add to your short position and take out a leverage multiplier of 50% on your new buy too? Maybe you could make big money!”

Customer “nice try, but the moon is red today, so I’ll be covering my position ASAP, you blood sucking vampire”

Fidelity “I hath come to suck your blood! I mean uh, have an A1 day!”

Anyway, joking aside, that’s exactly how a short works.

How Much Money Can You Make Short Selling?

So your max gain on a short position is if the shares go down to $0.01, because then you can still buy the shares and use them to cover. If the stock goes to $0.00 or if trading becomes so illiquid that you can no longer buy the stock then you actually lose the game rather than winning, because you have no way of buying the shares to replenish, so your initial investment is just gone…I believe this is how it works at least.

*update, sounds like the stock going to $0.00 is actually the BEST case scenario. You don’t need to buy them back, the lender has no claim, you were right, and you make 100% profit on your short speculation!

Back to it, your max gain on a short position is if the share goes to 0, so your max gain is a double of whatever money you’ve put in. ie. that $18,000 we put in can maximize at a 100% profit of another $18,000, in that you don’t need to pay back the shares, you basically got a free loan that was forgiven.

Do You Need a Margin Account to Short Sell a Security?

Yes, just because once again, every single short sell is a loan of shares against the other holdings in your account, as the remainder of the account assets are used as collateral that the brokerage firm can take (and then some via debt collectors if need be) if the short seriously goes against you, as mathematically you technically have unlimited risk. That’s what the financial math says, since there’s technically no limit to how high a stock price can go, such as with bubble’s etc. But this is actually not 100% true in reality, as Apple can’t become a $100,000,000,000,000 company overnight, it would swallow up the valuation of the whole US economy, and then we’ve got bigger problems than the giant bill that you owe

Can You Short Sell Cryptocurrency?

You can but it is a bit more of a process. First you have to get approved and open an account on Fidelity Crypto, or another brokerage that allows you to buy and sell Bitcoin and other Tokens. From there you need a Margin account on top of this, and then you can bet against crypto. In total honesty using options instead of this is a much more cautious strategy, in that you truly have an almost unlimited risk of a short position with not much cover, and it’s actually harder to offload than closing out a losing options position is.

How Selling Stock Short as a Hedge Works

As a hedge, short selling is a more long term alternative to using options to protect a sale or a buy. Say I own my 100 shares of Apple at $180 per share worth $18,000 again, however this time we’re going to buy these shares long. We’re going to let them appreciate a bit, and then we’re going to buy an offsetting short position on the stock so we don’t take on any losses. This is just like if you were to sell the stock in terms of your gains and losses except you hit “pause” essentially, so you don’t pay any capital gains if you have a very low cost basis. In this way, you can wait out the flash crash and keep your losses without eating a huge amount of taxes.

Let’s use an example to show how powerful this hedging tool could be if you’re right about a stock dipping.

I buy one share of the Dow Average at $35,000.

I place a short sell order on the DOW at $35,000.

The Dow Drops to $30,000 within 30 days due to the COVID panic.

You cover your short position and take the $5,000 profit. Even after taxes this is a $4,000 profit. You put this into the now cheaper DOW average stock. Now you have a lower cost basis and more money in the position. Now when the DOW goes up to $70,000, you have 1.15 shares, or around $80,000, versus if you had just held you’d only have $70,000.

Things to Realize When Short Selling

Well the first thing to realize is I guess short term capital gains 😉 sorry had to do it.

One of the first things to realize is that there are massive gain and loss implications on both sides of whatever’s happening, as well as the fact that your Theta, which is the time value of your position, is technically plummeting because you are eating margin interest every single day on your short sell. So even if the underlying value based on the security isn’t changing just based on time, relative to YOU it is because your margin loan interest is eating up your profits. On a $100,000 position, expect to pay around $1100 per month in margin interest, or just under $40 for every day that you hold your position. Better be profitable if you decide to short sell, and better be profitable quickly! This is a huge advantage to using options over a short sell, no margin interest!

Considerations When Market Timing

Always make sure you know that you are being a pure speculator when you are short selling. A leveraged gambler, that’s all you’re being. That being said, Hedge Fund Managers are also gamblers and they’re billionaires so….I mean two sides to every coin.

Final Thoughts On What Actually Happens When You Short Sell a Stock?

And there you have it. Hope you enjoyed reading my extensive blog post article on what actually happens when you short sell a stock. For more details and information on all things business and finance, read on or subscribe to our blog for additional details and information.

Cheers!

*Inflation Hedging.com

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

[…] El Nino this year. If I’m right that also means that oil futures could tank….might be a good short position now that I think about it, will follow up on that in another […]