Virgin Galactic IPO, The Space Race for Millionaire, Luxury Clients, The Exclusivity Market At Its Finest!

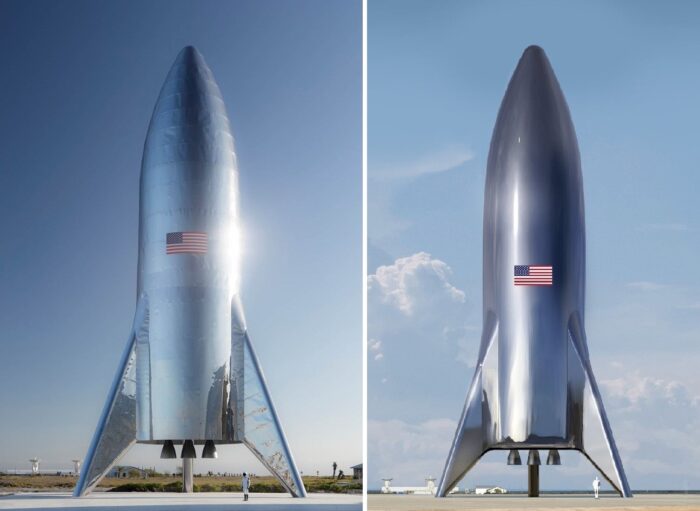

The Virgin Galactic IPO, is actually something that has already happened, strangely enough, and the Virgin company spinoff already has a market cap of $4.3 billion, higher than the valuation of tons of other companies in the US markets right now, especially for a company that published a $320,000,000 loss last year. Typically on this blog, I write blog posts about speculative companies, such as Reddit or Dippin Dots, that have not IPO’d yet but that I think might be IPOing relatively soon. In this case, this is what I was going for with the Virgin Galactic company blog post, but to my absolute surprise, they did their initial public offering in late 2019, and they are already worth over $4B. And so, without further ado, this blog post will look at the future projections for Virgin Galactic, both in their business models, and in their annual revenue. For more information on other top Space stocks that may soon be going public, such as SpaceX, Blue Origin, and even possibly NASA, be sure to comment down below and to subscribe to our blog for additional details and information.

Other top companies we’ll be reviewing in the space or tech sector that may soon be going public include the following:

Virgin Galactic

Tesla

SpaceX

SpaceX

Blue Origin

Nasa

The Space Force

Johns Hopkins APL

Baidu

Google Stock

Apple Stock

Facebook Stock

Snapchat Stock and their IPO Date

Morning Brew

And a host of other similar and related companies, be sure to subscribe for more details and information!

| Related Posts |

|---|

Why The Virgin Galactic IPO is a Castle in the Air With Pipe Dream Fundamentals to Back it Up, And Why I’d Rather Have My Portfolio 100% in Penny Stocks than in Virgin Galactic

So, the stock market is currently giving the Virgin Galactic company stock a total market capitalization of north of $5 billion, which on revenue of negative $300,000,000 for the year, is what we in the finance industry would call a “castle in the air” situation stock, in comparison to something that is based on more “firm fundamentals,” meaning that the financials of the company coincide closely with the stock price. Firm financial companies include stocks like Apple, Google, Facebook, JP Morgan Chase, Walmart, etc. You can hold these in a portfolio forever, and the standard deviation of your overall returns will never be overly crazy.

Compare this with some Castle in the Air type stocks that have no support by the financials, which include Tesla, Zoom, Snowflake, Virgin Galactic, etc. etc. Basically, these are companies without earnings that are standing on nothing, it is a castle built on sand, propped up by nothing more than the media, momentum, and about public sentiment of the stock. One thing I can add to this is that the stock market is typically very forward looking, ie. the market is skyrocketing right now, or at least has been volatile this year, in that it is wishy washy on what a future economic and global virus recovery is going to look like. With this in mind however, it is pricing Zoom extremely highly, yet also is over-pricing the market, which means that it is saying Coronavirus is here to say, but also that it will eventually recovered…a very strange sentiment indeed.

Why Virgin Galactic Has the Highest Chance of Making Space Tourism a Reality

So, I’m going to actually go out on a limb here and say that Virgin Galactic is able to succeed with the first consumer-based, space flight luxury goods product that is fully functional and on the market before SpaceX or Blue Origin does. The reason I say this, is that this is the primary focus of the company, while Jeff Bezos and Elon Musk are focusing on a multitude of other things like making space flight cheaper, getting government contracts, colonizing Mars, building Amazon etc. I think the fact that Virgin Galactic is also already having test flights, as well as the fact that the market is pricing it as the highest space stock on the market right now, is saying something about the possible long term validity of this stock.

Final Thoughts on the Virgin Galactic IPO, And why It Was So Successful for a Company With Negative Earnings

What did you think about the 2019 Virgin Galactic IPO, and what do you think are its revenue plans for the future? I personally think that they will be the first ones to commercialize space travel fully sometime around 2030, and that it’ll be the new hottest commodity product for the rich! For the top one percent of society, spending $250,000 is a cakewalk if it lets you go to space and tell all your clients and co-workers about it in the office! What do you think about Virgin Galactic? Comment down below and let us know, and be sure to subscribe to our blog for additional details and information, plus weekly news on all things finance, even space travel stocks.

Cheers!

*Inflation Hedging.com

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

Leave A Comment