What Is The Hardest Finance Designation? My Top Ten Most Difficult Designations Ranked

What is the hardest finance designation to obtain? In this blog post, I give you the toughest and most powerful Finance designations that you can get if you are looking to climb the ladder in the field of finance, if you are looking to become CFO of a bank one day, if you want to be more educated than all of your colleagues, and so on. These are each very difficult and somewhat expensive to obtain, and many of them have pretty strict work experience requirements in their respective fields. With this being said however, each of these is achievable with a little hard work, persistence, and a good study schedule, as well as a rigorous interest in Finance and Accounting, read the full list below, and be sure to comment down below or to subscribe to our blog for more information on all things finance and accounting.

What Is The Hardest Finance Designation? My Full Top Ten List In Order Of Resume Boosting Power

0. The Actuarial Science Exams, The Bonus Most Difficult Certification

This is sort of an outlier in that most other jobs in finance, like PM roles, like Wealth Management, or even Accounting, are not going to care a surprising amount about these designations. However, the actuarial field is a growing field and is one that can get you to a 6 figure salary rather quickly, and if you tell people in other finance fields that you were a former actuary, trust me they will most definitely start to take you very seriously.

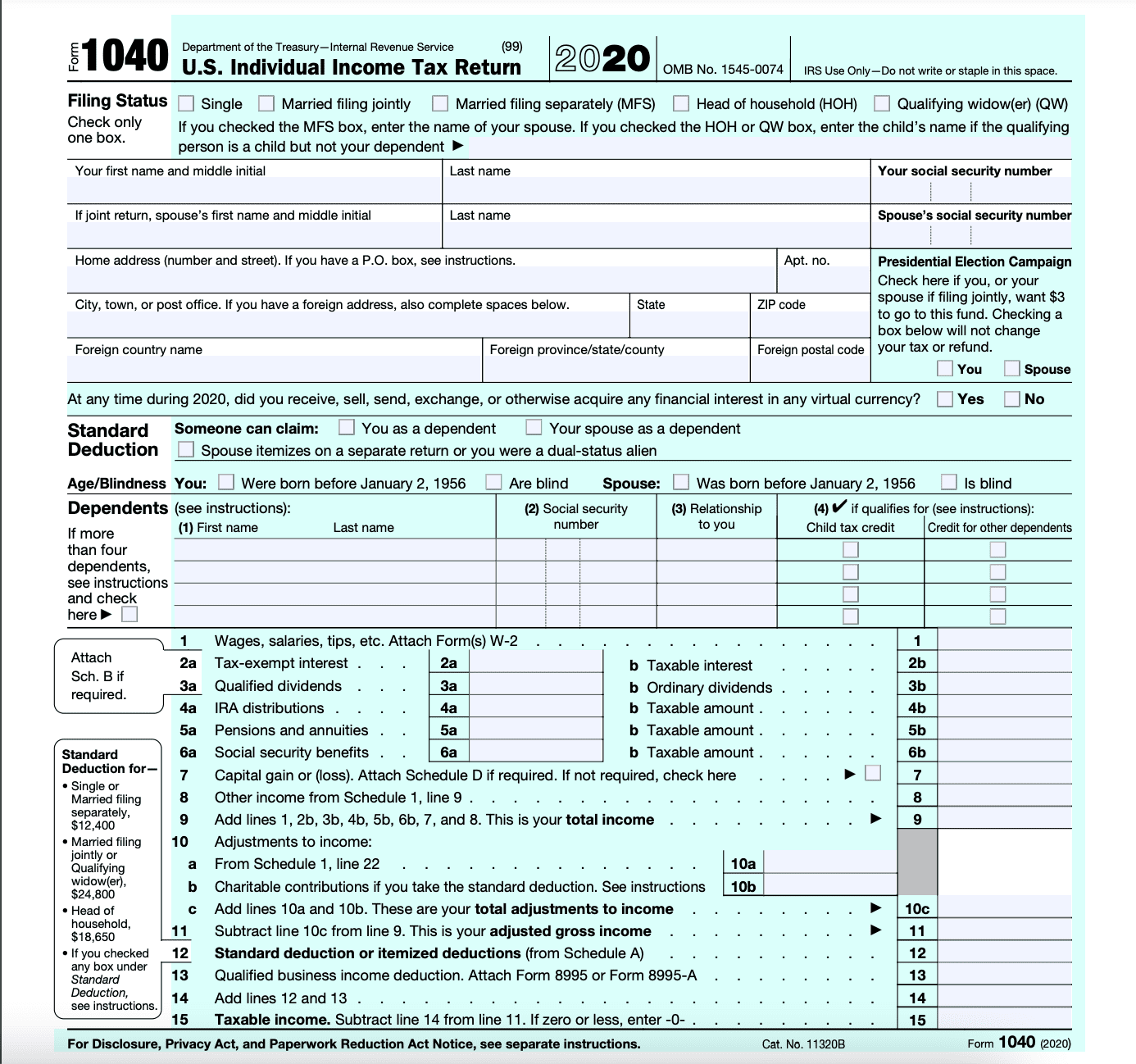

1. The CPA License

The CPA license is probably the most powerful realistic license that one can get in order to seriously bolster their career in the field of finance and to

be taken much more seriously in the job market, and it can lead to job flexibility and salary increases to a pretty exciting degree. A CPA license is very

