What is an Inflation Hedge? And How Can You Hedge Inflation In Your Portfolio Through the Use of Treasury Bonds

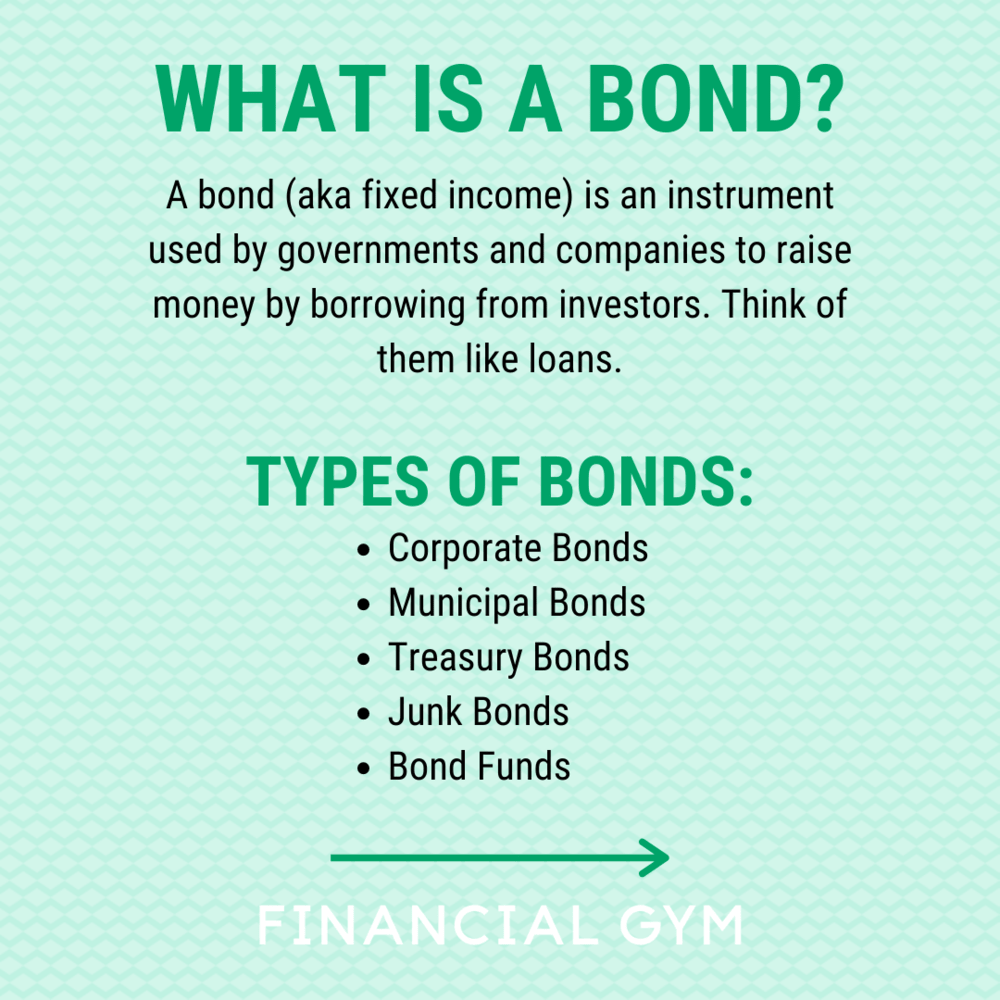

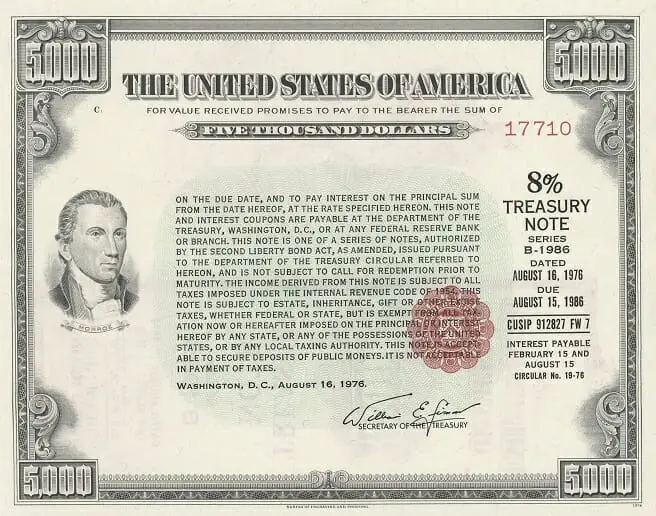

What is an inflation hedge you ask? An inflation hedge is typically going to be any security or investment instrument within your portfolio that can be used for hedging against inflation by providing a rate of return to the investor that is equal to or higher than inflation. The best tools that are used for Inflation Hedging include things that are used to just mitigate moneys value depleting, such as Treasury Bills, Notes and Bonds, as well as Corporate Bonds or more High Yield Corporate Bonds that can be used to get a rate of return higher than just meeting inflation.

However in my opinion the absolute best way that you can hedge inflation is by investing in the stock market. Equities typically have a significantly higher rate of return and track record over long periods of time than do bonds. Warren Buffett said it best, and I totally agree with him, that if he had to hold a Bond, or an S and P 500 Index fund for a 10 year period of time, that he would pick the S and P every single time. And so, without further ado, lets look at what an Inflation Hedge is, and why I titled my website after it.

Tools that can be best used as an inflation Hedge include the following:

Index Funds

Blue Chip Stocks

High Risk Stocks

Treasury Bonds

| Related Posts |

|---|

TIPS (Treasury Inflation Protected Securities)

Mutual Funds

Certificates of Deposit

Money Market Accounts

And a host of other monetary instruments. Basically anything that is frequently used as a security to generate a rate of return, will serve as a fantastic inflation hedge over long periods of time, something to think about the next time you decide to walk around with a lot of physical cash in your pocket.

The Best Inflation Hedges That Are Not Equities, What is an Inflation Hedge?

Some of the best inflation hedges and ways to generate a rate of return on your money that I can think of actually have absolutely nothing to do with buying stocks or bonds. In reality, for someone with very little savings, say $25,000 to $50,000, if their job is unstable, should quite possibly be keeping a lot of this money in cash. Ways they can use money to make money in this case include the following:

- Pay off all Debt – Not having interest or monthly payments on debt is the fastest way to stack stack and stack up cash some more.

