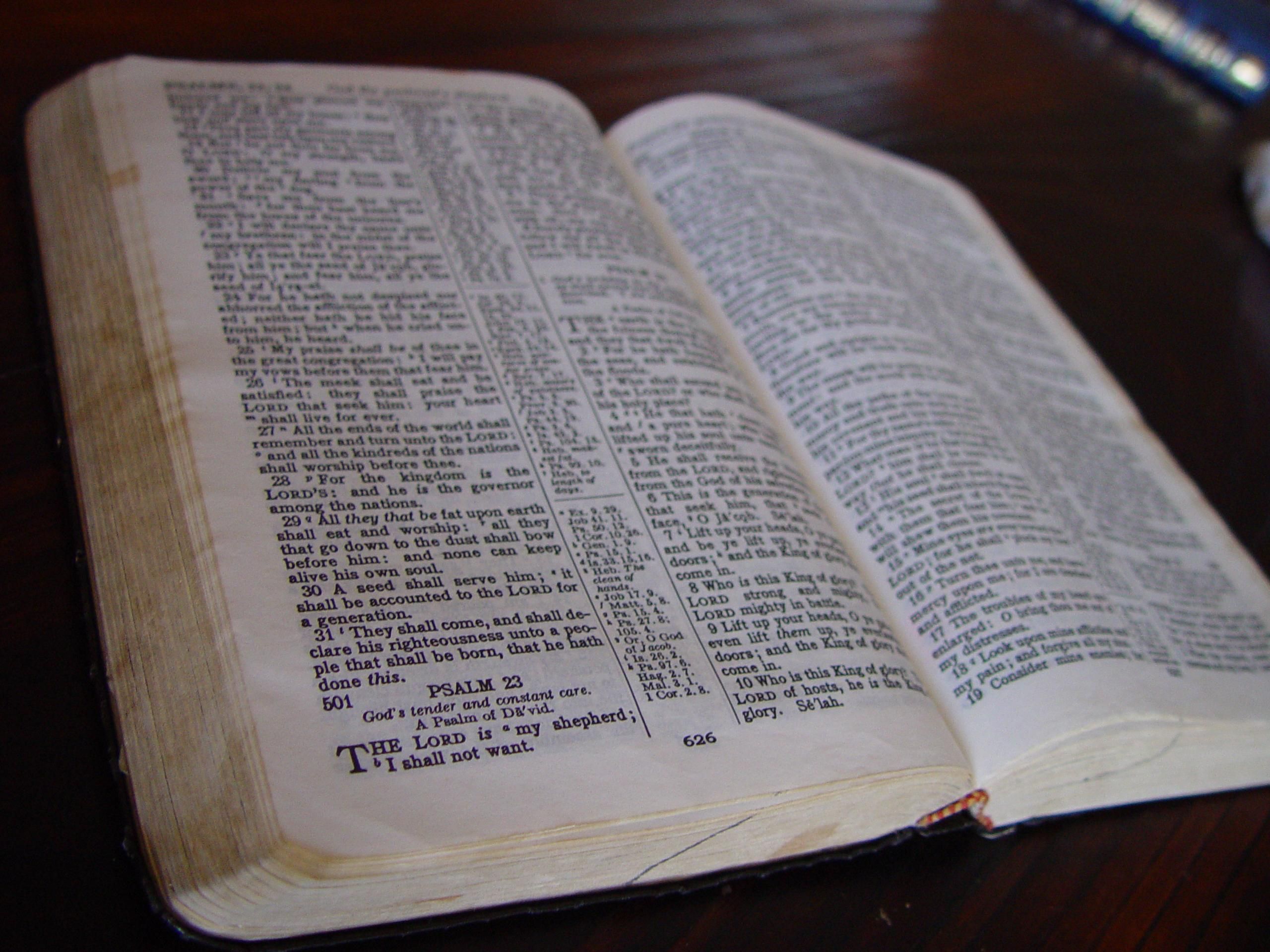

What Does God Think of Rich People? Quoting and Interpreting Excerpts From The Bible

What does God think of rich people? I chose to write this blog post because of the handful of blog posts that I have on my website on both religion and money, they seem to be getting a lot of traffic and doing very well. This is a search term that is very highly searched, and so given our blog is on all things money and business, I thought it would be fitting to explore exactly what the Bible thinks about rich people, about money, and to run through some of the most popular quotes in the bible on money.

What Does the Bible Say About Money?

