Can You Still Buy A Collateralized Debt Obligation?

When collateralized debt obligations (CDOs) first hit the market, banks, consumers, and homebuyers alike jumped on the ideal of repackaged individual loans. The idea of these financial tools was to repackage said loans into products that were sold in secondary markets to investors. Let’s answer the question: What is a CDO and review their impact on the economy. While, from my understanding, CDOs are no longer around, that does  not mean that they did not have a massive effect on the US economy at one point, and that they did not leave their place in the world of financial history. In this blog post, I’ll walk you through exactly how these products worked, and why they were so dangerous. Read on or subscribe to our blog for additional details and information.

not mean that they did not have a massive effect on the US economy at one point, and that they did not leave their place in the world of financial history. In this blog post, I’ll walk you through exactly how these products worked, and why they were so dangerous. Read on or subscribe to our blog for additional details and information.

What Are Collateralized Debt Obligations?

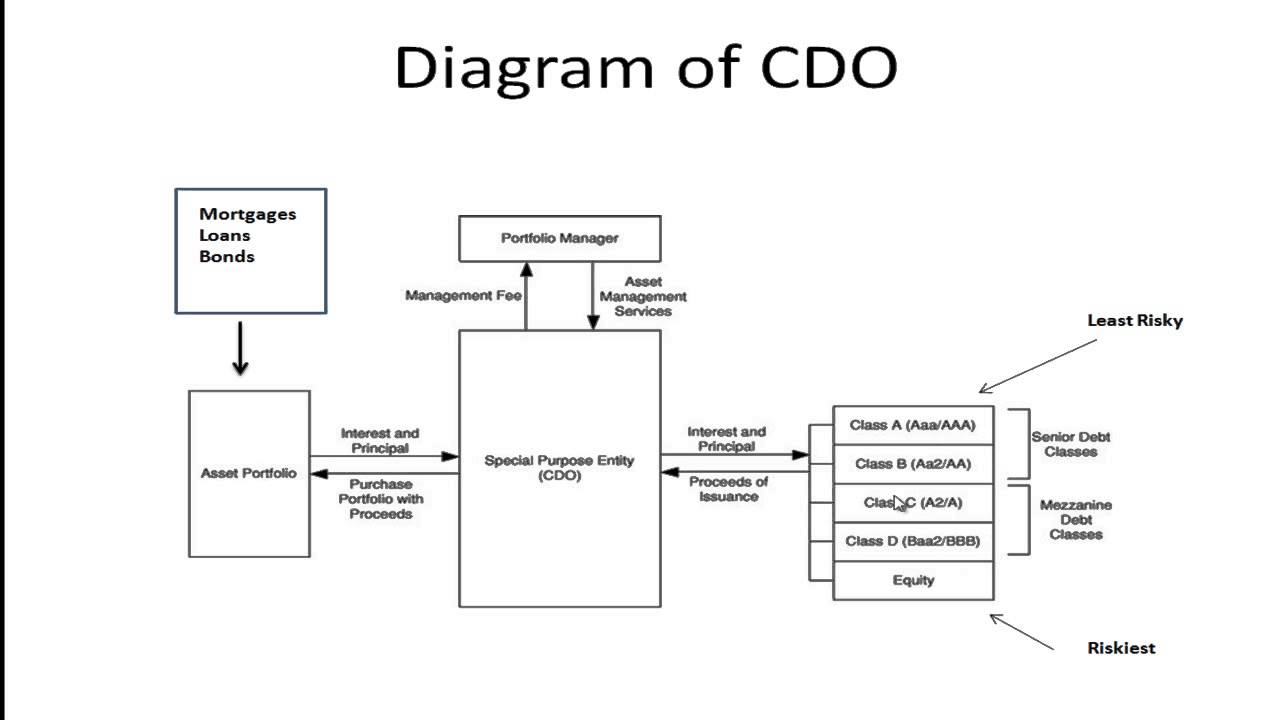

A collateralized debt obligation, abbreviated as CDO, is a tool used by banks to repackage an individual loan into a product that is then sold on secondary markets to investors. The packages usually consist of credit card debt, auto loan, corporate debts, or mortgages. Essentially, they are referred to as collateralized because they draw their value from the promised loan repayments.

The 2007 Market Panic

| Related Posts |

|---|

Packaging debts into sellable packages created an extra liquidity that resulted in an asset void in credit cards, housing, and auto debts. Soon, home prices rose beyond actual market values and people began to buy property just to sell them. Since debt was now easily available, more and more people overused their credit cards. This consumer behavior saw the credit card debt rise to nearly $1 trillion in 2008.

Banks began selling CDOs and were no longer worried about loan defaults because they had shifted the loans to investors that had bought them. Consequently, they were less inclined to adhere to the string standards that govern lending in the country. Banks began giving loans to people that were not credit worthy and things only got worse.

CDO buyers, on the other hand, became confused and misinformed about the entire system. They had not actual idea of the value of the packages they were purchasing and had to lean on their trust of the selling bank.

Final Thoughts On Can You Still Buy A Collateralized Debt Obligation?

What is a CDO? In simple terms, a CDO is a bundle of debt that is resold to an investor by a bank. By nature, these packages are difficult to analyze because several debts are grouped together. The confusion that arises from this lumping of debt is likely what caused the economy crash of 2007. Since then, CDOs have grown less popular as an investment opportunity although some restructured forms are still in play since 2012. The gist of what happened with these products is that the underlying mortgages had customers default and go bust due to them essentially not being qualified for these loans in the first place. In the current financial world however, these no longer exist and it is a much cleaner world indeed. For more details and information on all things business and finance, read on or subscribe to our blog for additional details and information.

Cheers!

*Inflation Hedging.com

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

Leave A Comment