Can a CFP Prepare Taxes? Yes And No, And Why There Are Other Factors Involved

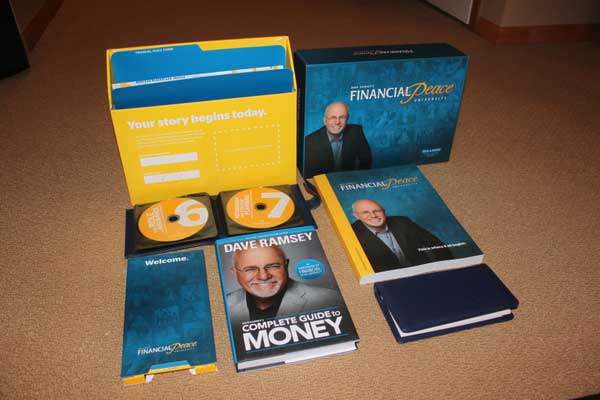

Can a CFP prepare taxes? This is something of a loaded question, and one that I chose to write about in that I just recently passed the first section of my CFP course, and am now on to the Income Tax portion of the curriculum. I also was curious about this question about myself as I am a candidate for both the Enrolled Agent and the Certified Financial Planner exams sometime in 2022, and am currently doing a course called HS 321 in my CFP class, which is all about income tax regulations. Scarily enough, I actually really enjoy income tax, and I really enjoy feeling like I am learning the “technical” part of finance, versus the more people-skills oriented and subjective part of the field which is financial planning and being a financial advisor. And so, in this blog post, lets discuss whether or not your CFP can file income taxes for you, and what type of tax they are typically trained in.

:max_bytes(150000):strip_icc()/ScreenShot2021-02-07at9.17.55AM-43bd78fa82bb4fa397892e3e69047cf2.png) The taxation concepts that are most prevalent during the CFP exams include the below:

The taxation concepts that are most prevalent during the CFP exams include the below:

Adjusted Gross Income

Filling out a form 1040

Filing Individual Taxes

Filing Partnership Returns

Form 1065

How to file Corporate Taxes

Form 1120-S for S-Corporations

Tax Credits

Tax Deductions

The Standard Deduction

And a host of other concepts, read on or subscribe to our blog for additional details and information.

| Related Posts |

|---|

Can A CFP Prepare Taxes? As a Fiduciary They Will Need a PTIN, But Yes they Should Be Able To!

So technically a CFP is going to be able to prepare your tax returns, especially if they have a PTIN with the IRS and they have some other type of credential in the tax field, such as the Enrolled Agent designation, which makes it so that they can legally represent you in front of the IRS (technically the only people that have full IRS representation rights are going to be Enrolled Agents, CPA’s and Attorney’s) and so your CFP will be in good standing to have this certification before he begins filing tax returns.

Once this occurs, having the combination of a tax preparer and someone who manages your investments can absolutely be a great deal for your finances, especially as tax season rolls around and you have all of your finances in one place!

Why Getting an Enrolled Agent Designation as a Certified Financial Planner Can Be So Valuable

Getting the enrolled agent designation is something that I think is extremely valuable as a financial planner for a number of reasons:

- It adds a massive certification to your resume.

- It gives you the ability to pivot to the field of income tax should you need to or want to.

- It lets you be able to file income taxes for your investment clients.

- It educates you on the field of tax which makes you a more holistic financial planner.

- It may give you a raise at your current banking institution.

There are many more benefits, but these are just a few of the really cool and major benefits that this designation can offer you. I will warn you however, it is a 1,000 page book that will put you to sleep, and it can be very boring indeed!

Should You Add The CPA License to Your CFP Designation?

This is a designation that can really make you a lot of money. And while it is about as boring as watching paint dry with literally 1000 pages of taxation information, I have got to say that it is definitely worth the time in terms of skill kickback. The amount of tax information I got just from reading the book that I know in my wealth management job has definitely aided me day to day and I am very glad that I dove into the book like I did.

Can A CFP Prepare Taxes? And Why This is a Yes and No Answer

So yes, in short a CFP can prepare taxes! I would recommend using a CFP that has the Enrolled Agent designation if you choose to do this, but it absolutely can be done, read on or subscribe to our blog for additional details and information!

Cheers!

*Inflation Hedging.com

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

Leave A Comment