How to Payoff Credit Card Debt Fast, Payoff Higher Interest Balances First!

As ice rolls and gains momentum down the hill, it grows bigger and ultimately becomes a boulder. The equivalent concept applies when you want to end all your debts. You start by working on the small bills and take care of the big ones later. This debts reduction plan is efficient and will inspire you to repay all your arrears without struggling. It is equally efficient in financial management as it tames down your rogue spending behavior.

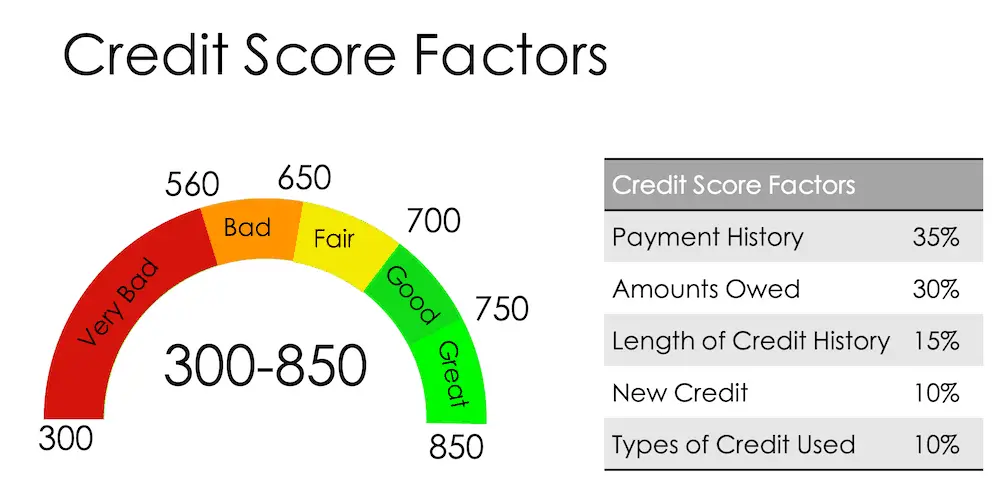

Debts can affect your finances. They can derail your progress as all your funds go to settling various bills for a lengthy period. Failure to repay your debts in time can get you in trouble. You can get a bad credit history. You may end up paying high interest rates to local banks if they agree to grant you money. Therefore, it is vital to repay all your debts in time. You can adopt snowballing method as a means to discharge your debts. Here is a breakdown of what you ought to know about snowballing. In this blog post, I’ll show you a few simple ways for how to payoff your credit card debt fast.

| Related Posts |

|---|

You can follow the following steps.

List all your debts. If you have been struggling with debts, it is the time you surface with a list of the bills. You should start with the smallest liability to the biggest. Compiling a list will deliver to you an idea of the status of you debts.

List all your debts. If you have been struggling with debts, it is the time you surface with a list of the bills. You should start with the smallest liability to the biggest. Compiling a list will deliver to you an idea of the status of you debts.

How to Payoff Your Credit Card Debt Fast, Snowballing vs Higher Interest Cards

Continue honoring the least amount of payments to all debts apart from the smallest. You should start by prioritizing the small debt. Utilize all your resources at hand to repay the small debt. You have to sacrifice on your expenses and cut off some of the luxury or get an extra job to help you offset the amount. It supports you free up some of your resources to cater for other debts.

After repaying the first debt on your list, you can work on the next one.

Final Thoughts on How to Payoff Your Credit Card Debt Fast

Snowballing is helpful since it gives you direction and momentum to tackle the following item on your list. You should make the least payments amounts on all the obligations except the next one on your list. You can then add your payment on the second bill. It will shorten the remittance time, and you can move on to the next debt on your list.

You should sustain the momentum until you say goodbye to all the debts. Snowballing method of debt reduction is efficient as it keeps you on a high morale to discharge all the liabilities. It also aids in properly shaping your spending behavior. You should get more savings in future and keep tabs on your lavish spending. For more information, be sure to comment down below and to subscribe to our blog for additional details and information.

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

[…] Previous Should I Use a Credit Card? […]