Is Buying a Covered Call Option ETF Smart? Why I Am Buying One Soon

If you’re like me, you’re always on the lookout for new and interesting investments. I recently came across an investment that I think is both interesting and potentially quite lucrative: buying a covered call option ETF. And so in this blog post, I’ll answer the question of is buying a covered call Option ETF Smart? And why I’m considering adding some portfolio exposure into one very soon. For more details and information on all things business and finance, read on or subscribe to our blog for additional details and information.

What is a Covered Call Option ETF?

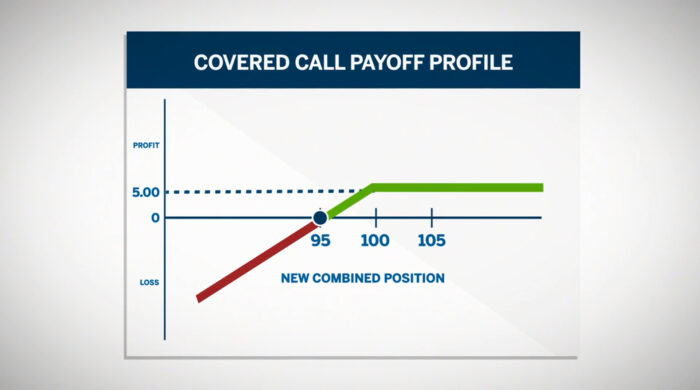

A covered call option ETF is an exchange-traded fund that takes the leverage and margin account requirement out of writing covered call options on a portfolio. In other words, it’s a way to get the benefits of writing covered call options without having to put up any extra cash or collateral.

What are the Benefits of Buying a Covered Call Option ETF?

There are several potential benefits of buying a covered call option ETF. First, it can help you generate additional income from your portfolio without the sometimes unlimited risk of doing something like writing actual naked call options.

Second, it can help you protect your portfolio against a potential market decline. If the market does take a downturn, the covered call options that you own will increase in value, offsetting some of the losses in your portfolio.

Second, it can help you protect your portfolio against a potential market decline. If the market does take a downturn, the covered call options that you own will increase in value, offsetting some of the losses in your portfolio.

And finally, it can help you lock in gains on your portfolio by selling call options at a premium. If the market is flat when writing covered call options, you also get to keep the premiums.

Why I Am Buying a Covered Call Option ETF Soon

I am planning on buying a covered call option ETF soon for all of the reasons listed above. I think it’s a smart way to generate additional income, protect my portfolio, and lock in gains. If you’re looking for a new and interesting investment that does not have the massive risk sometimes associated with an actual options trading strategy, consider using a covered call option ETF to take a risk while minimizing some of the associated downsides.

| Related Posts |

|---|

Why Is The Dividend Yield So High On A Covered Call Option ETF?

The dividend yield on a covered call option ETF is typically quite high because the underlying investments in the fund pay out dividends on a regular basis. In addition, the fund managers may also choose to reinvest some of the dividends received back into the fund, which can further increase the yield.

One thing to keep in mind, however, is that the high dividend yield may not be sustainable in the long run. If the underlying investments in the fund cut their dividends, or if the fund managers decide to stop reinvesting dividends back into the fund, then the dividend yield will go down.

Still, for the moment, the dividend yield on a covered call option ETF can be quite attractive, which is one of the reasons why I am considering buying one soon.

When Is the Best Time to Sell a Covered Call Option?

The best time to sell a covered call option is typically when the market is near its highs and you think it might consolidate or pull back in the near future.

By selling your call option, you get to keep the premium while still having the upside potential if the market continues to move higher. If the market does pull back, your covered call option will increase in value, offsetting some of the losses in your portfolio. Of course, timing the market is never an exact science, so there is always the risk that the market could continue to move higher even after you purchase your covered call options, which would drastically minimize some of your gains. I would never recommend doing this with more than just a small portion of your portfolio.

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

Leave A Comment