Should I Use a Credit Card, Why All The Research Says Absolutely Not!

Most people who are in credit card debt never expected to find themselves in debt. When you are approved for your first credit card, other credit card companies often start sending offers. Soon, your one credit card has turned into five, and each of them has high balances. If you are hoping to own a home, buy a brand new car, or be approved for any type of loan, you are going to need to pay your debt down. One great way to pay down your debt is to snowball your debt. And so, without further ado, in this blog post I’ll answer the question of should I use a credit card, and the answer is always no.

What Is Snowballing Your Credit Card Debt?

Snowballing your debt entails you working to pay off your card with the lowest balance first. Sure, you need to make the payments for your other cards on time; however, the majority of the cash that you spend on making payments should go to the card with the lowest balance first.

Snowballing your debt entails you working to pay off your card with the lowest balance first. Sure, you need to make the payments for your other cards on time; however, the majority of the cash that you spend on making payments should go to the card with the lowest balance first.

What Are the Benefits of Snowballing Your Debt?

There are a few reasons why financial experts believe that snowballing your credit debt is the best way to pay off your credit cards.

| Related Posts |

|---|

Encouragement: When you are overwhelmed in credit debt, it is easy to get discouraged. When you see the monthly bills come in, it can be difficult to imagine ever being debt free. When you snowball your credit card debt and work on paying your lowest balance off first, it will feel great when that balance is zero. This will encourage you to keep working and saving to pay the next card off.

Rolling the First Debts Payments: When your first card is paid off, you can use the money that you budgeted for that card and put it toward the card with the next lowest balance. The extra money that you put on that card will help you to pay it off faster. When that card is paid, you will have the funds budgeted for the first and second card to put toward the third. Snowballing allows you to pay off your cards much faster.

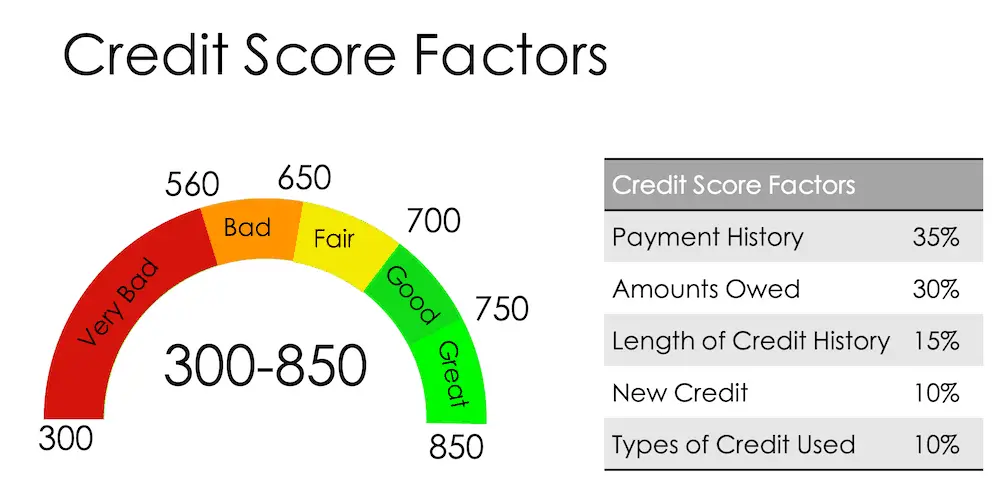

Increased Credit Score: When you have paid down the debt from the first card, your credit score will increase because you will be reducing your overall debt. As each card gets paid, your credit score will increase more. Soon, your credit score will be high enough for you to start shopping for mortgages or car loans. Snowballing your debt will help you reach your financial goals much faster.

If you feel as though you are drowning in credit card debt, snowballing your debt can be a life preserver. It is going to take time to get your debt down to a number that feels manageable, but through patience and budgeting, snowballing your debt will get there faster.

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

Leave A Comment