- Always pay for everything with physical cash – Studies show that you spend the least when paying for everything with physical Benjamin’s and Andrew Jacksons, in comparison to using a Debit Card or a Credit Card.

- Buy items in bulk when they’re on sale – This one is a little bit tricky to implement at first, such as buying toothpaste in bulk when there is a sale, etc. like Mark Cuban recommends.

What is an Inflation Hedge, And At What Point of Net Worth Should You Purchase One?

So, aside from the aforementioned, an inflation hedge is pretty much any type of equity or fixed income security that generates a rate of return that helps stop your money from bleeding out due to inflation.

Since inflation is somewhere around 2% per year typically in the United States, with cash, you are getting -2% per year, with a Treasury Bond, you are getting really 0% per year if you can get a 2% annual rate of return, and with equities, if you average an 8 to 9% annualized rate of return, then you are really getting like 6 to 7% returns per year, heck of a lot better than losing 2% each year on your money, or losing 10 to 11% per year on your money like you will be if you have debt.

So, to keep this blog post short and sweet, and in the spirit of answering what an Inflation Hedge actually is, an inflation hedge is anything that generates a rate of return, such as a Stock or a Fixed Income Security.

Final Thoughts on What is an Inflation Hedge?

And so, an inflation hedge is anything that generates a rate of return on your money which allows the balance in your account to grow. Once you get something like $50,000 in liquid cash to your name, you would be wise indeed to put the majority of your additional savings into 401Ks, IRAs, CDs, Bonds, and other instruments that generate a rate of return on your income, over the long run, your future self will surely thank you. Until next time, you heard it first right here at Inflation Hedging.com.

Cheers!

*Inflation Hedging.com

Sources:

- https://medium.com/nori-carbon-removal/how-i-passed-the-securities-industry-essentials-sie-exam-de86529f9feb

- https://www.professionalexamtutoring.com/sie-exam-difficulty/

- https://www.efinancialcareers.com/news/evergreen/seven-tips-for-acing-the-series-7-and-other-financial-exams

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

[…] ACAT transfer is an automated customer account transfer service that allows investors to move their securities and cash from one brokerage firm to […]