Can You Write Covered Calls In Your Roth IRA?

You are allowed to write covered call options in a Roth IRA. However, you will need to make sure that the option is adequately covered. This means that you must have enough cash or securities in your account to cover the cost of the option, plus any transaction fees. If you don’t have enough cash or securities to cover the option, your broker may require you to deposit more money or securities into your account. And so in this blog post, I’ll answer the question of can you write covered calls in your Roth IRA? Be sure to read on or subscribe to our blog for additional details and information on all things finance.

Why Aren’t You Allowed To Have Margin In An Individual Retirement Account?

The main reason why you can’t have margin in an Individual Retirement Account is because it would be considered a form of borrowing. And since IRAs are already tax-deferred, there’s no need to further defer taxes by using margin. In addition, having margin in an IRA could result in the account being classified as a pattern day trader, which would not really fall into line of the purpose of the Individual Retirement Account.

The main reason why you can’t have margin in an Individual Retirement Account is because it would be considered a form of borrowing. And since IRAs are already tax-deferred, there’s no need to further defer taxes by using margin. In addition, having margin in an IRA could result in the account being classified as a pattern day trader, which would not really fall into line of the purpose of the Individual Retirement Account.

Why Is Writing Covered Calls In An IRA Allowed?

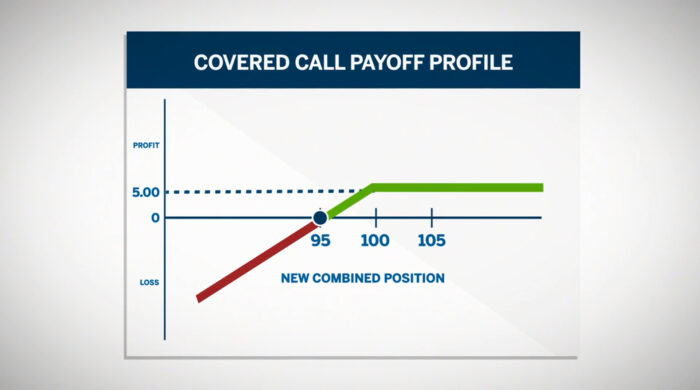

While you can’t have margin in an Individual Retirement Account, you are allowed to write covered call options. This is because a covered call is considered to be a form of hedging, and it doesn’t involve any borrowing. In addition, writing covered calls can help generate additional income from your IRA without having to take on any additional risk.

And because you can do this in a Roth IRA Account, what is also allowed is the use of Covered Call ETFs, which require no margin at all. This strategy greatly simplifies the once difficult strategy of maintaining covered call options, by giving you a super high yield dividend, to the tune of 10% or 11% off of your portfolio, as your profits from an options premium. Use a Roth IRA for this like I am doing and you have yourself a nice little income source that grows tax free.

| Related Posts |

|---|

Should I Buy Crypto In My Roth IRA?

No one can give you a definitive answer as to whether or not you should buy crypto in your Roth IRA. It really depends on your individual circumstances and investment goals. However, there are a few things you should keep in mind if you’re considering buying cryptocurrency in your Roth IRA.

First, it’s important to remember that cryptocurrency is backed by virtually nothing and that is has no fundamentals and no financial ratios to back it. Therefore, it’s incredibly volatile and is considered a very speculative investment.

Final Thoughts On Can You Write Covered Calls In Your Roth IRA?

Second, cryptocurrency is not currently recognized as an asset class by the IRS. This means that if you do buy crypto in your Roth IRA, you’ll be required to pay taxes on any gains when you sell or trade it. And finally, because crypto is so volatile, it’s important to make sure that you have enough cash or other assets in your Roth IRA account to cover the cost of the crypto, plus any transaction fees. Otherwise, you may end up having to liquidate a portion of your IRA for living expenses!

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

[…] recent Ron Desantis attack on the company has led to a drop in its stock price. This is because investors are worried about the potential impact that this could have on Disney’s business. After all, if […]