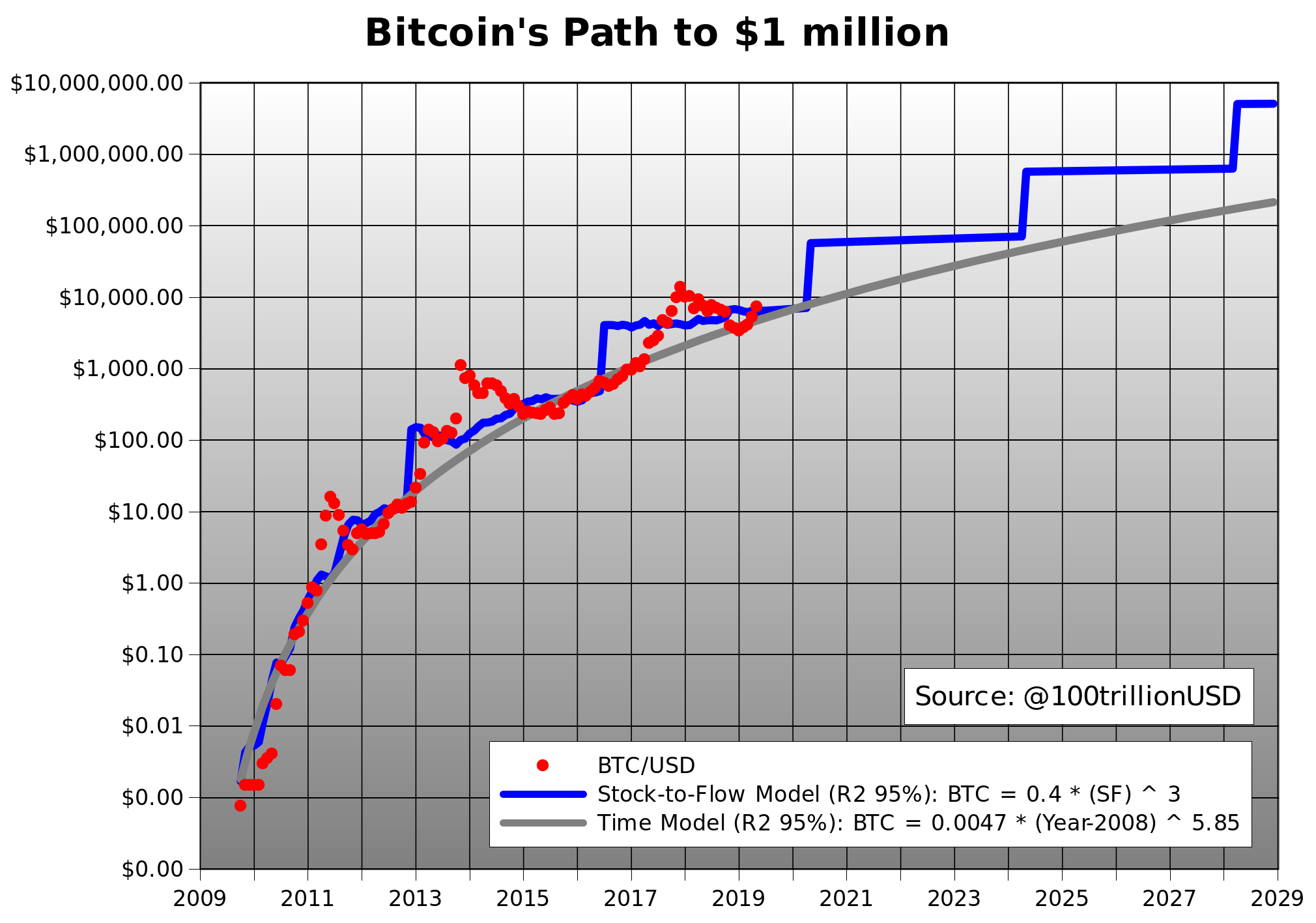

*What Will The Price Of Bitcoin Be In 2030? I Say Between $500,000 And $1,000,000 Per Coin

This is a difficult question to answer. I think that the price of Bitcoin will be strongly influenced by how widely it is adopted. If it is widely adopted, then the price will be higher. If it is not widely adopted, then the price will be lower. But What Will the price of Bitcoin be in 2030? And why I am I putting my official price target at somewhere in between $280,000 and $500,000 per coin.

I think that there is a good chance that Bitcoin will be widely adopted by things like Institutional investors, ETFs, the New York Stock exchange, and even as a currency alternative to fiat in other countries. Every single analyst rating over the next 10 years or so has Crypto Currency hitting between $250,000 and $1,000,000 per coin, and nearly all of them have a valuation over half a million dollars. I am very serious when I say that I firmly believe Bitcoin will hit $500,000 at a minimum by 2030, I cannot believe that I am saying this, but I am starting to think that the masses and the  pundits are actually correct in this one.

pundits are actually correct in this one.

How The Winklevoss Twins Made a Fortune Off Of Bitcoin

*When it comes to Bitcoin, the Winklevoss twins are probably best known for their early involvement with the digital currency. In fact, they were some of the first people to invest in Bitcoin and they have made a fortune off of their investment.

The twins first became interested in Bitcoin in 2012 and they quickly became some of the largest stakeholders in Bitcoin as a Crypto Currency. They may have lost the War on Facebook back in the early 2000’s, but they got their $60,000,000.00 each and were able to leverage it into a huge Crypto stake that is now worth like $12,000,000,000.00, they became nearly as Rick as Mark Zuckerberg (okay about 1/10th as rich, I would still take Facebook personally) without even so much as half the effort, not a bad gig. Having $6,000,000,000.00 personally in a Bitcoin exchange would definitely start to make life interesting to say the least. My final thought on this subject, is that I think the Crypto markets can make up as much as $5,000,000,000,000.00 in assets, to possibly 10T$ in assets by 2030. This would give Bitcoin a price target of around $280,000 per coin, which I think is my prediction for its price in 2030.

| Related Posts |

|---|

Why Are Analysts Putting Bitcoin At a $1,000,000.00 Valuation Per Coin By 2030?

I will tell you why, it is simple Economics. The law of supply and demand. There are only so many Bitcoin that can be mined and when they are all gone, that is it. So as adoption increases, the price per coin has to go up because there are more people trying to buy Bitcoin than there are Bitcoin to buy. Bitcoin is much more of a castle in the air type investment than a firm fundamentals one, there are no cash flows to go off of, and in fact in earlier years on this blog I have been a very strong proponent against Bitcoin as an investment tool. With all these hedge fund managers and well respected investors buying into Crypto however, I cannot help but think they might be onto something.

Final Thoughts On My Bitcoin Price Target, $550,000 by January 1, 2030

I know this number seems outrageous, and I get that. I also know that a lot can happen between now and then that could change the entire landscape of Crypto. For example, China could ban it tomorrow, or some other world power could come out with their own version of Bitcoin and make it the global standard, or at least for their neck of the woods. What I have learned from watching Crypto Currencies skyrocket from 2015 to 2022, is that they are not going away, I can finally see that now, and I want to get in now while I still have a chance to get a 15x or 20x bagger security buy at some point in my life. Be sure to read on or subscribe to our blog for additional details and information.

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

Leave A Comment