Is Pepsi A Good Dividend Growth Stock?

Pepsi has been a Dividend Aristocrat for 25 years, meaning it has increased its dividend payout for 25 consecutive years. That’s a pretty impressive track record, and one that investors should take note of. Even though the company’s share price has been volatile in recent years, Pepsi still offers investors a solid dividend yield, and one with a very long track record of growth. For these reasons, we believe Pepsi is a good dividend growth stock for investors to consider. In this blog post, we will answer is Pepsi a Good Dividend Growth Stock, and will run through some basic financials on the popular sugar water company!

Other popular Dividend Growth Stocks that we’ll be covering on this blog include the following:

Pepsi

Pepsi

Coca Cola

McDonald’s

Exxon Mobil

AT&T

Verizon Wireless

Apple

Kraft Heinz

Chevron

Bank of America

Principal Financial

Phillip Morris

| Related Posts |

|---|

What Is The Dividend Yield For Pepsi Stock?

One of the things that makes Pepsi a good dividend growth stock is its long history of increasing its dividend payout. The company has been paying out a dividend yield of 2.50% annually on its stock, for Dividend payments of around 43 cents per share. Pepsi’s recent share price performance has been volatile, but the company still offers a solid dividend yield. Pepsi has been increasing its dividend payout for 25 consecutive years.

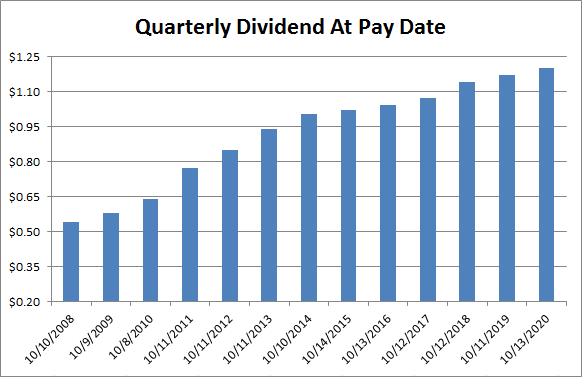

What Is Pepsi’s Dividend History?

Pepsi has increased its dividend payout for 25 consecutive years, making it a Dividend Kingpin. The company has paid out dividends consistently for more than 100 years, and investors can expect it to continue doing so in the future. The company first declared its dividend way back in 1965, and has been increasing it steadily almost ever since. The financials of Pepsi are extremely strong, and you will be hard pressed to find an analyst that would ever tell you to sell your shares in this stock, especially if you have any noticeable capital gains in your portfolio that don’t necessarily need to be realized.

How Are The Financials Of Pepsi? What Is Its Price To Earnings Multiple?

The financials of Pepsi are strong, and the company has a very solid balance sheet. The company’s P/E ratio is currently at 25.48, which is slightly higher than its 5-year average of 23.73. Pepsi has a long history of increasing its dividend payout, making it a good dividend Growth Stock to buy and hold over the long term. And if you are wondering how it’s done in comparison to it’s main rival Coca Cola? Pepsi has a longer dividend payment history than Coca Cola, and has increased its payout for the last quarter century. Pepsi also has a higher dividend yield than Coca Cola. So if you’re looking for a good dividend Growth stock to buy and hold, then Pepsi looks like a good choice. Personally, I give this stock a Hold rating, and will always hold this stock in my portfolio to collect that quarterly dividend for life!

Final Thoughts On The Dividend Growth History of Pepsi, A Solid Blue Chip With Moderate Growth Prospects

I personally peg Pepsi as one of my all time favorite Dividend Growth Stocks, along with Verizon, Coca Cola, AT&T, McDonald’s, and Kraft Heinz. And while I know Index Funds can typically beat out Dividend Growth stocks over the long run, I’ve got to say that nothing beats the satisfaction of a portfolio that pays you regular dividends on a consistent basis that grows year over year. It is such an awesome and soothing feeling that it is just too much fun not to play with.

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

[…] are a few possible reasons for why the stock is Plummeting, and here’s my analysis to answer why is Coinbase stock […]