valuable if you ever want to be CFO, if you want to break into Tax accounting or government work or even analytics, if you want to be a Financial Analyst, if you want to upgrade your financial planning abilities, or even if you want to be an attorney (being a CPA looks very good on Law School Applications so I have heard.) This designation requires you to take the 4 main sections of the CPA exam, a well as have 36 Accounting Credits (at least in Florida, this varies by state) to have one year of full-time work experience at an accounting firm under a CPA. The overall requirements to get this credential are difficult but doable.

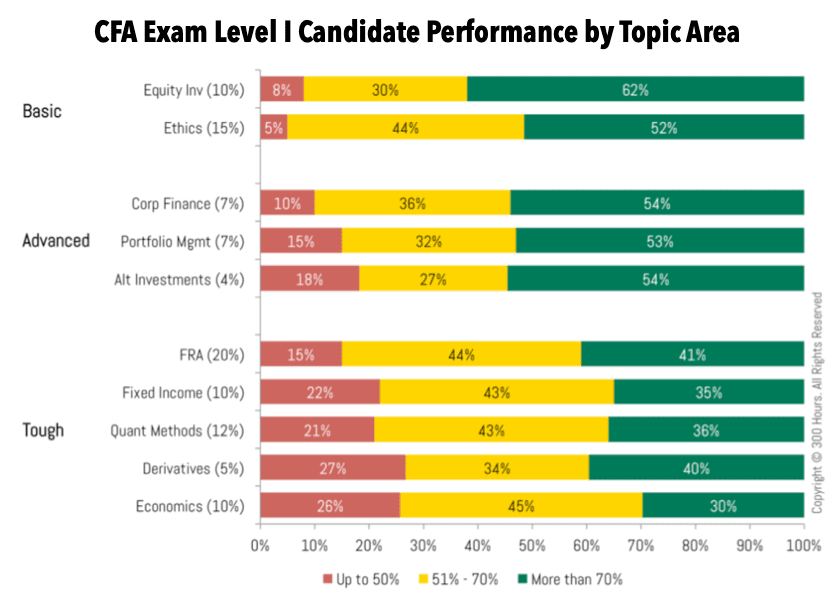

2. The CFA Designation

The CFA designation I have heard is about 5 to 8 times harder than the CPA exam in terms of relative content difficulty. That being said for someone in my current career position, this seems to be much easier than getting a CPA license for the following reasons:

It requires no additional college credits for me, just a regular BA degree and it it is actually relatively cheap, with the Lifetime Learning Credit tax

deduction that I would get for this certification, we are looking at around $1400 in total cost for this program.

deduction that I would get for this certification, we are looking at around $1400 in total cost for this program.

This should take around 24 months to complete, and even with the $275 annual fee, it should pay for itself over time with the amazing amount of resume capital that it provides.

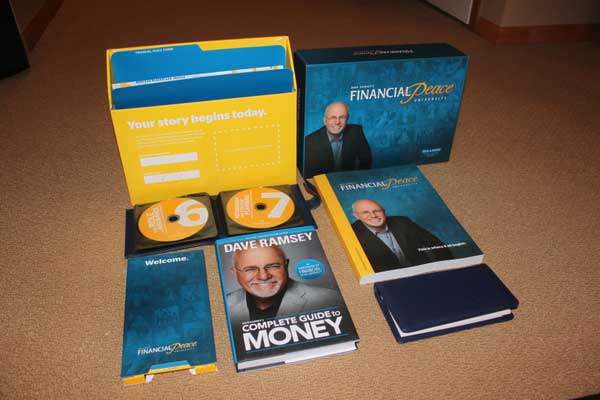

3. The CFP Designation

The CFP designation shines the most in Financial Planning, and it is the one that is most near and dear to my heart on this list as I am about halfway

through the program currently. I have 3 classes down out of 7 and am hoping to take the CFP exam by July of 2022, will report back if I am able to pull this off.

