How To Trade Options In Your Roth IRA? Why I Will Be Doing This With Covered Calls Soon

If you have a Roth IRA, you may be wondering if you can trade options within it. The answer is yes, but there are some things to keep in mind before doing so. For starters, it’s important to understand that there are two types of options: covered and uncovered. Covered means that the option is protected by an underlying security, such as a stock or mutual fund. Uncovered means that the option is not protected by an underlying security. If you’re going to trade options in your Roth IRA, it’s important to use covered options. That way, if the option expires worthless, you won’t lose any of your IRA account value. In this blog post, we will explore the topic of how to trade options in your Roth IRA, and why Covered Call Option ETFs might just be the appropriate risk setting for your portfolio.

Another thing to keep in mind is that, just like with stocks and mutual funds, you’ll need to pay taxes on any gains from options trading. However, since the Roth IRA is already tax-deferred, you won’t have to pay taxes on the gains until you withdraw the money from the account. Finally, it’s important to use a broker that offers IRA-approved options. Not all brokers do, so be sure to check before opening an account.

Another thing to keep in mind is that, just like with stocks and mutual funds, you’ll need to pay taxes on any gains from options trading. However, since the Roth IRA is already tax-deferred, you won’t have to pay taxes on the gains until you withdraw the money from the account. Finally, it’s important to use a broker that offers IRA-approved options. Not all brokers do, so be sure to check before opening an account.

If you’re interested in trading options in your Roth IRA, there are several things to keep in mind. However, if done correctly, options trading can be a great way to boost your account’s returns.

Why Writing Covered Call Options Is Such A Good Strategy For Your Roth IRA

If you have a Roth IRA, you may be wondering if you can trade options within it. The answer is yes, but there are some things to keep in mind before doing so.

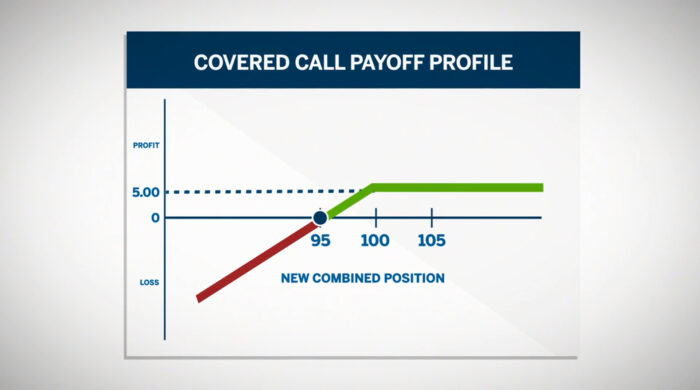

For starters, it’s important to understand that there are two types of options: covered and uncovered. Covered means that the option is protected by an underlying security, such as a stock or mutual fund. Uncovered means that the option is not protected by an underlying security.

If you’re going to trade options in your Roth IRA, it’s important to use covered options. That way, if the option expires worthless, you won, you get to keep the premium as your buyer cannot exercise the option.

| Related Posts |

|---|

Here’s Why Selling Covered Call Options Can Be A Dangerous Strategy As Well

While selling covered call options can be a great way to generate income, it can also be a dangerous strategy if the stock price increases dramatically.

If the stock price increases too much, the buyer of the option may exercise their option and force you to sell your shares at an unfavorable price. This can obviously eat into your profits or even result in a loss. Therefore, selling covered call options can be a great way to generate income but you need to be aware of the risks involved. Make sure you understand how the option works before selling any covered call options. Options can be a great way to hedge risk, like in the case of Writing Covered call options, but they can also greatly increase your risk.

What are my Final Thoughts On How To Trade Options In Your Roth IRA

Overall, I think writing covered call options is a great way to generate income, especially if you are comfortable with the risks involved. However, it’s important to remember that this strategy can also be dangerous if the stock price increases too much. If you do decide to sell covered call options, make sure you understand how the contracts work, and never write contracts on more than you can afford to lose. Till next time!

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

[…] Previous Harvey Specter Vs Tommy Shelby […]

[…] 1) The scene in “The Pilot” where he breaks down the reasons why he’s the best closer in New York. […]