Now in all honesty I’m just an SEO specialist and a financial analyst that is trying to get traffic to his blog with this post, that’s it. I am not a biblical analyst, and I don’t want to get tons of flack in the comments (though more comments is good for the algorithm) about being a bigot etc. Take what you read here with a grain of salt, this is just one lonely blogger’s own personal research on  what the Bible says about money.

what the Bible says about money.

Generally speaking, the Bible does not speak well of money, and though it is not all bad about it, when it is directly mentioned it brings things up like the love of money, and it being extraordinarily difficult to get into heaven as someone being rich etc.

This being said, there are some quotes in the Bible that give fundamental laws about money. For instance “to he who has everything more shall be given. To he who has little, everything should be taken away.” This is essentially Price’s law and the Pareto distribution at work, and while I’m not sure if this is condoning money or not, it is a technically accurate rule of money, of fortune, and of life. This rule works because as you get further away from 0, it increases the probability that you are going to continue getting further away from 0. And as you get closer to 0, it increases the probability that you are going to go closer to zero.

To illustrate this, let’s think of a business scenario. We have your friendly neighborhood website entrepreneurs, let’s call them Steve and Jess. Steve builds up his business more conservatively, while Jess is somewhat more impetuous with his money. Steve strives to be cautious with his cash flow and saves up $50,000 from a job, as well as from the earnings on his website, which are now at $100 per month.

Jess is much more impetuous with his money, he deploys $20,000 into his website and only makes $10,000 back. He purchases a house, a car, and new clothes all on credit, and spends huge amounts of time looking for new business ideas, instead of working for consistent cash flow and pursuing a “lean start-up model” method of business, where you only spend on the business what it earns.

| Related Posts |

|---|

Fast forward 3 years into this, Jess has $500,000 into debt and a miniscule revenue stream. Steve has no debt, has $300,000 in assets, and has a website that has snowballed into a $5,000 per month passive income source. He also kept his job and is now a manager making $130,000 per year, and has been offered an additional vacation package which he will use to continue growing his websites. He even has made new friends in the Real Estate space who are showing him how to purchase Duplex properties with very little debt in the deal that cash flow as soon as they are bought.

Why did the two of them turn out so differently over time?

It is the rule of Price’s law. Because Steve got momentum in his entrepreneurial journey early, stayed away from debt, and always tried to maintain a healthy net worth, he was able to spiral himself upwards in a major way (to he who has everything, more shall be given). Jess had his snowball go against him right from the very beginning, because he took too much risk and had his net worth go negative. As it went negative, it became more likely that it would continue to go more negative.

Steve instead kept spiraling his upward, he was able to grow one business, which led to more business opportunities, which grew his savings account, which grew his savings account more, and so on and so on. The spiral upward kept on giving him more opportunities, and given enough time put the two men in radically different positions. It is a rule of life, more than it is about what is right or wrong.

What Are The Most Popular Quotes In The Bible About Money

Aside from the parable above, here are some of the most popular quotes in the Bible about money:

“30 pieces of silver, the one I kiss is the chosen one.”

“To he who has everything more shall be given. To he who has too little, everything shall be taketh away.”

“It is easier for a Camel to pass through the eye of a needle than for a wealthy man to enter the Kingdom of Heaven.”

There is also the story of Jesus getting upset at the Tax Collectors for over-taxing the citizens where they were at. There are countless stories in the Bible of rich Kings and peasants, like King David, Samson and Delilah, King Solomon, and tons of other parables about money. The “Prodigal Son” is another good one about money, while the story of Cain and Able is another good one about how resentment and momentum works.

Final Thoughts On What Does God Think of Rich People?

I personally don’t think anywhere in the Bible that it says you should not try to have resources or money. There are so many stories and quotes in the Bible, like the story of the Prodigal son, where the kid essentially runs out of money and has to go back home to his parents where he is welcomed back once again with open arms. That story is largely about frugality of money as the guy is running around giving away all his gold and eventually pays for it as he ends up on the street, and with his father having money as the main way the boy then can eat.

What I think the Bible says instead about money is to not obsess over it, but to still be disciplined about it and make it an important part of your life. I think it more gives forewarnings about get rich quick schemes and dubious ways of acquiring wealth that are not in line with Christian teachings, than it does warn against making money through legitimate means. Once again, just this bloggers thoughts on money.

Hope you enjoyed reading, subscribe to our blog for daily blog post updates and be sure to comment down below with any questions you may have on the article.

Cheers!

*Inflation Hedging.com

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

Leave A Comment