4. The MBA Designation

Getting an MBA is more of a general business certification that is utilized as something of an overall business degree for a variety of career fields.

Engineers, those in Human Resources roles, and those looking to move from a 9 to 5 role into a management position often pursue this expensive masters degree. MBA programs are typically going to run you between $25,000 to $100,000 depending on what school you get them from, the sad thing is most of the knowledge that these schools teach is virtually useless.

| Related Posts |

|---|

5. Becoming a Salesforce Admin, Is This The Hardest Finance Designation?

I would say that this skill is significantly more powerful than an MBA at at a 99% cost reduction. If an MBA is $40,000, you get a 99.7% discount on this, as you can often get this certification for as low as $80 to $100. No prior experience needed to learn the Salesforce software, however I have been told that having a Computer Science background, or even a business background, can make a significant impact on your ability to learn this program.

6. Learning SQL, Python, And Other Computer Science Designations

These are the cheapest on this list, and by far the most difficult on this list, at least for me. I am fully convinced that I could become a salesforce

admin easier than I could become a full blown developer. I have had many attempts at trying to learn SQL and Python, both with a company teaching me and via self taught online courses and textbooks. I would likely need to go to a formal degree program for 3 years full-time in order to get good enough at software engineering to muck around. Especially with me not being terribly interested in this, the odds of me learning this one looks somewhat grim.

7. The CHFC And the CLU Designation

These aren’t terribly difficult or powerful designations, however they are super easy to get once you have obtained the CFP. The CFP courses themselves are actually pretty easy, and you can get both of these with just 3 additional courses. The hardest part of getting these once you have your CFP is the $2500 you have to fork over in order to get these under your belt.

8. The CIMA (Certified Investment Management Analyst) Designation

This designation does not seem terribly difficult to get, however it is remarkably expensive. It costs around $4,000 to purchase the program, another $1,000 to take the exam, and then costs $850 per year for the rest of your life to maintain the designation. Personally I’d rather have that money in an index fund.

9. The CAMS Designation

This designation is much cheaper and much more powerful than many of the other certifications on this list. The CAMS, which stands for the Certified Anti Money Laundering Specialist, is a basic course structure that teaches you a lot of the concepts behind fraud and financial fraud and what you should look out for. It is very strong and when combined with something like a Series 7 license, can definitely help you to pivot to an Anti Money Laundering Career should you want one.

10. The CFE Designation (Certified Fraud Examiner)

This is more of an Accounting certification than anything else, and you are typically going to need a CPA license or a strong accounting background in order to qualify for this designation. This is much more detailed in the field of AML, compared to getting a simple CAMS designation, and deals much more with the math and the specifics of the field.

Honorable mentions that I should have put on this list include the Series 7 and the Series 66 license, these are some of the most powerful resume boosters that you can get your hands on, and I would highly recommend getting them should you ever have the opportunity.

Final Thoughts On What Is The Hardest Finance Designation

And that is my official top ten list, with bonus designations, regarding the hardest and the most powerful designations in Finance. Actuary is by far the hardest on this list, followed by computer programming, followed by the CFA, then the CPA and the Certified Fraud Examiner. Dive into some of these awesome and valuable finance designations to bolster your career in the field. And for more information on all things business and finance, read on or subscribe to our blog for additional details and information.

Cheers!

*Inflation Hedging.com

Sources:

https://www.bankrate.com/banking/cds/cd-rates/

https://money.cnn.com/data/markets/

Disclaimer: The opinions and documentation contained within this article and on this blog are the sole property of inflationhedging.com and are not to be copyrighted or reproduced in any manner, else legal action within the rights of the United States legal code could be use to obtain recompense. All articles and blog posts are the sole opinions of the writers of the blog, and are not necessarily in line with what exactly will work for you, you should consult a CPA, Tax Professional, or Financial Professional to determine what exact financial needs are in line with your interests. Also, from time to time, certain links on this website will be used to generate affiliate commissions, in order to support the health and growth of our website, health and business.

Leave A Comment