The Benefits of Getting Your CFP, And Why The Long Term Career Benefits Always Outweigh the Costs

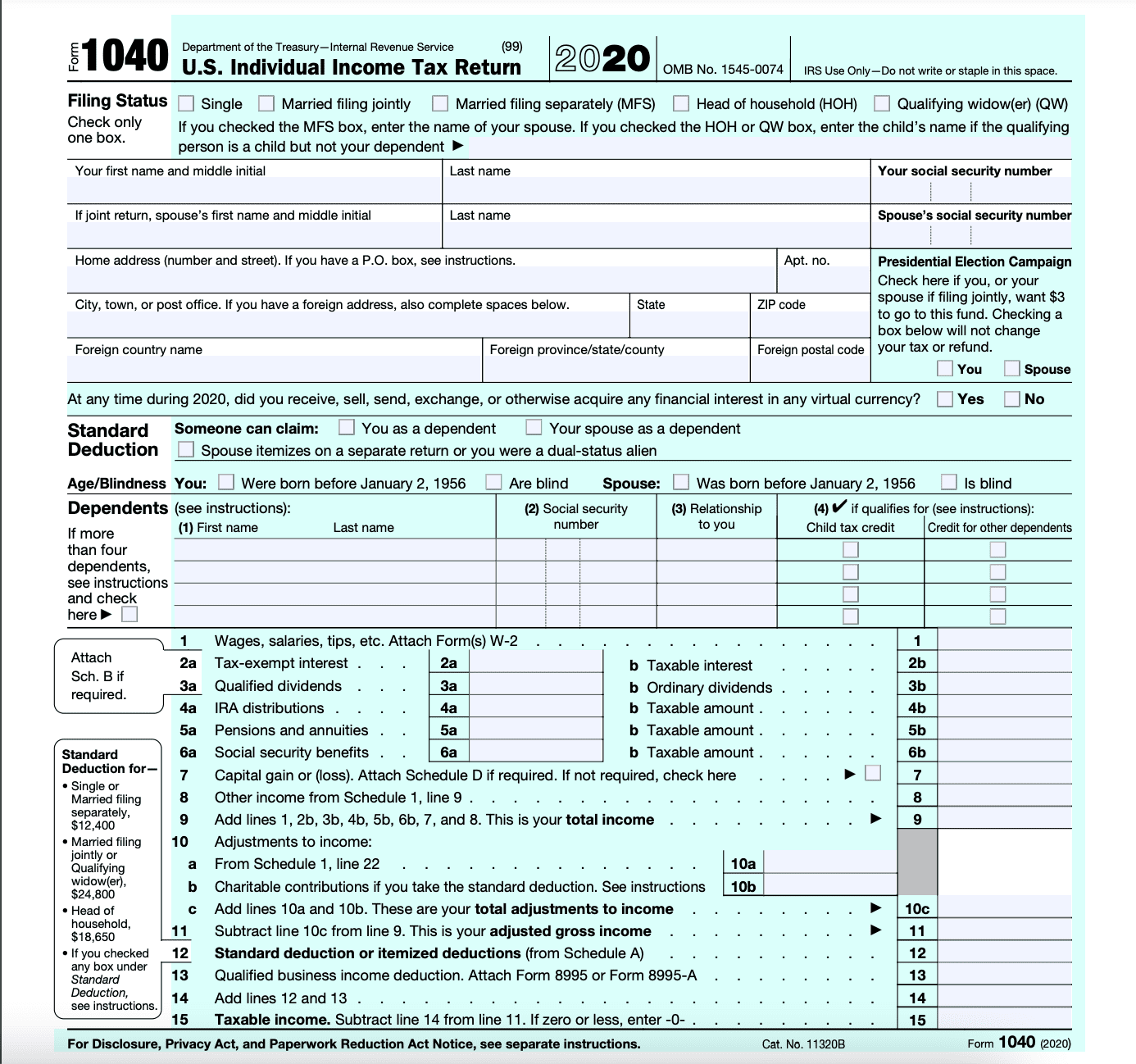

The benefits of getting your CFP are much more than just a resume boost, in terms of your overall education, how much people in the industry  respect you, and how people look at you differently when you have the credential, it really does a good job of growing and maturing you as a financial advisor or a banking associate. The way that I think about the credential, is that if someone spent the money out of pocket, if someone went through the rigors of taking 7 classes, if they passed the CFP exam, if they learned about the seven types of finance involved in the program, which are:

respect you, and how people look at you differently when you have the credential, it really does a good job of growing and maturing you as a financial advisor or a banking associate. The way that I think about the credential, is that if someone spent the money out of pocket, if someone went through the rigors of taking 7 classes, if they passed the CFP exam, if they learned about the seven types of finance involved in the program, which are:

Financial Planning

Investments

Financial Analysis

Insurance

Tax

Retirement Planning

Estate Planning

In vivid detail, taking a full class on each one and passing a rigorous final exam, as well as passing the CFP exam, it will definitely mature them and educate them as a person. Add to this the fact that you need 3 years of work experience, the hardest part of the equation here, in order to pass this program, and you will definitely get a lot out of becoming a CFP. People like to see the letters next to your name because it gives them sort of an inkling into your brain, it shows them that you are extremely dedicated and that you have both intelligence and work ethic, and that you have the people skills and persistence to work as an Investment Professional for a minimum of 3 years, while going for the CFP at the same time! Lets look at some other things that the CFP Credential gives you.

A Show of Work Ethic, The Benefits of Getting Your CFP Revealed

When you put the letters CFP next to your name, and the letters of any financial designation this goes for, it shows that you are willing to work hard, outside of business hours, in order to grow your career. It shows employers that you are not simply a clock puncher, but that you have the discipline and effort to see it through when times get tough, and that you want a career, not just a job!

A Great Resume Boost

Anyone with the CFP designation by their name is definitely going to get some attention from recruiters, especially when you include other licenses with it like the Series 7 and 66, the 215, or when you go for the trio designation, the CFP, CHFC, CLU like I am doing with the American College currently (they give you 3 in one shot, even though it’ll cost you around $7,000.00 and a year of your life all told to get these designations) it definitely stands out in job applications, and definitely puts you on track towards becoming a financial advisor.

A Strong Financial Education

Taking 7 Finance classes and then taking a massive final exam all with regards to tax and finance is definitely going to increase your overall education in the field of finance. It makes you a very well-rounded financial planner, gives you enough experience to speak intelligently to financial planning clients, and it allows you to have a leg up in terms of your knowledge.

Shows Employers You are Serious

Anyone who is crazy, dedicated, obsessed enough (call it what you will) to have the wherewithal to spend an entire year of their lives studying finance after hours, definitely has a show of character behind them. Adding this designation to a resume is something that not too many advisors can do, and it is definitely valuable because of that.

Final Thoughts on Why the CFP Benefits Far Outweigh the Costs, a Great Investment Indeed!

If you are looking at getting into the field of Financial Planning and for becoming a Financial Advisor one day, I would highly recommend jumping into the CFP program, the investment in knowledge and resume capital is well worth the money. For more information on all things business and finance, read on or subscribe to our blog for additional details and information.

Cheers!

*Inflation Hedging.com

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

Leave A Comment